LIVESTOCK MARKETS: Milk prices to depend on milk production

Overall cheese prices have shown surprising strength in November.

Volatile cheese prices have meant volatile Class III milk prices this year, University of Wisconsin-Madison professor emeritus Bob Cropp said. On the Chicago Mercantile Exchange (CME), 40 lb. cheddar blocks averaged a low of $1.3174/lb. in May but rebounded to $1.7826 in August, only to fall back to $1.6035 in October. The result was that the Class III price was $12.76 in May, $16.91 in August and $14.82 in October.

“The good news is that while November cheese prices have had some rather big price increases as well as decreases, overall cheese prices have shown surprising strength in November — to the point that the November Class III could be near $16.75,” Cropp said.

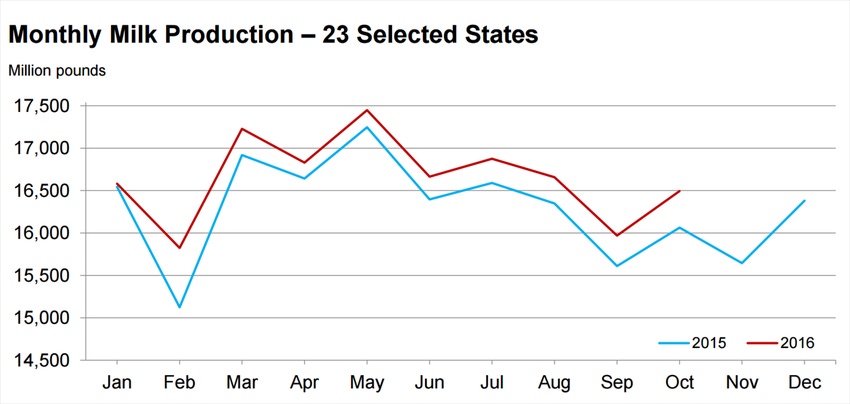

Source: USDA NASS

During November, 40 lb. cheddar blocks started out at $1.80/lb. and got as high as $1.9425, and barrels started at $1.73/lb. and got as high as $1.86. As of Nov. 18, Cropp said prices were lower, with 40 lb. blocks at $1.91 and barrels at $1.75.

“After Christmas season cheese orders are filled, cheese prices are likely to weaken, resulting in a Class III in the low-$16s for December,” he said.

Cropp said the Class III price will average near $14.75 for the year, compared to $15.80 last year and $22.24 for 2014.

Despite adequate cheese stocks, Cropp said the price has increased. Sept. 30 American cheese stocks were 6.5% higher than a year ago, but continued good cheese sales have tightened the availability of fresh 40 lb. block cheddar cheese, while stocks of more aged cheese are much more plentiful, he said.

“Stocks of cheddar barrel cheese have not been as tight, explaining the rather large existing price spread between blocks and barrels,” Cropp added.

Exports didn't provide any help for cheese prices, as September cheese exports were just 0.6% lower than a year ago but 20.5% lower than strong exports of 2014. Cropp said higher cheddar cheese prices may be partially explained by cheese production. While the production of Italian types has been running more than 4% higher than a year ago, Cropp said cheddar cheese production was 0.5% lower in September and 0.8% lower year to date. Total cheese production was 1.6% higher in September and 1.9% higher year to date.

Class IV prices have not been as volatile, according to Cropp. CME butter averaged over $2/lb. January through September before dropping to an average of $1.8239 for October. However, strong buying to build inventory for the peak holiday sales has pushed butter prices up again, he said.

At the start of November, butter was $1.86/lb. and now is $2.03. Nonfat dry milk prices slowly strengthened to reach an average of 91.6 cents/lb. in September but fell back some to 88.52 cents for October and has now increased to 90 cents. The Class IV was a low of $12.68 in April, a high of $14.84 in July, dropped to $13.66 in October and will be near $13.80 for November.

Cropp said interest in U.S. butter picked up in September, with exports 137% higher than a year ago but still 30% lower than September 2014 exports and 73.5% lower than 2014 exports year to date. Nonfat dry milk/skim milk powder exports have held up, with September exports 10% higher than a year ago and year-to-date exports 5% higher than last year and even 3% higher compared to 2014.

Looking ahead into 2017, Cropp said milk prices will depend a lot on the level of milk production. On that note, milk production continues to run well above year-ago levels, with October production up 2.5% (Figure). Milk cow numbers have been declining falling by 6,000 head since peaking in August. Of the 23 reporting states, 11 had fewer cows than a year ago, but more milk per cow is driving the increase in milk production. Milk per cow was 2.3% higher than a year ago. Of the 23 reporting states, just three had lower milk per cow than a year ago.

USDA is forecasting 2017 milk production to increase another 2.1%.

“That is a lot of milk, but we can expect high milk prices from continued good butter and cheese sales, as well as improved exports as we move through next year,” Cropp said.

He said the growth in world milk production has slowed as major exporters — the European Union, New Zealand, Australia and Argentina — all are experiencing lower milk production, with either a decline or relatively small increases for 2017. The U.S. is the only major exporter experiencing increased milk production, Cropp added.

World demand has picked up, with China and other major importers being more active, according to Cropp.

“This tightening of world supply and demand will reduce the buildup of world surplus, increasing world dairy product prices and making U.S. dairy products more competitive on the world market," he said. "World prices are already showing strength. Prices on the Global World Dairy Trade have strengthened for seven of the last eight trades.”

As of now, Cropp said it looks like the Class III price may be in the high $15s at the start of 2017, the low $16s by the end of the first quarter, the mid-$16s by the second quarter, the higher $16s in the third quarter and the $17s as a possibility in the fourth quarter. The average for the year could be near $16.50 — a good improvement over the expected $14.75 this year, Cropp noted.

While he said this is more optimistic than the U.S. Department of Agriculture and some other forecasters are projecting — "USDA has the Class III averaging from $15.30 to $16.20 — but final milk prices will be subject to any rather small changes in milk production, sales or exports.”

About the Author(s)

You May Also Like