Global beef trends: China, Brazil grab spotlight

Global beef trends, including consumption, production, imports and exports, vary by country.

April 19, 2017

By DAVID A. WIDMAR*

*David Widmar is an agricultural economist specializing in agricultural trends and producer decision-making. Through his research, he supports agribusinesses and farmers in their strategic and planning efforts. His work has been featured in several university and agricultural media publications, webinars and agribusiness conferences. He is also a researcher with the Center for Commercial Agriculture at Purdue University. Widmar received his bachelor's degree from Kansas State University and his master's degree from Purdue University, both in agricultural economics.

In late March, the beef industry was rocked by a meat scandal in Brazil that created concerns about quality and safety controls. Many countries, including China, temporarily halted imports of Brazilian beef while the scale and scope of the issues were sorted out.

In light of these events, it is worthwhile to step back and reflect on beef trends as well as consider global beef trends, including consumption, production, imports and exports.

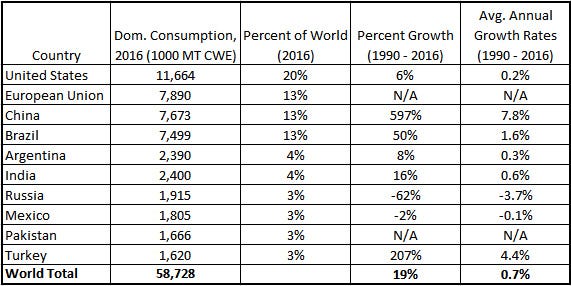

Consumption

When it comes to beef consumption, the U.S. is the leader (Table 1). In 2016, U.S. beef consumption accounted for 20% of global beef consumption. In fact, U.S. beef consumption is well ahead of other top consumers; the European Union, China and Brazil each account for 13% of global consumption. Overall, the top 10 counties account for 79% of global consumption.

Growth in beef consumption is important to consider. To do this, beef consumption in 2016 was compared to 1990 levels (an admittedly simplistic but still insightful method). Globally, growth in beef consumption has been rather lackluster, increasing a total of 19% during this period, or an average annualized rate of 0.7%. For context, corn consumption expanded at 3% annually over the same period.

While both numbers are small, the difference is huge. For instance, the Rule of 72 suggests that total corn consumption — given 3% annual growth — would double in 24 years, while it would take more than 100 years for total beef consumption to double at 0.7% annual growth.

While the global trends are for slow growth, the story is quite variable by country. Consumption in the U.S. has been even slower than the global trends: just 0.2% annual growth. In Russia and Mexico, other significant countries, consumption has trended lower.

On the other hand, beef consumption in China has been more aggressive, with an annual growth rate of 7.8%. If this growth rate remains constant into the future (which is a big "if"), China would become the largest consumer of beef in 10 years. The Rule of 72 and an average growth rate of 7.8% suggest that consumption would double in 9.2 years; a doubling of 2016 consumption levels would put China well ahead of the U.S.

One final comment on China's growth in beef consumption is that, from 1990 to 2016, the increase was equal to 69% of total global consumption growth. So, while growth in beef consumption has been slow, China has been the source of most growth.

Table 1. Total domestic beef consumption and growth in consumption in the 10 largest beef-consuming countries as of 2016. Beef consumption. Global beef trends. Ag Trends. Agricultural Economic Insights.

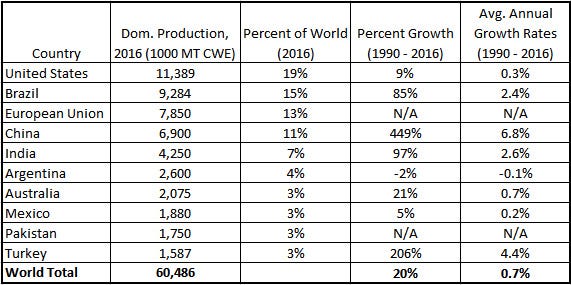

Production

Taking a look at global production trends, the list of top 10 beef-producing countries in 2010 (Table 2) is nearly the same as the top beef consumers (Russia made the consumption list but was bounced by Australia in production).

Global beef production from 1990 to 2016 was, like consumption, slow to expand, with an annual growth rate of 0.7%. Also similar to the consumption trends, U.S. beef production in the same period was slower than global expansion, at 0.3% annual growth. More broadly, U.S. production from 1990 to 2016 increased 9% total (not annually). Growth in global and U.S. beef production has been quite small.

Beef production in Brazil, which is the second-largest beef producer and accounted for 15% of global production, expanded 85% from 1990 to 2016, or 2.4% annually. This rate was faster than consumption trends during the same period (2.4% versus 1.6%), setting the stage for Brazil to play an important role in global exports (more on that later).

The opposite trend occurred in China, where annual growth rates were slower in beef production than in beef consumption — — 6.8% versus 7.8%. Again, while the differences between these growth rates seem small (one percentage point), the impacts over time can be quite significant. For example, if two bank accounts both started with $100 but grew at the different interest rates of 6.8% versus 7.8%, the faster-growing rate would have a balance of $212 after 10 years, compared to $193 for the slower growth rate (a 9.8% difference).

Another country to note is Turkey. Turkey ranked 10th in both production and consumption but experienced relatively large rates of growth. Expansion in production and consumption were nearly in lock step as both increased at an average annual rate of 4.4%. Should these growth rates be sustained, one could expect Turkey to quickly jump in the rankings over the next decade.

Table 2. Total domestic beef production and growth in production in the 10 largest beef-producing countries as of 2016. Beef production. Beef trends. Ag Trends. Agricultural Economic Insights.

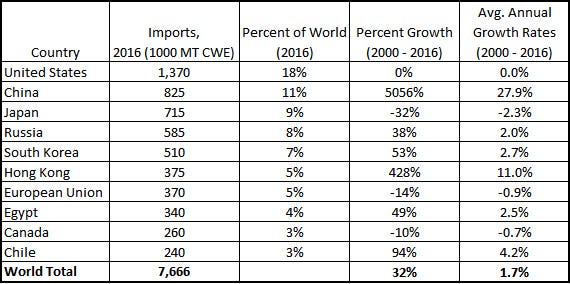

Imports

Global beef imports are shown in Table 3 (the time frame has shifted to 2000-16 due to data availability limits). In 2016, total global beef imports were up 32% from 2000, or an average annual growth rate of 1.7%.

Many would be surprised to know that the U.S. — the world's leading consumer and producer of beef — is also the largest beef importer. In 2016, U.S. beef imports accounted for 18% of total global beef imports. However, while the U.S. is a large importer of beef, there was essentially no change in those imports between 2000 and 2016.

Given China's production and consumption trends, it's no surprise that China's growth in beef imports has increased in recent years. The rate of increase, however, is quite shocking: Since 2000, China's beef imports have increased at nearly 28% annually. This is a phenomenal rate of growth. For context, China's beef imports skyrocketed from 86,000 metric tons (carcass weight equivalent) in 2012 to 825,000 mt in 2016. This will be an important trend to monitor in the coming years.

Beef imports in Hong Kong also have experienced large increases, up nearly 11% annually since 2000.

Table 3. Total domestic beef imports and growth in imports in the 10 largest beef-importing countries as of 2016. Global beef trends. Beef import. Ag Trends. Agricultural Economic Insights.

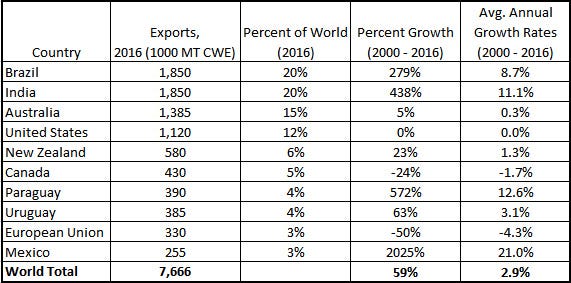

Exports

Given its status as a large producer of beef, and with growth in production outpacing domestic consumption, Brazil is a beef export heavyweight. In 2016, Brazil accounted for 20% of global exports (Table 4). Furthermore, Brazil's beef exports have increased at an annual rate of 8.7% since 2000.

The unexpected story in beef exports is likely India. In 2016, India exported the same amount of beef as Brazil, yet India's export growth was substantially faster than Brazil: 11.1% versus 8.7% from 2000 to 2016. India also is very reliant on exports, with 44% of production exported in 2016, compared to only 20% for Brazil. Don't expect beef from India at your local grocery story anytime soon, however, as the meat is from water buffalo rather than cows.

While the U.S. is the largest beef importer, it is also the fourth-largest exporter and accounted for nearly 12% of total global exports in 2016.

Beef exports also expanded rapidly in Paraguay, increasing at an average rate of nearly 13% from 2000 to 2016.

Table 4. Total domestic beef exports and growth in exports in the 10 largest beef-exporting countries as of 2016. Beef exports. Global beef trends. Ag Trends. Agricultural Economic Insights.

Final thoughts

On the surface, global beef consumption and production have been rather lackluster, with slow rates of change for both. However, differences among countries have set up some interesting trends in the beef industry.

Brazil, where production is growing faster than consumption, is an important beef exporter, as is India. In contrast, China's consumption has outpaced production, leading to a large increase in its reliance on imports.

Looking ahead, all eyes will be on China to see if it will repeat in beef what happened in soybeans. China went from accounting for very little of total global soybean imports in the 1990s to comprising more than 60% in recent years. Most recently, China has been working to open the door to U.S. beef.

You May Also Like