CoBank gives U.S. pork industry advice as China rebuilds

While China rebuilds pork production capacity, U.S. pork sector can take steps to lessen impact of reduced trade flows.

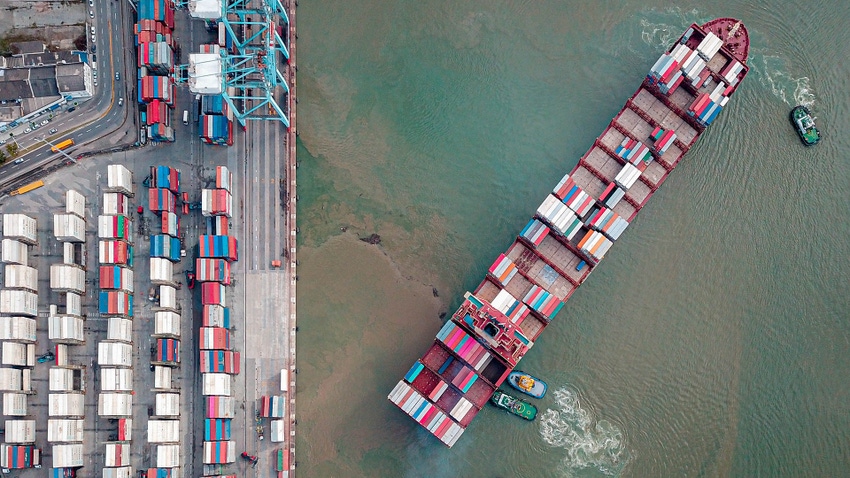

U.S. pork exports to China have skyrocketed this year as African swine fever (ASF) eroded two-thirds of China’s hog herd and drove its hog prices to record highs. In fact, a new report from CoBank’s Knowledge Exchange notes that exports to greater China now accounts for nearly 8% of U.S. pork production, compared to around just 2% in 2018.

However, the report suggests that as China makes progress rebuilding its hog herd, this jeopardizes the U.S. export picture over the next three to five years.

“China’s pork market is showing the early signs of herd rebuilding, and hog prices have fallen 30% from their peak a year ago,” CoBank lead animal protein economist Will Sawyer said. “This increases the risk of an oversupply of U.S. pork if exports to other markets, primarily in Asia and Latin America, are unable to absorb this supply.”

The report said while some market participants look at China’s hog numbers with skepticism, the “green shoots” of the rebuilding of China’s hog herd are starting to be seen.

“These signs include billions of dollars of Chinese investments in large-scale production over the last couple of years, diminishing national and provincial subsidies and incentives for hog producers, and hog prices that have declined almost 25% in the last three months,” the report noted.

CoBank explained that ASF has been known to linger in hog herds for decades, stunting the local industry’s ability to fully recover. As such, ASF will likely remain an issue in China’s hog industry for years, if not decades, the report suggested. However, the financial incentive to expand production is quite compelling, as producer margins in China have averaged hundreds of dollars per head for months now.

“A flood of investment is building massive production facilities with very high levels of biosecurity to help keep ASF out,” the report said.

As the recovery continues, the loss of exports to China would likely lead to difficult conditions for U.S. hog producers and processors alike. The U.S. pork industry has built multiple new plants over the past four years, increasing packing capacity by 12%, with much of this new capacity eyed for international market destinations.

Following the discovery of ASF in Germany in September, many key pork importing countries have banned German pork, opening the window for increased shipments from the U.S. and other main pork exporters. This provides the U.S. with a short-term opportunity to increase market share in China, as Germany represents approximately 14% of China’s pork imports. Although the ban is unlikely to last forever, and with China’s hog prices showing signs of weakening, the U.S. may still feel the pressure of China's reduced pork imports.

While lower trade flows with China to pre-ASF levels would put a good deal of stress on the U.S. pork sector, there are strategies and changes the pork industry can make now to help dampen that impact. Shifting trade relationships from transactional to strategic, pursuing trade diversification and building the U.S. market are among those strategies.

The greatest opportunity and possible challenge for the U.S. pork sector is the U.S. market itself, CoBank noted. With few exceptions, over the last 30 years, annual per capita pork consumption in the U.S. has been rangebound between 48 and 52 lb.

Spurring new or increased demand from other markets is another industry imperative. These growth opportunities, the report explained, may come from the U.S. pork industry’s core trade partners but also from expanding trade opportunities with secondary customers. Markets like Japan, Korea and Mexico will be critical in the next few years. The U.S. pork sector also has great export opportunities in numerous smaller markets, especially in the Caribbean and Central and South America.

U.S. packers have opportunities to strengthen their relationships with importers and customers of their end products. With all major pork-producing countries eyeing the Chinese market, suppliers that have strategic relationships in China will fare much better during the down cycle.

“One of the many lessons from the COVID-19 pandemic of 2020 is the necessity of a strong relationship between producer and packer,” Sawyer said. “This is true in both beef and pork, as those producers who had a deep and strategic relationship with their packer fared far better during the plant shutdowns and slowdowns in April and May 2020.”

The relationship between a hog producer and their packer can become strategic in many ways, whether that be by contract, ownership, geography, size or efficiency. In an environment where demand is falling as exports shrink, producers with the deepest relationships will better weather any changes in plant capacity that may come.

Read the full report here.

About the Author(s)

You May Also Like