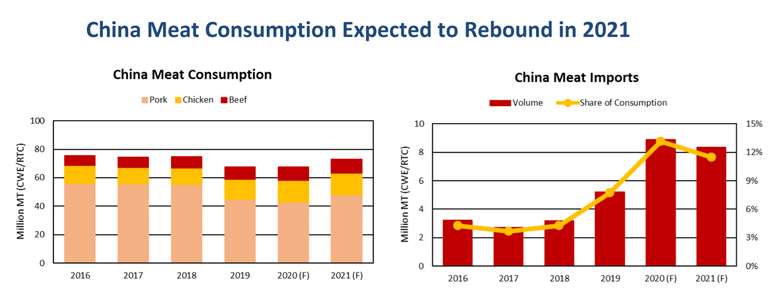

China meat consumption to rebound

China’s import demand expected to be lower year over year but still elevated by historical standards.

Driven by higher estimates for pork, USDA recently revised higher its 2020 and 2021 forecast for China total meat imports by 4% and 1%, respectively.

“While pork import growth slowed in the fourth quarter of 2020, it nevertheless exceeded expectations and results in a more bullish outlook for 2021,” USDA’s Foreign Agricultural Service (FAS) noted in a recent report.

The impact of African swine fever (ASF) is expected to have peaked in 2020, which FAS said pressured consumption and increased the country’s reliance on meat imports.

“Despite the elevated pace of trade, China meat consumption in 2020 fell to its lowest level in more than a decade. In 2021, higher estimates for both China pork production and imports lead total meat consumption up 2% from the prior forecast. However, total meat consumption is still expected to be below pre-ASF levels.”

USDA data, compiled by the U.S. Meat Export Federation (USMEF), revealed beef exports to China continued to reach new heights in November at 8,372 mt, up 700% from a year ago, with value up 642% to $60.1 million (by comparison, exports to China for all of 2019 totaled $86.1 million). For January through November, exports to China totaled 33,081 mt (up 277% year-over-year) valued at $237.8 million (up 239%).

November exports to China/Hong Kong were 3% below the previous year’s large volume, at 83,396 mt, and fell 5% in value to $193.8 million. However, through November, USMEF exports to the region were still up 72% to 955,008 mt, valued at $2.18 billion (up 85%).

USDA recently raised its 2021 global pork production forecast by 2%, to 103.8 million tons, due to China’s domestic hog production recovery from ASF.

“Elevated prices continue to incentivize producers to expand their herds, resulting in the production forecast for China being revised 5% higher,” FAS noted, adding that despite upward revisions, “China production is still expected to remain below pre-ASF levels as rising costs and animal management challenges generate headwinds.”

While China’s import demand is expected to be lower year over year, it will remain elevated by historical standards, FAS said.

“Abundant exportable supplies around the world are expected to find a home in China as consumption in this key market continues to be well below pre-ASF levels.”

USDA revised its global pork exports forecast for 2021 by nearly 3%, to 11.1 million tons.

About the Author(s)

You May Also Like