Grain prices spill back into the red on Wednesday

Afternoon report: Corn, soybean and wheat prices all trend lower on spring planting optimism.

Currently, Minnesota and the Dakotas are covered in bountiful amounts of snow, while other parts of the Corn Belt are soaking wet after a round of recent rains farther south. (Click here for a wealth of weather-related intel from Farm Futures grain market analyst Jacqueline Holland.) But the prospect of improving weather conditions later in April was enough to send grain prices scattering lower on Wednesday. Corn and soybean losses were fairly minimal, while wheat prices suffered double-digit declines today.

Between Thursday and Sunday, loads of rain is expected across the Mid-South and Southeast, while most of the Midwest and Plains will remain relatively dry during this time, per the latest 72-hour cumulative precipitation map from NOAA. Meantime, the agency’s 8-to-14-day outlook predicts a return to seasonally wet weather for the western half of the country between April 12 and April 18, with much warmer-than-normal conditions likely for the entire Corn Belt.

On Wall St., the Dow trended 81 points higher to 33,483 in afternoon trading, although investors were somewhat skittish over ADP’s latest private payrolls report, which showed signs of slowing job growth last month. Energy prices were mixed but mostly higher. Crude oil eased 0.4% lower this afternoon to $80 per barrel, while diesel jumped nearly 2.5% higher and gasoline firmed by almost 3%. The U.S. Dollar firmed moderately.

On Tuesday, commodity funds were net sellers of all major grain contracts, including corn (-6,000), soybeans (-5,500), soymeal (-5,500), soyoil (-3,500) and CBOT wheat (-1,500).

Corn

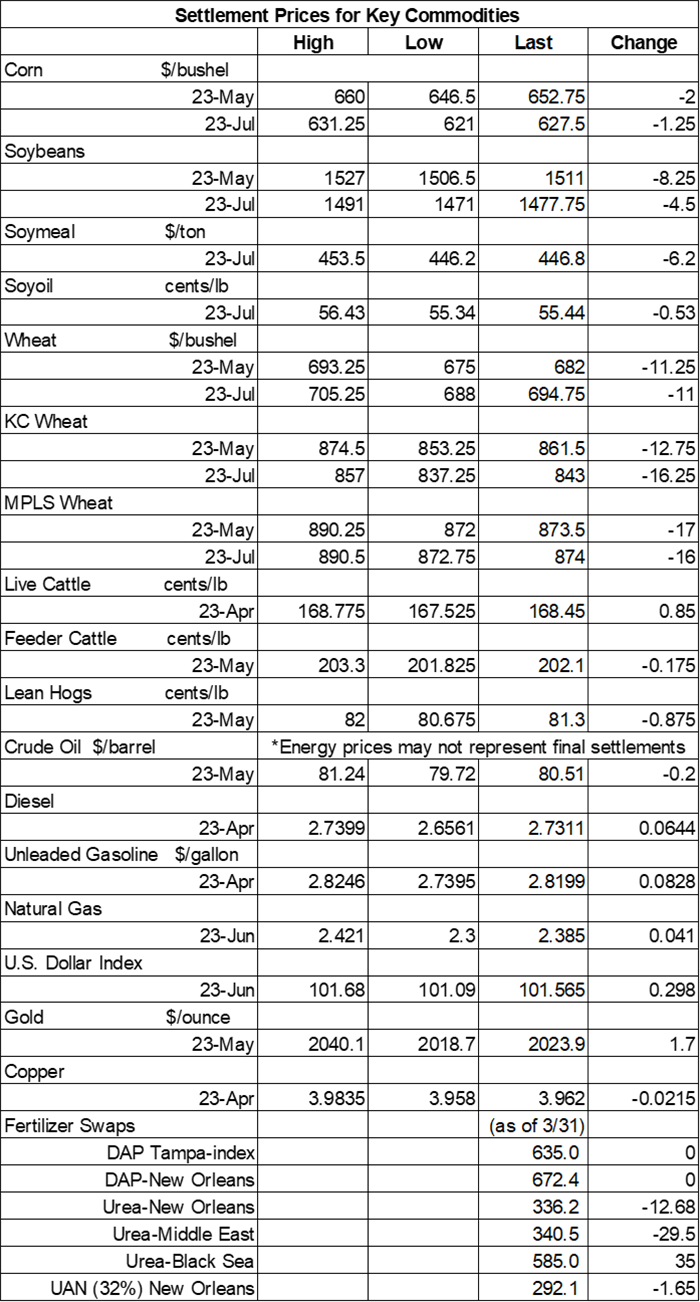

Corn prices eased slightly lower despite a large flash sale announced this morning. Prices did shift higher for a bit after that but eventually settled back into the red by the close. May futures dropped 2 cents to $6.5175, with July futures down 1.25 cents to $6.2675.

Corn basis bids were largely steady across the central U.S. on Wednesday but did tilt 5 cents higher at a Nebraska processor today.

Private exporters announced to USDA the sale of 4.9 million bushels of corn for delivery to unknown destinations during the 2022/23 marketing year, which began September 1.

Ethanol production for the week ending March 31 was unchanged from the prior week’s tally of 1.003 million barrels per day, according to the latest data from the U.S. Energy Information Administration, out earlier today. That was also slightly below the prior five-week average of 1.005 million barrels per day. Ethanol stocks eased 2% lower last week.

Prior to Thursday morning’s export report from USDA, analysts expect to see corn sales ranging between 31.5 million and 68.9 million bushels for the week ending March 30.

Per the latest data from the European Commission, 2022/23 EU corn imports have climbed 72% higher year-over-year after reaching 834.6 million bushels through April 2. Ukraine, Brazil, Canada, Serbia and Russia were the top five suppliers.

Ukraine’s agriculture ministry reported that the country has exported 38.5 million metric tons of grain during the 2022/23 marketing year as of April 5. That includes corn sales totaling 893.7 million bushels, plus an additional 485.0 million bushels of wheat sales. Ukraine is among the world’s top exporters of both commodities.

Grain traveling the nation’s railways saw another 20,628 carloads on the move last week. That brings 2023’s cumulative totals to 282,739 carloads, which is 6.9% below last year’s pace so far.

Preliminary volume estimates were for 288,521 contracts, shifting slightly below Tuesday’s final count of 294,619.

Soybeans

Soybean prices suffered a moderate setback on Wednesday after a round of technical selling led to cuts of around 0.5%. May futures dropped 8.25 cents to $15.0925, with July futures down 4.5 cents to $14.7825.

The rest of the soy complex fared even worse today. Soymeal futures were down nearly 1.5%, while soyoil futures lost more than 1%.

Soybean basis bids were steady across most Midwestern locations on Wednesday but did trend 5 cents higher at an Ohio river terminal while fading 3 cents lower at an Iowa river terminal today.

Private exporters announced to USDA the sale of 10.1 million bushels of soybeans for delivery to unknown destinations during the 2022/23 marketing year, which began September 1.

Ahead of tomorrow morning’s export report from USDA, analysts think the agency will show soybean sales ranging between 7.3 million and 29.4 million bushels for the week ending March 30. Analysts also expect to see soymeal sales ranging between 125,000 and 525,000 metric tons, plus up to 30,000 MT of soyoil sales.

European Union soybean imports during the 2022/23 marketing year reached 333.6 million bushels through April 2, which is moderately below last year’s pace so far. EU soymeal imports are down slightly year-over-year after reaching 11.99 million metric tons over the same period.

According to the Rosario stock exchange, Argentina is no longer the world’s No. 1 soymeal exporter for the first time in more than two decades after suffering through widespread drought this past season. Production is expected to tumble 36% lower year-over-year, leaving exports at around 20 million metric tons. Brazil’s Abiove expects the country’s soymeal exports to reach 20.7 million metric tons, meantime.

Preliminary volume estimates were for 262,816 contracts, trending moderately above Tuesday’s final count of 219,968.

Wheat

Wheat prices faced double-digit losses on Wednesday, with some contracts falling nearly 2% lower, after an ample round of technical selling partly due to improving weather conditions in the Plains expected later in April. May Chicago SRW futures fell 11.25 cents to $6.8025, May Kansas City HRW futures dropped 12.75 cents to $8.5975, and May MGEX spring wheat futures lost 17 cents to $8.7250.

Prior to Thursday morning’s export report from USDA, analysts expect the agency to show wheat sales ranging between 3.7 million and 22.0 million bushels for the week ending March 30.

European Union soft wheat exports during the 2022/23 marketing year have reached 850.6 million bushels through April 2, a year-over-year increase of nearly 8%. Morocco, Algeria, Nigeria, Egypt and Saudi Arabia were the top five customers. Meantime, EU barley exports are trending around 29% lower this marketing year, with 206.7 million bushels so far.

Japan plans to hold a simultaneous buy-and-sell auction in the hopes to acquire 2.2 million bushels of feed wheat and a little over 900,000 bushels of feed barley that will be held on April 12. The grain is for arrival in late September.

Preliminary volume estimates were for 111,201 CBOT contracts, which was 25% higher than Tuesday’s final count of 88,884.

About the Author(s)

You May Also Like