Soymeal rally continues on Midwest storms, Argentine drought

Afternoon report: Wheat continues its slide as hopes for a Black Sea Grains Initiative renewal persist

Our March 2023 Farm Futures survey is underway. We will use this data to predict and publish 2023 planted acreage ahead of USDA’s Prospective Plantings report to help you prepare your marketing and management plans for the upcoming growing season. And to thank you for helping me out, my team and I are offering $50 Amazon gift cards in a drawing for five very lucky respondents at the end of the survey!

Thank you to everyone who already responded to my first email request over the weekend! The survey will end on March 14. If you are a farm operator interested in participating in our survey, click here to share your insights!

Thank you! -JH

Corn

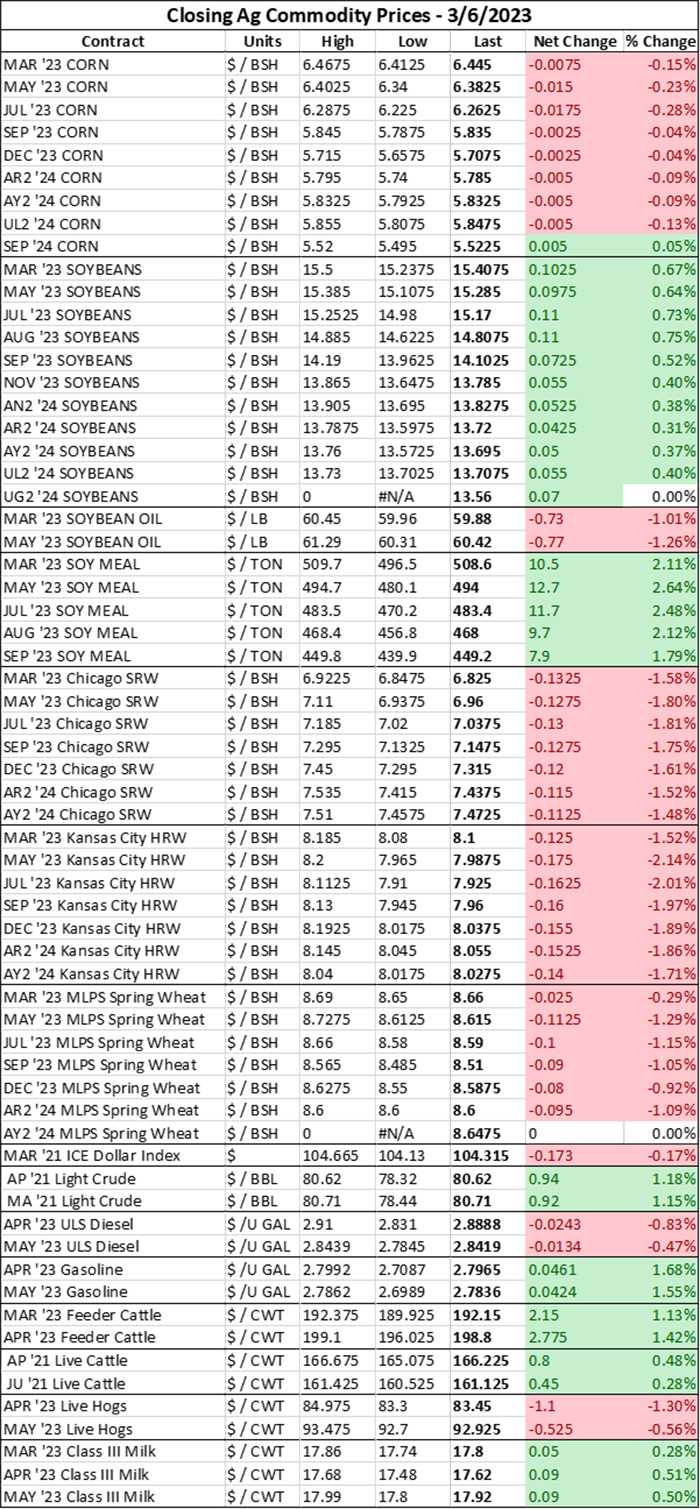

Corn prices closed today’s trading session $0.01-$0.02/bushel lower as nearby futures drifted down to $6.26-$6.45/bushel and the Dec23 contract settled just shy of $5.71/bushel. Some of the day’s losses were due in large part to spillover weakness from the wheat market, where some global supply tensions are easing, especially as favorable progress was made over the weekend to extend the Black Sea Grains Initiative to keep Ukrainian shipping corridors open amid the ongoing Russian invasion.

Corn shipments stole the show in this morning’s USDA Grain Inspections for Export report, rising nearly 39% from week ago volumes to 35.4 million bushels for the February 24 – March 3, 2023 reporting week. Pre-report analyst estimates had pegged today’s figure between 17.7 million – 29.5 million bushels, so this morning’s figures were far above market expectations.

Before the weekly Grains Inspections for Export report was published, USDA announced two large daily flash corn sales – one for 7.2 million bushels to an unknown buyer and another totaling 4.3 million bushels to Japan, both in the 2022/23 marketing year. But corn prices continued to trade at a $0.01-$0.03/bushel loss today, despite plenty of export demand optimism.

Forecasts for a large U.S. 2023 corn crop and weakening demand prospects in the coming months �– particularly in the export market – contributed to today’s lackluster futures prices and underlying usage concerns. At 601.7 million bushels of corn inspected through March 2, marketing year to date corn shipments are 38% below year-ago volumes. Markets remain wary of prospects for U.S. corn export demand amidst an ongoing trade dispute between the U.S. and Mexico over GMO corn imports.

Elevating those concerns this morning, the U.S. Trade Representative’s office requested technical evidence from Mexico, which will lead to more formal trade discussions between the two countries over Mexico’s impending GMO corn import ban. This move is the first official step in a dispute settlement panel under the USMCA.

"Mexico's policies threaten to disrupt billions of dollars in agricultural trade and they will stifle the innovation that is necessary to tackle the climate crisis and food security challenges if left unaddressed," U.S. Trade Representative Katherine Tai said in a statement. "We hope these consultations will be productive as we continue to work with Mexico to address these issues."

Prior to 2021 when China took the crown, Mexico was the top buyer of U.S. corn shipments. This week no shipments were inspected to go to China, though 14.8 million bushels of U.S. corn were inspected at Gulf and Interior terminals, accounting for nearly 42% - the majority – of the U.S.’s corn shipments over the past week.

Soybeans

Even with lackluster shipping data reported for U.S. soy exports this morning, there was still plenty of optimism to be had in the soy market today as soybean futures closed $0.05-$0.11/bushel higher today, sending nearby futures to $15.17-$15.41/bushel and Nov23 new crop futures settling just shy of $13.79/bushel.

More strength was derived from the soymeal market, which extended last week’s gains for another massive rally during today’s trading session. Nearby March23 soymeal futures surged past the $500/ton benchmark to close $10.50/ton higher at $508.60/ton. It marked a seven-week high for soymeal prices.

Soymeal prices have been surging both at home and abroad amidst slow crushing paces in Argentina, where drought has cut production in the world’s largest soymeal and soyoil exporter and left soy crushers scrambling for scarce supplies, as well as in the Upper Midwest, where recent winter storms are slowing farmer and dealer transport.

Markets are also bracing for USDA to make cuts to Argentina’s soymeal production in Wednesday’s WASDE report, with an expectation of tightening global soybean supplies as a result.

Soybean shipments slowed during USDA’s export reporting week of February 24 – March 3, 2023 according to its Grain Inspections for Export report released this morning, but U.S. soybean prices reversed early morning losses to trade in the green this morning on optimism that slow selling paces by Brazilian soybean producers would give rise to another late-season shipment push for U.S. soy exports.

Through the week ending March 3, U.S. soybean volumes inspected for export fell 29% from the previous week to 19.9 million bushels. Shipments have slumped in recent weeks as Brazil’s record-setting – and cheaper – soybean crop is being harvested and brought to market. This week’s volume could be the smallest weekly tally since last fall’s low water closures on the Mississippi River ground U.S. soy shipments to a halt.

Most of last week’s shipments were destined for China (9.3M bu. or 47% of last week’s total). Japan was the second top destination, with 2.8 million bushels of soybeans inspected at export terminals en route to the Land of the Rising Sun.

But marketing year to date inspection volumes continue to sit just 3% higher than the same time last year, indicating that the slow start to the soybean shipping season did not slow down Chinese purchasing speeds significantly.

Brazil’s rainy harvest season has been a windfall for U.S. soy exporters in recent weeks, keeping soy export volumes closely aligned with last year’s paces. If Brazilian farmers start holding back their crops at a more rapid rate in the coming weeks, U.S. soy producers could enjoy even more favorable cash opportunities at terminals feeding into the U.S. Gulf.

Wheat

U.S. wheat prices fell $0.10-$0.18/bushel lower today, with Chicago SRW wheat dropping below the $7/bushel benchmark – the lowest price the complex has seen since September 2021 – as the global wheat market braces for more supply availability in the coming season.

Markets are expecting the BSGI will be renewed, keeping critical grain corridors open to international buyers. Dwindling international demand for high-priced U.S. wheat is also contributing to bearish market forces at play today in the wheat complex.

Wheat export inspections also suffered a brutal week during February 24 – March 3, 2023. During the reporting week, inspection volumes dropped 59% lower than the previous week to 9.9 million bushels. Steady competition from record-setting Russian supplies continues to dominate the global market and a strong dollar will likely keep U.S. exporters from being a supplier of choice in the coming months.

Buying interest just isn’t present for U.S. wheat exporters. A strong dollar continues to deter international interest in U.S. wheat, with only seven of countries booking shipments of U.S. wheat cargoes last week.

Shipments to top U.S. wheat buyer Mexico (3.1M bu.) as well as to China (2.5M bu.) accounted for 57% of the week’s wheat bushels inspected at export terminals.

Plus, forecasts for record-setting Australian wheat exports, favorable winter growing conditions in Europe, and more optimism for Ukraine’s crop development also dragged U.S. wheat prices lower during today’s trading session as worries about global supply constraints eased.

Ukraine’s winter wheat and barley crops are reported by scientists to be in good condition despite the ongoing Russian invasion.

"The analysis of the viability of winter wheat ... showed that the vast majority of plants - 92% to 97%, depending on the predecessor and sowing date - were in relatively good condition," reported Ukrainian ag consultancy APK-Inform of Ukraine’s Academy of Agricultural Science.

Soil moisture levels are "quite significant and did not cause concern," according to the academy. That’s a great sign for Ukrainian grain yields in the upcoming year.

"There are good reasons to make preliminary forecasts for the formation of yields that will be close to the average long-term average," projected APK-Inform overnight. Ukrainian government weather forecasters expect that only 9% of the country’s winter crops (just shy of 1 million acres) will need to be replanted this spring due to poor conditions.

Ukrainian farmers planted 32% fewer winter wheat acres (10.1 million acres) last fall compared to the previous year amidst the ongoing Russian invasion. Last summer, only 68% of Ukrainian winter wheat crops were harvested, with the remainder decimated by war or occupied by Russian military forces.

Increased freight costs due to higher war risks have taken a massive bite out of Ukrainian farmers’ profit margins and are a key driver for lower acreage planted last fall and this upcoming spring. Ukrainian farmers have begun planting activities in the southern region of Odesa in recent weeks as spring weather approaches.

Weather

Scattered snow showers will pop up across the Northern Plains and Upper Midwest today, though accumulation will likely be light. Clear skies and warmer temperatures are in the forecast for the Central Plains and southern portions of the Eastern Corn Belt.

NOAA’s 6 to 10-day outlook is trending cooler than usual for the entire country through the weekend, with the highest chances of cold temperatures settling over the Mississippi and Ohio River Valleys. Chances for precipitation late this week are still trending above average for the western half of the country, with near normal chances expected for the Upper Midwest and Eastern Corn Belt.

In terms of temperature, the 8 to 14-day outlook is showing below average coldness covering the entire country through next week, though not as cool as forecasts for this weekend are projecting. Chances for precipitation during the second full week of March are trending above average for Plains, with near-normal chances expected for the Upper Midwest and Eastern Corn Belt.

Here’s what else I’m reading this morning on FarmFutures.com:

Bryce Knorr weighs all possible strategies farmers may be considering – including futures, options, HTAs, crop insurance, and cash sales – as they look to pull the trigger on 2023 corn and soybean sales.

Water Street Solutions’ CEO Darren Frye has three questions farmers should be asking ahead of an uncertain spring planting season.

Naomi Blohm reminds growers that U.S. grain stocks are still tight and only Mother Nature can fix it.

Bryce Knorr explains the impacts a recession would have on farming over the next couple years.

Senior editor Ben Potter has five helpful tips on how to make the most out of your on-farm meetings.

About the Author(s)

You May Also Like