Soybeans test moderate gains on Monday

Afternoon report: Corn and wheat prices continued to retreat to start the week.

Grain prices were mixed but mostly lower on Monday. Corn and wheat futures each spilled into the red after a key Black Sea shipping deal captured a two-month extension over the weekend. Wheat incurred the heaviest losses, with some contracts eroding more than 1.5% lower. Soybeans bucked the overall bearish trend, shifting 0.5% higher to start the week.

Some more wet weather is set to arrive across much of the Corn Belt between Tuesday and Friday, per the latest 72-hour cumulative precipitation map from NOAA. A band stretching from Missouri through southern Michigan is likely to gather the greatest amounts during this time. NOAA’s new 8-to-14-day outlook predicts some wetter-than-normal conditions in parts of the Northern Plains and upper Midwest between March 27 and April 2, with seasonally cold weather likely for the western half of the country next week.

On Wall St., the Dow climbed 325 points in afternoon trading to 32,187 as investors place their bets that the worst of the latest banking crisis could be in the rearview mirror. Energy futures were mixed. Crude oil firmed 0.5% to $67 per barrel this afternoon on easing domestic stocks. Gasoline was up around 0.75%, while diesel dropped 0.75%. The U.S. Dollar softened moderately.

On Friday, commodity funds were net buyers of corn (+1,000) and CBOT wheat (+4,500) contracts but were net sellers of soybeans (-6,000), soymeal (-6,000) and soyoil (-1,000).

Corn

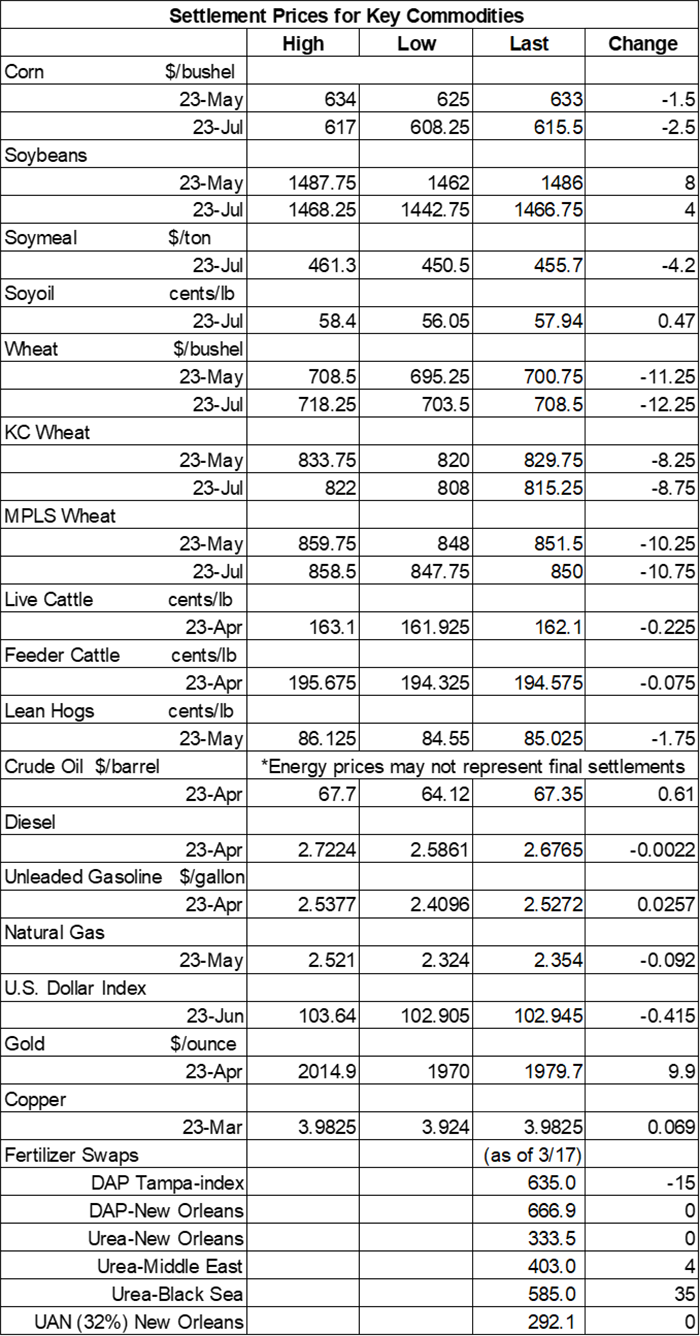

Corn prices failed in its bid to overcome moderate overnight losses today after some net technical selling kept them slightly in the red. May futures dropped 1.5 cents to $6.3275, with July futures down 2.5 cents to $6.1525.

Corn basis bids were mostly steady across the central U.S. on Monday but did ease a penny lower at an Ohio elevator while firming 2 cents at an Illinois ethanol plant today.

Corn export inspections shifted moderately higher week-over-week, moving to 46.8 million bushels. That was also toward the higher end of trade guesses, which ranged between 23.6 million and 58.1 million bushels. Mexico (12.4 million) and Japan (12.0 million) were the top two destinations. Cumulative totals for the 2022/23 marketing year remain well below last year’s pace, however, with 689.9 million bushels since last September.

Chinese corn imports sourced from the United States in January and February have climbed 22% higher year-over-year to 92.5 million bushels, per the latest data from the country’s General Administration of Customs. Brazil and Ukraine were the other top destinations during the first two months of 2023.

Algeria issued an international tender to purchase 2.8 million bushels of animal feed corn, sourced from Argentina or Brazil, that closes on Tuesday. The grain is for shipment between late April and mid-May.

Preliminary volume estimates were for 197,374 contracts, spilling moderately below Friday’s final count of 247,476.

Soybeans

Soybean prices incurred moderate overnight losses but were able to move back into the green thanks to some late-session technical buying on Monday. May futures added 8 cents to $14.8450, with July futures down 4 cents to $14.6525.

The rest of the soy complex was mixed. Soyoil futures moved almost 1% higher, while soymeal futures faded 0.9% lower.

Soybean basis bids shifted 2 cents higher at an Illinois river terminal while holding steady elsewhere across the central U.S. on Monday.

Soybean export inspections made it to 26.3 million bushels last week after firming modestly above the prior week’s tally of 23.3 million bushels. That was also on the high end of analyst estimates, which ranged between 12.9 million and 29.4 million bushels. China was again the No. 1 destination, with 14.9 million bushels. Cumulative totals for the 2022/23 marketing year are now trending slightly above last year’s pace, with 1.619 billion bushels.

Due to Brazil’s relatively slow soybean harvest, China’s purchases of U.S. soybeans in January and February were up 15.4% year-over-year, with 425.9 million bushels. Brazilian imports during the first two months of 2023 are down 36%, meantime, with 82.3 million bushels. Total imports during this time moved to a record level of 595.2 million bushels.

On a related note, Brazil’s Safras & Mercado reported today that the country’s 2022/23 soybean harvest has reached 58.6%, which is moderately behind last year’s pace of 69.9% so far.

Preliminary volume estimates were for 227,943 contracts, moving slightly ahead of Friday’s final count of 219,525.

Wheat

Wheat prices faced moderate cuts on worries about overseas competition, particularly in the Black Sea region, which led to a round of technical selling on Monday. Most contracts closed with double-digit losses. May Chicago SRW futures lost 11.25 cents to $6.9925, May Kansas City HRW futures dropped 8.25 cents to $8.2750, and May MGEX spring wheat futures fell 10.25 cents to $8.5050.

Wheat export inspections found moderate week-over-week improvements after moving to 13.8 million bushels. That was near the middle of trade estimates, which ranged between 7.3 million and 18.4 million bushels. China was the top destination, with 2.5 million bushels. Cumulative totals for the 2022/23 marketing year are slightly below last year’s pace so far, with 598.4 million bushels.

Russian consultancy Sovecon estimates that the country’s wheat exports will reach 154.3 million bushels in March. That would be a month-over-month increase of 45% and the largest tally since last November, if realized.

Ukraine’s agriculture ministry expects the country’s combined grain and oilseed harvest to slide 10% lower in 2023, with a preliminary estimate of 63 million metric tons. Ukraine enjoyed a record-breaking grain harvest in 2021 but has seen obvious complications since then due to the ongoing Russian invasion.

Meantime, Russia has agreed to extend a critical deal that allows safe passage for shipping vessels in the Black Sea for another 60 days. Ukraine had been hoping the deal would get a 120-day extension. Further, Russia indicated that further extensions will only be granted “subject to tangible progress” for Russian food and fertilizer exports. Russia also complained that the deal unfairly benefits “well-fed European markets” at the expense of poorer African nations.

Taiwan issued an international tender to purchase 2.1 million bushels of grade 1 milling wheat, sourced from the United States, that closes on March 24. The grain will be for shipment in May.

China sold 5.0 million bushels of its imported wheat reserves in an auction that was held on March 15, which was 97% of the total available for sale. China has offered a series of similarly sized sales in recent months to boost local supplies and lower high prices.

About the Author(s)

You May Also Like