Soybeans swiped by seasonal bears

Afternoon report: The record-breaking Brazilian harvest is taking its toll on prices.

Grains were mixed but mostly lower on Thursday. Soybeans suffered the heaviest losses, spilling more than 2% lower as Brazil’s record-breaking harvest continues to draw seasonal bearish sentiment. Corn prices tested gains at times in the session but closed modestly lower. Wheat prices were mixed, moving as much as 0.75% in either direction today.

Ample rains will drench the Mid-South and Ohio River Valley between Friday and Monday, per the latest 72-hour cumulative precipitation map from NOAA. Some areas are set to gather 3” or more total accumulations during this time. Later on, NOAA’s 8-to-14-day outlook predicts more seasonally wet weather for the eastern Corn Belt between March 30 and April 5, with colder-than-normal conditions likely for a large portion of the central U.S.

On Wall St., the Dow tested meager gains of 9 points in afternoon trading to reach 32,038 as investors expressed some confidence the Federal Reserve might not initiate additional interest rate hikes later in 2023. Energy futures were mixed. Crude oil trended 1% lower this afternoon to $70 per barrel on rising stocks. Nearby diesel contracts lost nearly 2%, while gasoline captured gains of around 1%. The U.S. Dollar firmed fractionally.

On Wednesday, commodity funds were net sellers of all major grain contracts, including corn (-1,000), soybeans (-11,000), soymeal (-4,000), soyoil (-6,500) and CBOT wheat (-6,500).

Corn

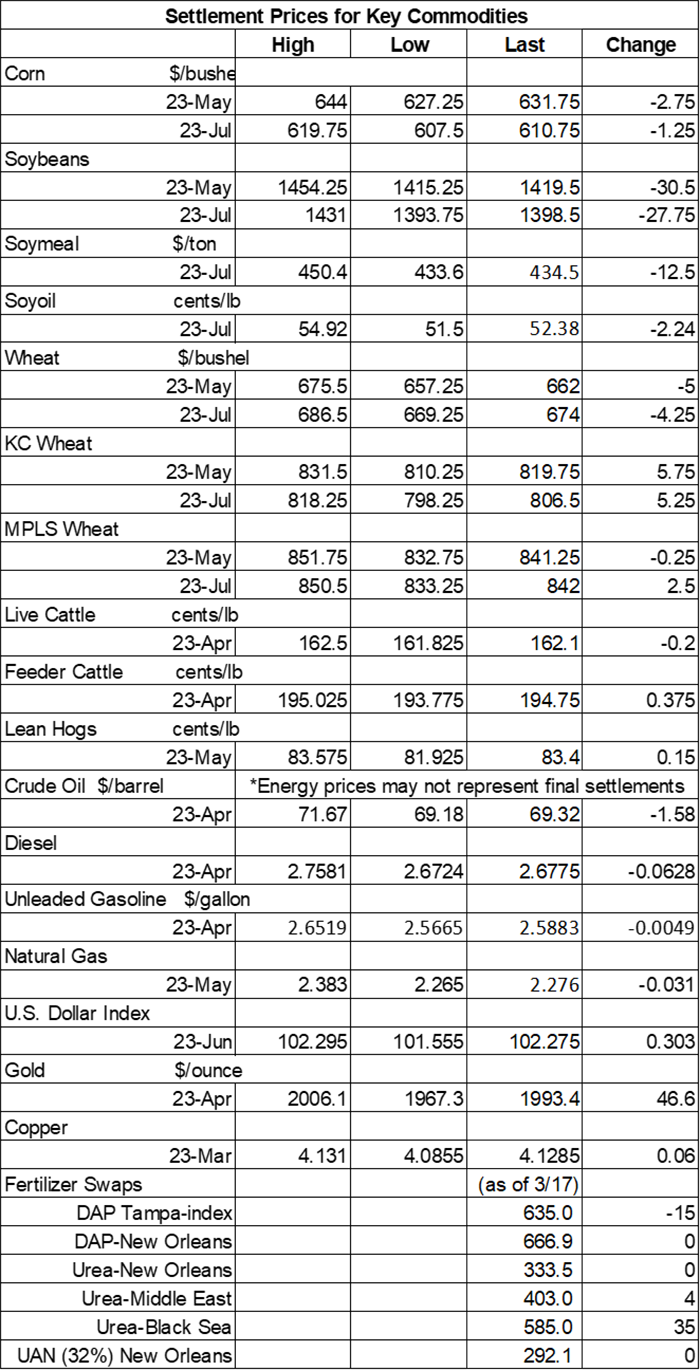

Corn prices tested decent gains on Thursday morning thanks to fresh export optimism but ultimately closed around 0.4% lower after spillover weakness from soybeans triggered a round of technical selling. May futures dropped 2.75 cents to $6.3075, with July futures down 1.25 cents to $6.1050.

Corn basis bids were steady to weak across the central U.S. after sliding 1 to 3 cents lower at three Midwestern locations on Thursday.

Private exporters announced to USDA the sale of 4.8 million bushels of corn for delivery to China during the 2022/23 marketing year, which began September 1.

Corn exports saw 121.9 million bushels in old crop sales, plus an additional 3.7 million bushels of new crop sales, for a total of 125.6 million bushels – a marketing-year high. That was also toward the high end of trade estimates, which ranged between 66.9 million and 147.6 million bushels. Cumulative sales for the 2022/23 marketing year still have a significant uphill climb to match last year’s pace, reaching 731.7 million bushels.

Corn export shipments were also at a marketing-year high, with 54.4 million bushels. Mexico, Japan, China, Colombia and South Korea were the top five destinations.

A new report from USDA-FAS estimates that Mexico will import 704.7 million bushels of corn during the 2023/24 marketing year. That would be a year-over-year increase of 3%, if realized. Mexico is the world’s top corn importer, and the U.S. is its top supplier.

In Argentina, the country’s Buenos Aires grains exchange made no changes to its forecast for 2022/23 corn production, leaving it at 1.417 billion bushels. The country has struggled with drought for much of the season but did see some modest rainfall totals over the past two weeks.

The current corn-soybean price ratio is 2.33, notes Farm Futures grain market analyst Jacqueline Holland. “Commonly accepted market logic is that a value of 2.4 is the inflection point at which growers will respond to market incentives (prices) and switch between crops,” she says. “A ratio value of 2.5 and higher indicates a strong market preference for soybean acres while 2.3 and lower indicates strong favorability for corn acres. The current reading of 2.33 as of March 15 suggests that the market wants corn, but there is not a strong preference for corn over soybean acres from a revenue standpoint.” Click here to read more of Holland’s latest analysis.

Preliminary volume estimates were for 342,440 contracts, which was moderately higher than Wednesday’s final count of 309,458.

Soybeans

Soybean prices faced another round of sharp declines as a seasonal bout of technical selling rages on. May futures lost 30.5 cents to $14.18, with July futures down 27.75 cents to $13.9725.

The rest of the soy complex also incurred significant losses. Soymeal futures fell nearly 3%, while soyoil futures tumbled more than 4% lower today.

Soybean basis bids were mostly steady across the central U.S. on Thursday but did inch a penny higher at an Ohio elevator while eroding 10 cents lower at an Iowa processor today.

Soybean exports saw old crop sales reach 5.6 million bushels, plus another 7.3 million bushels of new crop sales, for a total tally of 12.9 million bushels. That was below the entire range of trade estimates, which came in between 14.7 million and 40.4 million bushels. Cumulative totals for the 2022/23 marketing year are still tracking slightly above last year’s pace, with 1.600 billion bushels.

Soybean export shipments were more robust but still 26% below the prior four-week average, with 25.9 million bushels. China, the Netherlands, Egypt, Algeria and Mexico were the top five destinations.

Argentina’s Buenos Aires grains exchange made no changes to its 2022/23 soybean production estimates, which held steady at around 919 million bushels. On a related note, another group (the Rosario grains exchange) reported today that Argentina will import 139% more soybeans this year, totaling around 290 million bushels, in efforts to feed its hungry processing industry.

Preliminary volume estimates were for 320,754 contracts, moving moderately above Wednesday’s final count of 272,690.

Wheat

Wheat prices were mixed after some uneven technical maneuvering on Thursday. May Chicago SRW futures dropped 5 cents to $6.5850, May Kansas City HRW futures added 5.75 cents to $8.17, and May MGEX spring wheat futures eased 0.25 cents to $8.3350.

Wheat exports saw combined old and new crop sales reach 5.9 million bushels last week. Old crop sales tumbled 59% below the prior four-week average. Analysts were expecting a larger haul, with trade guesses ranging between 7.0 million and 27.6 million bushels. Cumulative totals for the 2022/23 marketing year are slightly below last year’s pace, with 547.5 million bushels.

Wheat export shipments improved 44% week-over-week but still slid 8% below the prior four-week average, with 13.3 million bushels. China, Mexico, the Philippines, Taiwan and Ecuador were the top five destinations.

Russia’s government reported it may increase 2023 grain purchases to 10 million metric tons via its state intervention fund. This fund is designed to lower domestic prices when they rise too quickly. Russia purchased 3 million metric tons of grain last year.

Preliminary volume estimates were for 98,179 CBOT contracts, trending moderately lower than Wednesday’s final count of 148,092.

About the Author(s)

You May Also Like