Soybeans keep mini-rally alive

Afternoon report: Wheat prices also make solid inroads on Thursday, while corn eases lower

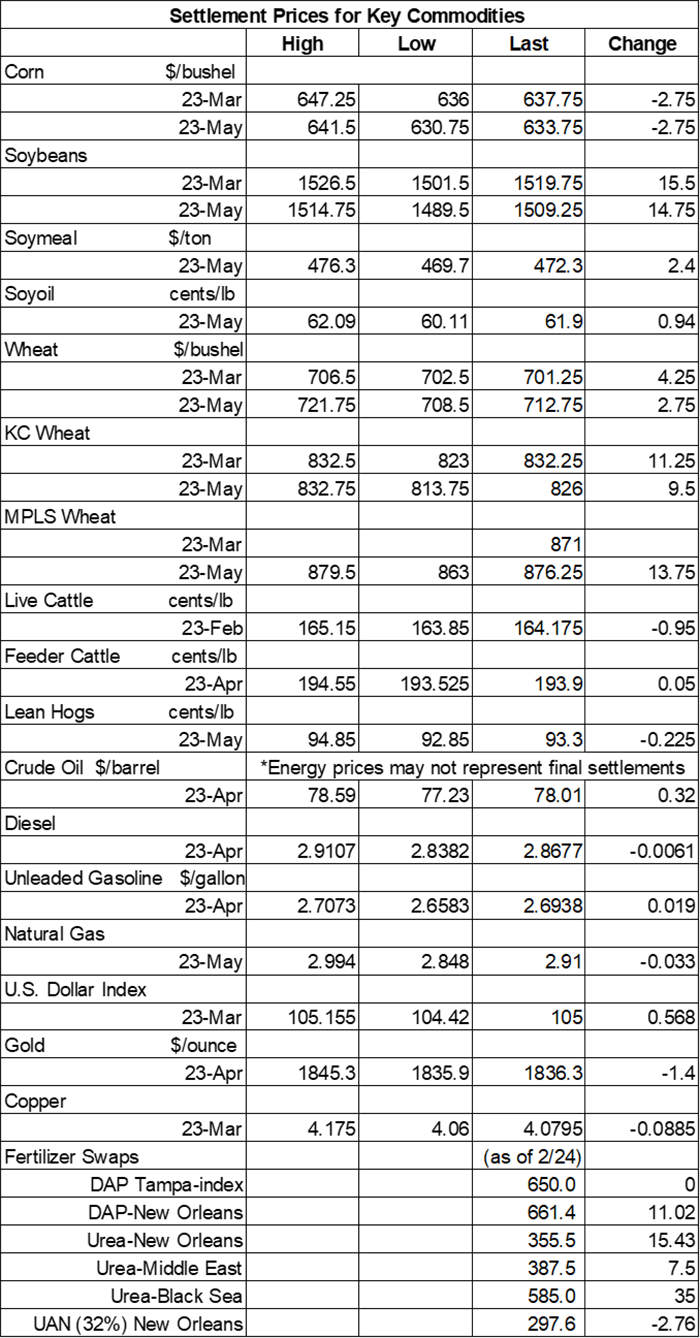

Grain prices were mixed but mostly higher on Thursday. Soybeans turned in another strong performance, picking up double-digit gains for the second consecutive session and closing around 1% higher today. Technical buying also benefited wheat contracts, which were mostly 1% to 1.5% higher. Corn failed to follow suit, shifting moderately lower after USDA released a lackluster round of export sales data this morning.

Plentiful rain is still expected to arrive in a large band stretching from the Mid-South through the Ohio River Valley between Friday and Monday, per the latest 72-hour cumulative precipitation map from NOAA. Some areas will gather 2” or more during this time. NOAA’s new 8-to-14-day outlook predicts more seasonally wet weather for parts of the Corn Belt between March 9 and March 15, with nearly the entire country likely to see seasonally cold conditions during this time.

On Wall St., the Dow improved 267 points in afternoon trading to 32,929 as investors consider the likelihood that the Federal Reserve will boost interest rates by another 25 basis points later this month. Energy futures were mixed but mostly higher. Crude oil firmed 0.5% to reach $78 per barrel this afternoon, and gasoline trended almost 1% higher. Diesel failed to follow suit, easing 0.25% lower.

On Wednesday, commodity funds were net buyers of all major grain contracts, including corn (+2,000), soybeans (+6,000), soymeal (+1,500), soyoil (+1,500) and CBOT wheat (+3,500).

Corn

Corn prices started Thursday’s session with moderate overnight gains, which eventually evaporated by the close after traders shifted back to technical selling amid a tepid round of export data from USDA this morning. March futures dropped 2.75 cents to $6.3775, with May futures down 2.25 cents to $6.3350.

Corn basis bids held steady across the central U.S. on Thursday.

Corn exports saw 23.5 million bushels in old crop sales (with no additional new crop sales) last week, which was 48% below the prior four-week average. It was also on the very low end of analyst estimates, which ranged between 19.7 million and 43.3 million bushels. Cumulative sales for the 2022/23 marketing year are severely below last year’s pace so far, with 591.7 million bushels.

Corn export shipments fared better, firming 13% above the prior four-week average with 26.2 million bushels. Mexico, Colombia, Japan, Honduras and Canada were the top five destinations.

Brazilian consultancy Agroconsult expects the country’s 2022/23 total corn crop to improve 8.6% from last season, with a current projection of 5.059 billion bushels. This is more bullish than some other entities’ estimates – most of which are just below the 5-billion-bushel benchmark.

South Korea passed on all offers to purchase 5.4 million bushels of animal feed corn from optional origins in an international tender that closed earlier today. Prices were regarded as too high. The grain would have been for delivery in July.

Preliminary volume estimates were for 314,778 contracts, moving moderately below Wednesday’s final count of 435,071.

Soybeans

Soybean prices rose another 1% higher on another round of technical buying partly spurred by another cut to Argentina’s production potential. March futures rose 15.5 cents to $15.1975, with May futures up 14.75 cents to $15.09.

The rest of the soy complex was also firm. May soymeal futures trended 0.5% higher, while May soyoil futures improved more than 1.5%.

Soybean basis bids were mostly steady across the central U.S. on Thursday but did move 5 cents higher at an Indiana processor today.

Soybean exports were lackluster after only reaching 18.2 million bushels in combined sales last week. In fact, old crop sales spilled to a marketing-year low. Total sales were also on the lower end of trade estimates, which ranged between 11.0 million and 38.6 million bushels. Cumulative totals for the 2022/23 marketing year are still slightly above last year’s pace, with 1.529 billion bushels.

Soybean export shipments tracked 50% below the prior four-week average, with 32.4 million bushels. China, Germany, Mexico, the Netherlands and Algeria were the top five destinations.

Brazilian consultancy Agroconsult is predicting the country’s 2022/23 soybean production will reach 5.622 billion bushels. That’s steady from the group’s prior estimate from a month ago and will be a record, if realized.

In contrast, Argentina’s production potential is still on the decline, according to the country’s Buenos Aires grains exchange, which reported today it is cutting estimates for the fourth time with a new total of 1.231 billion bushels. Widespread hot, dry weather earlier in the season is primarily to blame.

Preliminary volume estimates were for 184,058 contracts, sliding slightly below Wednesday’s final count of 219,009.

Wheat

Wheat prices saw healthy gains mostly ranging between 1% and 1.5% after a round of technical buying largely spurred by growing concerns that a current Black Sea deal will not get extended if Russia levies a formal objection to how it is currently structured. May Chicago SRW futures picked up 2.75 cents to $7.1275, May Kansas City HRW futures added 9.5 cents to $8.2575, and May MGEX spring wheat futures rose 13.75 cents to $8.7725.

Wheat exports only reached 11.1 million bushels last week, although old crop sales improved 39% compared to the prior four-week average. Analysts generally expected a bigger haul, with trade guesses ranging between 5.5 million and 25.7 million bushels. Cumulative sales for the 2022/23 marketing year are slightly below last year’s pace so far, with 511.1 million bushels.

Wheat export shipments were stronger, climbing 30% above the prior four-week average to 22.4 million bushels. Iraq, South Korea, Mexico, Japan and Indonesia were the top five destinations.

Ukraine’s agriculture ministry reports that although the country’s 2022/23 wheat production is smaller than it would be in times of peace, it is still larger than expected, and the government is unlikely to limit exports in the upcoming season. Current production estimates range between 587.9 million and 661.4 million bushels. Ukraine is one of the world’s top wheat exporters.

Ukraine’s export potential is also highly sensitive to a current deal that allows for safe passage for shipping vessels in the Black Sea, which expires on March 18 unless it is extended. Russia has been complaining about the deal recently, accusing U.S. Secretary of State Antony Blinken of “deliberately and systematically” causing a backlog of grain shipments in the region. Ultimately, if Russia doesn’t lodge a formal objection, the deal will be automatically renewed for an additional 120 days.

As expected, Japan purchased 2.6 million bushels of food-quality wheat from the United States and Canada in a regular tender that closed earlier today. Half of the total was sourced from the U.S. The grain is for shipment starting in late April.

Preliminary volume estimates were for 79,178 CBOT contracts, which was 14% below Wednesday’s final count of 92,477.

About the Author(s)

You May Also Like