Improved planting forecast sends soybeans falling

Afternoon report: Wheat also falls as markets brush of Russian threats and embraced improved U.S. weather outlook.

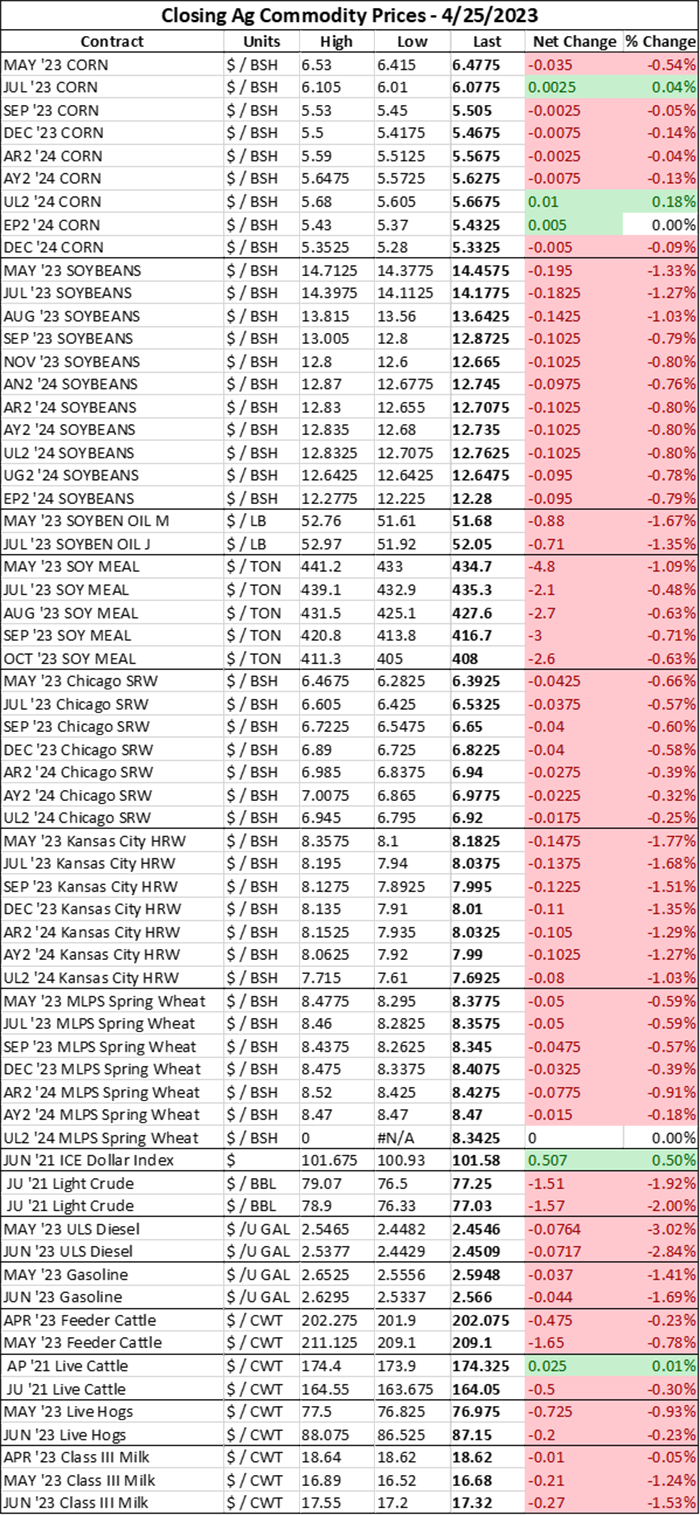

Corn futures prices traded mostly flat today, with the nearby July 2023 contract setting just shy of $6.08/bushel. The May 2023 contract has entered its delivery period and closed $0.035/bushel lower to $6.4775/bushel, reflecting strong cash demand from local processors and ethanol plants.

Price gains were largely held at bay by rapid planting progress across the Heartland throughout the past week as well as by prospects for a large Brazilian corn crop. But markets are awaiting further forecasts before passing final judgement on a behemoth Brazilian corn harvest.

Updated 10-day forecasts published today suggest that Brazil’s Central-West region (i.e. Mato Grosso) where much of the country’s second crop corn is grown is expected to experience warmer than average temperatures during that time. The increased dryness could pose a threat to the Brazilian corn crop over the next days, which could help to inspire more price movement in the U.S. corn market.

Cash corn prices weakened at select Eastern Corn Belt elevators, processors, and ethanol plants today. A Western Iowa ethanol plant widened its cash offering. Many river terminals rolled their bids over to the July 2023 CBOT contract today. Despite all of this noise, cash bids for corn across the Heartland continues to be offered at a healthy premium to both May 2023 and July 2023 futures contracts.

Overnight, Ukrainian grain consultancy APK-Inform projected this year’s Ukrainian corn harvest at 901.6 million bushels (22.9MMT). That’s a 14% drop from last year’s crop and a 46% decrease from the record-setting 2021 Ukrainian corn crop (1.66B bu.).

As a result, APK-Inform expects that Ukraine’s corn shipments next year will fall by nearly a quarter from current marketing year volumes to a meager 716.5 million bushels. Ukraine notched a record high for corn export volumes in 2018 when it shipped 1.19 billion bushels to international customers.

The Brazilian corn crop will likely go a long way to cover this year’s Ukrainian export market losses. But going forward, any future crop shortfalls in South America and the U.S. will cause more supply constraints on the global market if the Ukrainian corn crop and market accessibility continues to shrink at the current levels.

Soybeans

Soybean prices stumbled $0.10-$0.20/bushel lower today amid rapid planting paces in the U.S., shrinking U.S. export volumes, and softening cash market sentiments.

Yesterday’s Crop Progress report from USDA found that 9% of anticipated 2023 U.S. soybean acres had already been planted as of last Sunday, a slight increase from pre-report trade estimates. Plus, extended forecasts are trending cooler for much of the Heartland – a largely favorable sentiment for soybean planting in the coming week.

Soybean processors kept their cash offerings flat today, with bids ranging between $0.40-$0.60/bushel over July 2023 futures contracts today. A Cedar Rapids, Iowa processor continues to leave its bid at $0.65/bushel below futures. Crush margins have dropped to multi-month lows in recent trading session, though adequate soymeal supplies were reported by merchandisers today.

A Cincinnati elevator narrowed its basis by $0.11/bushel to trade even with May 2023 soybean futures prices.

On the Illinois River, cash bids widened by a penny per bushel to trade at a $0.05/bushel premium ahead of May 2023 futures, though flat price action elsewhere on the Mississippi River would suggest that export demand remains relatively quiet for U.S. soybeans at the U.S. Gulf.

Plentiful supplies of soymeal could soon send processing bids lower. Cash offerings for soymeal narrowed substantially today across the Heartland, especially on the rail market, with many rail locations’ bids now standing at a discount to May 2023 soymeal futures prices. Weakened shipping prices at the U.S. Gulf suggest that export demand has softened.

Soymeal buyers are satisfied with current supply levels and are now waiting to see how far soymeal prices will drop before booking further orders.

Wheat

The newswires have been in a tizzy this morning (and really over the past couple days) over Russia’s threats to abandon the Black Sea Grains Initiative that is currently keeping Ukrainian grain shipments flowing out of the invaded country.

But markets largely shrugged off that sentiment today, as Chicago wheat prices dipped $0.03-$0.04/bushel lower, with July 2023 futures settling at 6.5325/bushel. Russian Foreign Minister Sergei Lavrov continues to lament Western banking sanctions (that aren’t truly impacting feed and fertilizer shipments out of Russia). A Turkish import tariff imposed on wheat and corn purchases could slow some international buying paces, further exacerbating today’s wheat market losses.

More rain forecasted for the Plains this week is improving crop prospects for hard red winter wheat crops. That sentiment sent Kansas City futures $0.12-$0.15/bushel lower today, with July 2023 futures closing at $8.0375/bushel.

Optimism for spring wheat planting paces in the Northern Plains also sent Minneapolis futures $0.04-$0.05/bushel lower today as the July 2023 contract fell to $8.3575/bushel.

Soft red winter wheat cash prices in the Eastern Corn Belt were unchanged but hovered between a $0.30-$0.45/bushel discount to July 2023 Chicago futures prices today.

Weather

More rain and thunderstorms are expected today in some of the hardest hit drought areas of the Plains, according to NOAA’s short-range forecast. Accumulation is expected to be higher today than yesterday, reaching up to two inches in parts of Oklahoma and the Colorado Front Range (“Please, please, please!” – my yard).

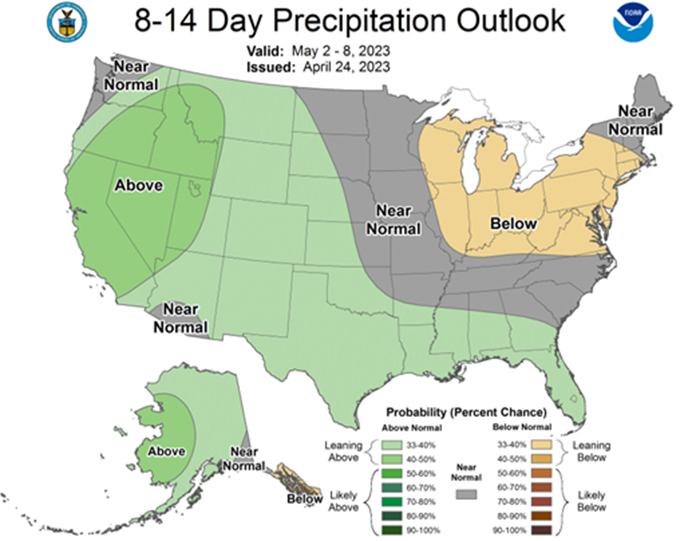

The 6-10-day outlook from NOAA projects below average temperatures for the Eastern half of the country through the first part of May, which could slow emergence rates for newly planted seedlings across the Heartland. Precipitation outlooks during that time are trending below average from the Upper Plains to the Southeast, which should at least keep planters rolling even if it is cooler.

Temperatures in the Eastern half of the U.S. will begin to warm through the second half of next week though are still likely to remain below average, according to NOAA’s 8-14-day forecast. In the Western Plains, temperatures are predicted to rise above average levels during that time.

But that is not a death sentence for winter wheat crops that have been suffering drought in that region. Through the latter half of next week, NOAA is forecasting an above average chance of moisture which should further benefit struggling winter wheat crops. Meanwhile in the Eastern Corn Belt, precipitation outlooks are trending below average, which should enable rapid planting progress.

Financials

Wall Street indices took a dive today as expectations for lower revenues from top tech companies Microsoft and Alphabet (Google’s parent company) are anticipated later today. The S&P 500 tumbled 1.42% to $4,078.35 at last glance after UPS’s CEO called for a weaker economic outlook for the rest of the year and deposits once again surged out of First Republic Bank after the struggling bank’s troublesome earnings were reported last night.

Here’s what else I’m reading this afternoon on FarmFutures.com:

Advance Trading’s Brian Basting makes calculated guesses about this year’s U.S. corn yields.

Water Street Solutions CEO Darren Frye has three insights about how to bring a fresh mindset into a new crop year.

Rachel Schutte and I discuss why easing inflation isn’t necessarily good news for farmers.

Bryce Knorr explains how El Niño could help price protection on corn hedges pay off this spring.

Naomi Blohm reminds farmers that the market is telling you it wants your stored 2022 corn – NOW.

This analyst’s father is “not worried” about planting. I explain how farmers are navigating “yield windows” in a recent E-corn-omics column.

About the Author(s)

You May Also Like