Grains slashed in end-of-month selloff

Afternoon report: Corn, soybeans and wheat all trend lower on Tuesday.

February 28, 2023

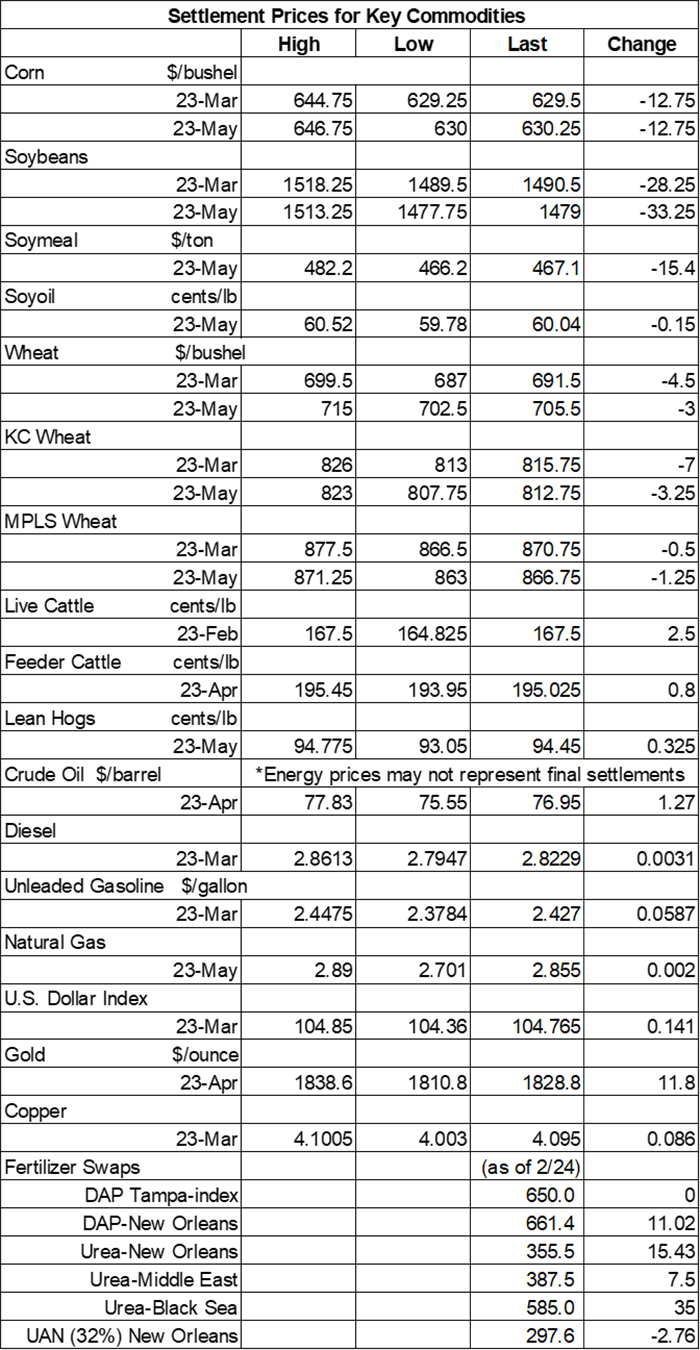

Grain prices turned in a dismal performance on Tuesday amid a round of end-of-month fund selling and worries about the latest export trends and overseas competition. Corn saw monthly losses of 7.2% and is now at the lowest level since August 2022. Soybeans also suffered a double-digit setback today. Wheat losses were variable, mostly ranging between 0.1% and 0.8%.

Loads of wet weather is on its way to the Mid-South and Ohio River Valley between Wednesday and Saturday, with a large portion of these areas set to gather another 2” or more during this time, per the latest 72-hour cumulative precipitation map from NOAA. The agency’s new 8-to-14-day outlook predicts more seasonally wet weather for the central U.S. between March 7 and March 13, with colder-than-normal conditions likely for the Midwest and Plains.

On Wall St., the Dow trended another 145 points lower in afternoon trading to 32,743 and will close the month of February with losses of around 4%. Energy futures were mixed but mostly higher. Crude oil grabbed gains of nearly 2%, moving to $77 per barrel. Diesel dipped slightly lower, while gasoline jumped 2.75% higher. The U.S. Dollar firmed slightly.

On Monday, commodity funds were net buyers of soymeal (+2,000) contracts but were net sellers of corn (-7,500), soybeans (-5,500), soyoil (-3,500) and CBOT wheat (-8,500).

Corn

Corn prices crumbled 2% lower amid an ample round of fund selling as February draws to a close. March futures dropped 12.75 cents to $6.30, with May futures down 13.25 cents to $6.3025.

Corn basis bids were steady to firm across the central U.S. on Tuesday, moving as much as 17 cents higher at an Iowa processor today.

In the ongoing dispute between the United States and Mexico regarding a looming ban on imported GMO corn, Mexico’s economy ministry issued a statement that the U.S. is threatening a trade dispute due to “politically motivated” reasons and that Mexico’s position is not in violation of USMCA terms. The two countries have agreed to “transparent and frank dialogue” to settle the matter.

USDA will release its survey of Prospective Plantings at the end of March, notes grain market analyst Bryce Knorr. A few factors should dominate the direction the grain market takes until that time. “Along with South American weather, the acreage debate should suck up most of the oxygen in the market, barring some wild card news from Wall Street, Ukraine or elsewhere around the world,” he says. Catch up on more of Knorr’s latest analysis here.

Per the latest data from the European Commission, EU corn imports during the 2022/23 marketing year at 706.7 million bushels through February 26. That’s sharply above last year’s pace so far.

Brazil’s Anec estimates that the country’s corn exports will reach 76.7 million bushels in February, down from the group’s estimate of 78.3 million bushels last week.

Three South Korean grain importers purchased a total of 7.7 million bushels of animal feed corn from optional origins in a series of international tenders that closed earlier today. The grain is for arrival on various dates in June.

Preliminary volume estimates were for 388,708 contracts, shifting moderately below Monday’s final count of 433,522.

Soybeans

Soybean prices followed corn prices lower on Tuesday, closing with losses of around 2% and spilling to a seven-week low following a round of technical selling today. March futures tumbled 28.25 cents lower to $14.90 while May futures lost 33.25 cents to $14.7950.

The rest of the soy complex was also in the red today. Soymeal futures incurred significant losses of around 2.5%, while soyoil futures faded 0.5% lower today.

Soybean basis bids were mostly steady to firm across the central U.S. after improving 2 to 15 cents at five Midwestern locations on Tuesday. An Iowa processor bucked the overall trend, sliding 5 cents lower today.

European Union soybean imports during the 2022/23 marketing year are trending moderately below last year’s pace so far after reaching 260.1 million bushels through February 26. EU soymeal imports are also trending lower year-over-year, with 10.17 million metric tons over the same period.

Brazil’s Anec estimates that the country’s soybean exports for February will reach 283.9 million bushels. That’s moderately below the group’s prior projection made a week earlier. Anec also expects to see soymeal exports reach 1.279 million metric tons this month.

Preliminary volume estimates were for 275,147 contracts, which was moderately higher than Monday’s final tally of 233,882.

Wheat

Wheat prices trended lower again on Tuesday – a common theme, as CBOT contracts have been in the red five out of the past six sessions. Losses were somewhat limited today, however, as traders are also closely monitoring whether the current deal for safe vessel travel in the Black Sea will be extended beyond March 18. March Chicago SRW futures dropped 4.5 cents to $6.9150, March Kansas City HRW futures fell 7 cents to $8.16, and March MGEX spring wheat futures eased half a penny lower to $8.69.

In its latest winter wheat quality ratings report, out Monday afternoon, USDA noted just 19% of winter wheat in Kansas (the country’s No. 1 production state) was rated in good-to-excellent condition through February 26, down two points from the end of January. Quality ratings improved significantly in Oklahoma, meantime, and also shifted higher in Texas, Montana and the Dakotas.

European Union soft wheat exports during the 2022/23 marketing year have reached 752.1 million bushels through February 26. That’s 7.1% higher than last year’s pace so far. EU barley exports are moderately lower year-over-year, meantime, with 167.6 million bushels.

Ukraine sent an appeal to the United Nations and Turkey urging the entities to begin negotiations to extend the deal that allows safe passage of shipping vessels through the Black Sea, which is otherwise set to expire on March 18. “We have sent a letter requesting that we start dealing with this issue as March 18 is very soon, but we have not had any feedback so far,” according to a source familiar with the matter. Ukraine is among the world’s top exporters of corn, wheat and barley.

Brazil’s Anec estimates that the country’s wheat exports will reach 20.2 million bushels in February, which is moderately below the group’s prior projection from a week ago.

Turkey purchased 29.0 million bushels of wheat from optional origins in an international tender that closed earlier today. The grain is for rapid delivery beginning in early March as the country looks to shore up its domestic needs following a devastating earthquake earlier that month that led to 44,000 deaths and massive infrastructure destruction.

South Korea purchased 3.1 million bushels of milling wheat, sourced from the United States and Canada, in an international tender that closed earlier today. Of the total, 59% was sourced from the U.S. The grain is for shipment in May.

Japan issued a regular tender to purchase 2.6 million bushels of food-quality wheat from the United States and Canada that closes on Thursday. Of the total, roughly half is expected to be sourced from the U.S. The grain is for shipment starting in late April.

Preliminary volume estimates were for 95,891 CBOT contracts, sliding moderately below Monday’s final count of 134,148.

You May Also Like