Grains in search of fresh direction

Afternoon report: Soybeans slightly firm on Thursday, while corn and wheat finish with mixed results.

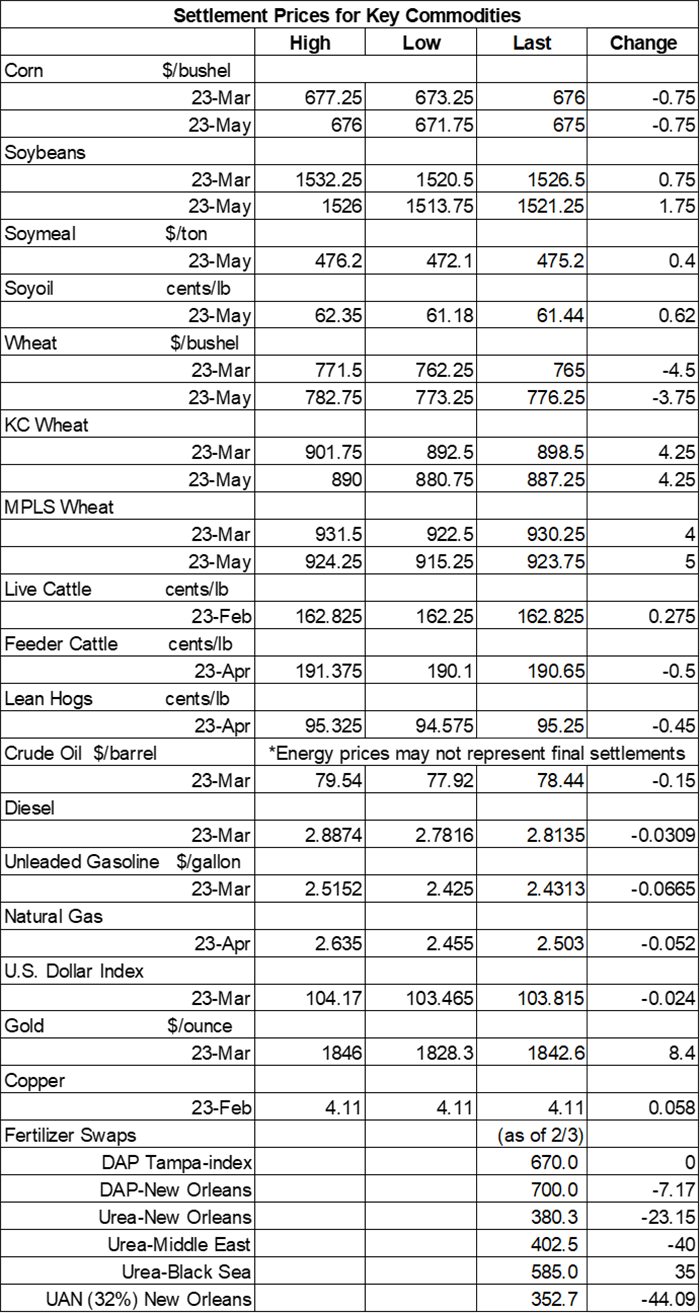

Grains were mixed but mostly higher following some uneven technical maneuvering on Thursday. Nearby corn contracts and Chicago SRW prices faded slightly lower. Soybeans made modest inroads following a choppy session today. Kansas City and MGEX spring wheat contracts each trended around 0.5% higher.

Little rain or snow is expected in the Midwest and Plains between Friday and Monday, although parts of the eastern Corn Belt could pick up some additional moisture during that time, per the latest 72-hour cumulative precipitation map from NOAA. The agency’s new 8-to-14-day outlook predicts seasonally cool, wet weather in the Northern Plains and upper Midwest between February 23 and March 1, with “near normal” conditions farther south.

On Wall St., the Dow faded 91 points lower in afternoon trading to 34,036 on lingering worries that the Federal Reserve will continue its currently aggressive stance on interest rates. Energy futures were also in the red today. Crude oil eased slightly lower to $78 per barrel. Diesel dropped more than 0.75%, while gasoline tumbled 2.5% lower. The U.S. Dollar softened slightly.

On Wednesday, commodity funds were net buyers of soyoil (+1,500) contracts but were net sellers of corn (-5,000), soybeans (-4,000), soymeal (-4,000) and CBOT wheat (-8,000).

Corn

Corn prices were narrowly mixed as traders failed to find much intriguing supply or demand signals. Corn export sales were solid but also rangebound. March futures eased 0.75 cents to $6.7550, while May futures picked up 0.25 cents to $6.7425.

Corn basis bids were steady to weak after softening 2 to 3 cents across three Midwestern locations on Thursday.

Corn export sales fell 12% lower week-over-week to 44.3 million bushels. That was toward the higher end of trade estimates, which ranged between 23.6 million and 55.1 million bushels. Cumulative sales for the 2022/23 marketing year remain well below last year’s pace, with 538.4 million bushels.

Corn export shipments jumped 70% higher week-over-week to 26.4 million bushels. Mexico, Saudi Arabia, Guatemala, El Salvador and Japan were the top five destinations.

The International Grains Council reduced its estimates for global corn production by eight million metric tons (approximately 315 million bushels) to 1.153 billion metric tons, citing downward revision for the United States and Argentina.

“You can find plenty of planter maintenance articles plus lots of articles telling you how much you can make adding attachments on your planter,” posits Tom Bechman, editor of Indiana Prairie Farmer. “What if you ignore them, pull out the planter, grease it and start planting? Will you grow less corn and make less money?” Bechman explores the situation in greater detail – click here to learn more.

Preliminary volume estimates were for 291,095 contracts, trending moderately above Wednesday’s final count of 222,365.

Soybeans

Soybean prices wobbled in a choppy session but managed meager gains by the close, thanks in part to a flash sale announced this morning. March futures added 0.75 cents to $15.2650, with May futures up 1.75 cents to $15.2125.

The rest of the soy complex was firm. Soymeal futures found modest gains of around 0.1%, while soyoil prices rose mor than 1%.

Soybean basis bids were largely unchanged across the central U.S. on Thursday but did ease a penny lower at an Ohio elevator today.

Private exporters announced to USDA the sale of 4.7 million bushels of soybeans for delivery to unknown destinations during the 2022/23 marketing year, which began September 1.

Soybean exports reached 28.4 million bushels in combined old and new crop sales. Old crop sales were up 37% from a week ago but down 35% from the prior four-week average. Totals sales were near the middle of analyst estimates, which ranged between 14.7 million and 40.4 million bushels. Cumulative totals for the 2022/23 marketing year are now trending slightly ahead of last year’s pace, with 1.439 billion bushels.

Soybean export shipments were nearly identical to the prior four-week average, with a robust total of 69.9 million bushels. China, Germany, the Netherlands, Spain and Mexico were the top five destinations.

Brazilian consultancy AgRural moderately reduced its estimates for the country’s 2022/23 soybean production to 5.545 billion bushels. That’s around 73.5 million bushels below its prior projection. AgRural’s new estimate would still be a record-breaking effort, if realized.

Between historically tight supplies, a war that has disrupted shipping lanes, drought in Argentina and a looming surge in biodiesel demand, how is the market not more bullish on soybeans, wonders Bill Biedermann, hedging strategist with AgMarket.net. “But the market doesn’t always agree with me for some reason,” he adds. “The market has been trading these stories for nearly a year.” Click here to catch up on Biedermann’s latest commentary and analysis.

Preliminary volume estimates were for 239,062 contracts, sliding slightly below Wednesday’s final count of 250,066.

Wheat

Wheat prices were mixed but mostly higher following some uneven technical maneuvering on Thursday. March Kansas City HRW futures gained 4.25 cents to $8.9875, and March MGEX spring wheat futures added 4 cents to $9.2875. Chicago SRW contracts failed to follow suit, with March futures dropping 4.5 cents to $7.6475.

Wheat exports found 8.6 million bushels in combined old and new crop sales. Old crop sales were 60% higher week-over-week but still 32% below the prior four-week average. That was also on the low end of analyst estimates, which ranged between 5.5 million and 18.4 million bushels. Cumulative totals for the 2022/23 marketing year are tracking slightly behind last year’s pace so far, with 476.3 million bushels.

Wheat export shipments firmed 25% above the prior four-week average, with 18.4 million bushels. Japan, Vietnam, Mexico, Egypt and the Philippines were the top five destinations.

As expected, Japan purchased 2.8 million bushels of food-quality wheat from the United States, Canada and Australia in a regular tender that closed earlier today. Of the total, 29% was sourced from the U.S. The grain is for shipment starting in late March.

Tunisia issued an international tender to purchase 3.7 million bushels of soft wheat and 3.4 million bushels of animal feed barley from optional origins that closes on Friday. The grain is for shipment in March.

Thailand purchased 2.2 million bushels of animal feed wheat, likely sourced from the Black Sea region, in a deal that closed yesterday. Traders indicated Bulgaria or Romania were the likely origins. The grain is for shipment in July.

Preliminary volume estimates were for 76,177 CBOT contracts, falling well below Wednesday’s final count of 134,103.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)