Grain markets wobble on WASDE, crop production reports

Prices mixed following release of Friday’s data dump.

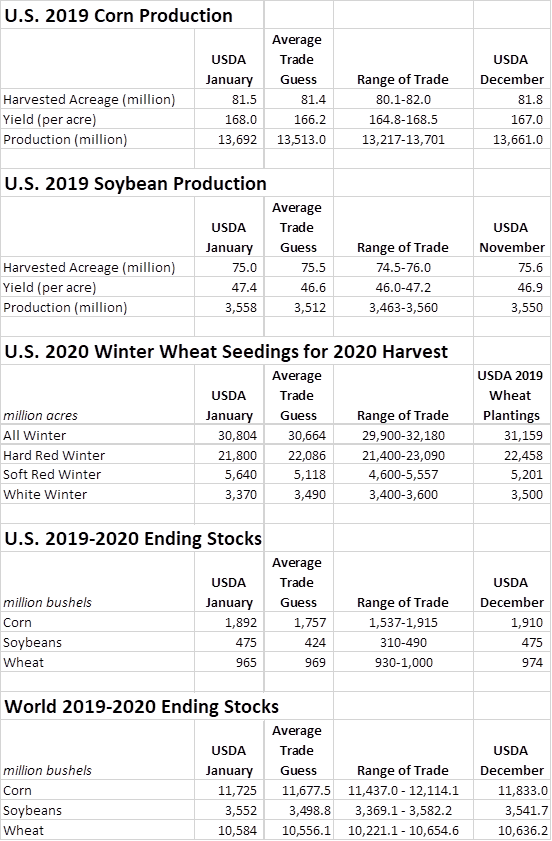

As expected, USDA dialed in some grain production changes in its latest round of supply and demand data from its monthly World Agricultural Supply and Demand Estimates (WASDE) report. But the agency’s data proved more bullish for corn and soybean production than analysts had hoped, which pushed prices into the red immediately following the report before recovering later in Friday’s session.

Ending corn and wheat stocks tightened while soybean stocks remained the same as December estimates.

NASS also announced this morning that it will re-survey corn and soybean producers with unharvested crops in Northern Plains and Great Lake states later this spring after noting that some states still had large unharvested acres as of early December – North Dakota, in particular, which had harvested just 43% of its crop by Dec. 8.

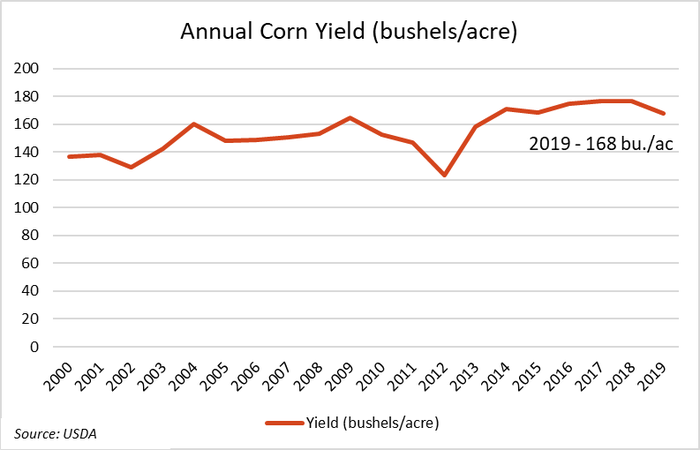

CORN

USDA now says the 2019 corn harvest had a total production of 13.692 billion bushels, with average yields of 168.0 bushels per acre across 81.5 million acres. That was a bit higher than trade estimates of 13.513 billion bushels, based on average yields of 166.2 bushels per acre across 81.350 million harvested acres. USDA’s prior tally was for 13.661 billion bushels, based on yields of 167.0 billion bushels across 81.815 million acres.

USDA’s corn ending stock estimates were for 1.892 billion bushels, which was moderately higher than trade estimates of 1.757 billion bushels but just below the agency’s December projection of 1.910 billion bushels. World ending stocks were for 297.81 million metric tons, which was also higher than analyst estimates of 296.61 MMT.

“Like the nearby corn futures, I was initially shocked to see an increase in yields but quickly recovered after NASS announced they would re-survey states with unfinished harvests later this spring,” notes Farm Futures grain market analyst Jacquie Holland. “It was the price action needed after increased yields and higher 2018/19 ending stocks sent futures several cents lower.”

Corn storage, in contrast, is down 5% year-over-year, with a total of 11.4 million bushels. The bulk of this volume (7.18 billion bushels) remains in on-farm storage, with the remaining 4.21 billion bushels stored off-farm.

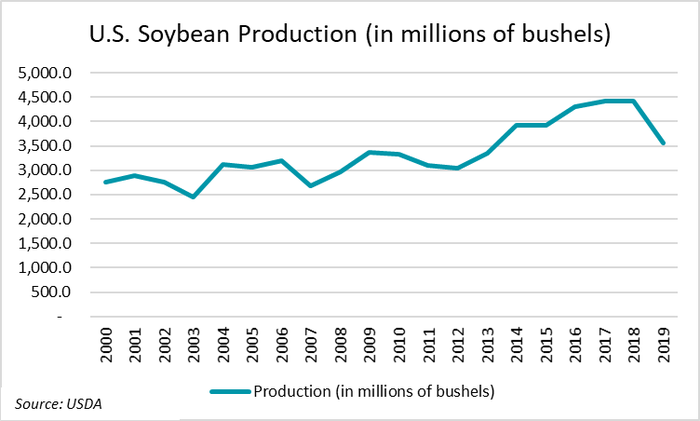

SOYBEANS

USDA’s latest data for the 2019 soybean crop included average yields of 47.4 bpa across 75.0 million harvested acres, for a total production of 3.558 billion bushels. Those numbers were more bullish than trade estimates, which averaged 3.512 billion bushels based on per-acre yields of 46.6 bpa across 75.462 million harvested acres. USDA’s prior tally was for 3.550 billion bushels, based on yields of 46.9 bpa across 75.626 million acres.

USDA’s soybean ending stock estimates were for 475 million bushels, which was somewhat higher than trade estimates of 424 million bushels while mirroring the agency’s December projection of 475 million bushels.

World ending stocks were for 3.552 billion bushels, which was slightly higher than the average trade guess of 3.499 billion bushels and USDA’s December projection of 3.542 billion bushels.

Soybean storage is down 9% from a year ago, at 3.25 billion bushels, split fairly evenly between on-farm and off-farm storage.

“Soybeans futures bounced back quickly after the NASS announcement despite an increase in Brazil’s ending stocks to end up relatively unchanged from the release of the reports,” Holland says. “Production supplies balanced out a decrease in exports, so stocks remained the same.”

For South American competitors, USDA is now estimating 2019/20 Argentina soybean production at 1.947 billion bushels, with Brazil’s soybean production at 4.519 billion bushels this season.

WHEAT

USDA also reported on winter wheat acres for 2019/20, estimating 30.804 million acres, which was down another 1% year-over-year (2018/19 plantings were at 31.159 million acres) and landing at the lowest level in more than a century. The agency’s official estimate was a bit higher than the average trade guess of 30.664 million acres, however.

USDA’s wheat ending stock estimates were for 965 million bushels, versus an average trade guess of 1.000 billion bushels and the agency’s December projection of 974 million bushels. World ending stocks were for 10.584 billion bushels, which was a bit above trade estimates of 287.32 MMT.

U.S. wheat storage fell 9% from a year ago, to 1.83 billion bushels. Off-farm stocks account for more than 70% of that total, with 1.31 billion bushels.

“Hard red winter wheat was the winner of the day,” Holland says. “Acreage dropped 658,000 acres but caused a 5-6 cent futures rally. Cash sales in the Plains have been slow this week – perhaps this rally will be enough to move more wheat to market.”

About the Author(s)

You May Also Like