Grain markets face quiet session on Friday

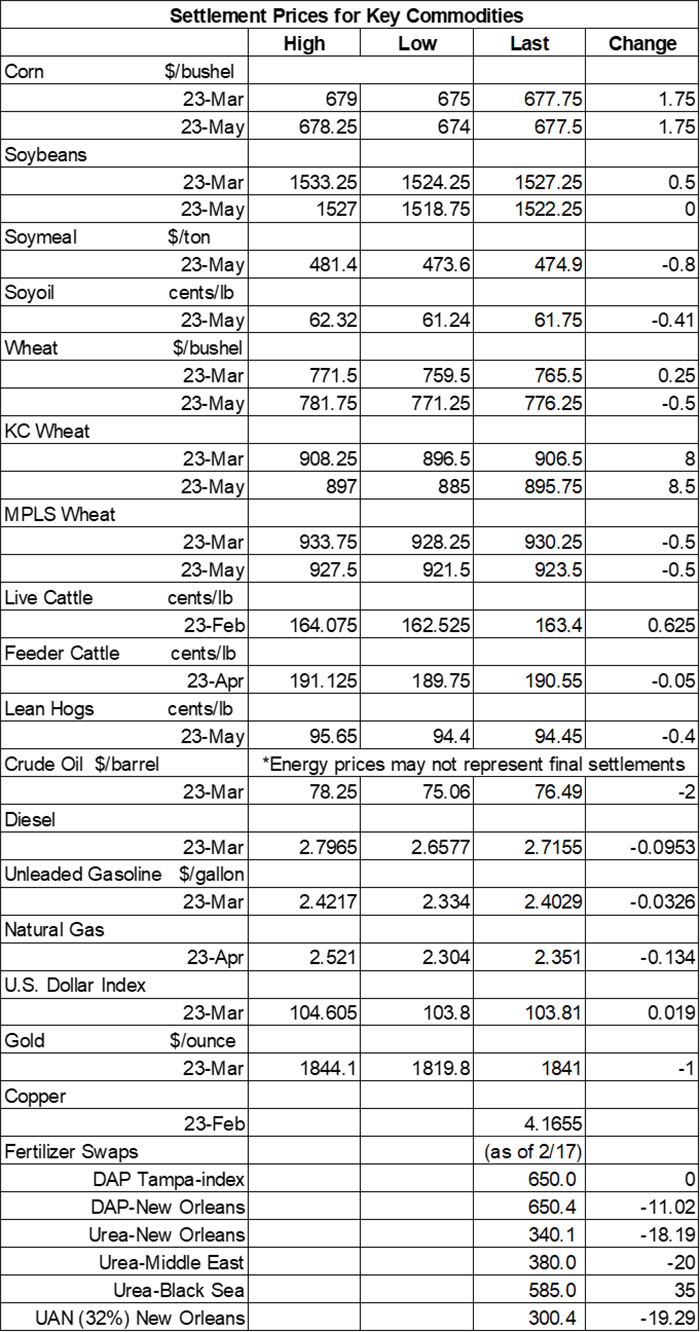

Afternoon report: Corn, soybean and wheat were lightly mixed today.

Grain prices were lightly as traders squared positions ahead of a three-day holiday weekend. Kansas City HRW contracts fared the best, rising nearly 1% higher following a round of technical buying today. Corn and soybean prices also moved slightly higher, while MGEX spring wheat futures moved modestly lower. CBOT contracts were narrowly mixed.

Aside from some parts of Minnesota and the Dakotas, little to no rain and/or snow is expected in the central U.S. between Saturday and Tuesday, per the latest 72-hour cumulative precipitation map from NOAA. The agency’s new 8-to-14-day outlook predicts a return to seasonally wet weather for most of the Midwest and Plains between February 24 and March 2, with colder-than-normal conditions likely for the western half of the U.S. during that time.

On Wall St., the Dow shifted 56 points higher in afternoon trading to 33,753. However, rising yields on 2-year and 10-year U.S. Treasury bonds are creating an increasingly bearish environment on equities right now. Energy futures faded significantly lower, with crude oil dropping 2.75% this afternoon to $76 per barrel on ample supplies. Diesel tumbled 3.5% lower, with gasoline down around 1.25%. The U.S. Dollar firmed slightly.

On Thursday, commodity funds were net buyers of soybeans (+2,000), soymeal (+1,000) and soyoil (+2,000) contracts but were net sellers of corn (-1,000) and CBOT wheat (-2,500).

Corn

Corn prices managed to hold onto modest gains after a choppy session on Friday, with another flash sale announced this morning spurring some technical buying today. March futures picked up 1.75 cents to $6.7775, while May futures added 2.75 cents to $6.7775.

Corn basis bids were mostly steady to firm across the central U.S. on Friday, improving as much as 5 cents at two Midwestern processors. An Iowa river terminal bucked the overall trend after spilling 6 cents lower today.

Private exporters announced to USDA the sale of 4.8 million bushels of corn for delivery to unknown destinations during the 2022/23 marketing year, which began September 1.

A South Korean feed group issued an international tender to purchase 5.4 million bushels of animal feed corn, sourced from optional origins, that closes today. The grain is for arrival in June.

There’s a reason why Illinois farmer Terry Pope has done cash flow projections every year since he started farming, according to Mike Wilson, executive editor of Farm Futures – quite simply, they work. “Depending on the year, I always try to keep track of not just everyday variable costs, but also fixed costs,” Pope says. “It’s my roadmap for the year.” Find out what else Wilson learned – click here for details.

Preliminary volume estimates were for 306,645 contracts, tracking slightly higher than Thursday’s final count of 291,095.

Soybeans

Soybean prices were steady to slightly firm following a light round of technical buying on Friday. March futures inched half a penny higher to $15.27, while May futures remained unchanged at $15.2125.

The rest of the soy complex spilled into the red on Friday. Soymeal losses were minimal, at less than 0.2%, while soyoil trended nearly 0.7% lower today.

Soybean basis bids were steady to weak after spilling 2 to 15 cents lower across three Midwestern locations on Friday.

Brazil’s largest grain farmer cooperative Coamo reports that forward sales in 2022/23 are only at around 5% of the total expected output, versus 25-30% at the same time a year ago. Coamo argues that this is due to farmers holding onto more of their grain to wait for higher domestic prices.

South Korea issued an international tender to purchase 60,000 metric tons of soymeal from optional origins that closes today. The grain is for arrival in June.

“Most years, the calendar is edging toward February before we get a good start in the shop,” according to Indiana farmer Kyle Stackhouse. “This year was no different. There is still some office work to finish up, but most days are spent in the shop.” Find out what all Stackhouse has been up to in his latest column – click here to learn more.

Preliminary volume estimates were for 192,601 contracts, which was moderately below Thursday’s final count of 254,326.

Wheat

Wheat prices were mixed after some uneven technical maneuvering on Friday. Kanas City HRW contracts showed plenty of upside, with March futures adding 8 cents to $9.0650. Chicago SRW contracts were fractionally firm, with March futures inching 0.25 cents higher to $7.6525. MGEX spring wheat contracts failed to follow suit – March futures eased half a penny lower, to $9.2975.

Additional negotiations are likely to take place next week to extend the current deal that allows safe passage of Ukrainian vessels through the Black Sea, which was initially brokered by the United Nations and Turkey last July. The agreement is up for renewal in March, and Russia is likely to ask for agricultural export sanctions to be lifted in order to keep extending the deal.

France’s current soft wheat crop is in great shape so far, with farm office FranceAgriMer reporting that 93% is rated in good-to-excellent condition through February 13. The country’s winter barley ratings are also solid, with 92% rated in good-to-excellent condition as of Monday.

Tunisia purchased around 3.7 million bushels of soft wheat and 3.4 million bushels of barley from optional origins in an international tender that closed earlier today. Additional details of the sale were not immediately available.

If it’s been a while since you’ve ventured over to FarmFutures.com, our Friday feature “7 ag stories you can’t miss” is a great opportunity to quickly catch up on the industry’s top headlines. The latest round of content includes an update on EPA’s dicamba restrictions, Mexico’s looming ban on GMO corn imports, new conservation funding from the NRCS and more. Click here to get started.

Preliminary volume estimates were for 82,822 CBOT contracts, slipping slightly below Thursday’s final count of 85,956.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)