Futures rally on bullish corn, soybean data

Strong demand moves markets higher.

June’s World Agricultural Supply and Demand Estimates (WASDE) report from USDA suggests lower domestic beginning and ending corn stocks, bolstered by bullish exports and ethanol production. The agency also reported lower soybean beginning and ending stocks, thanks in part to high disappearance from stronger-than expected use. The news had corn futures up nearly 2% in the moments following the report, with soybean futures adding around 0.5%. Wheat rallied as well on weather concerns around the world.

“After falling to oversold levels, corn and soybean futures were ready for a rebound and they’re getting it today based on friendly USDA data,” says Farm Futures senior grain market analyst Bryce Knorr. “Still, it will be important for the market to hang on to gains and maintain momentum.”

Knorr notes that summer markets are all about weather, and the end-of-planting selloff lasting longer than it did is an indication that crops haven’t faced any major adversities yet.

“At best, this could just be a correction in an otherwise bearish market,” he says.

Corn

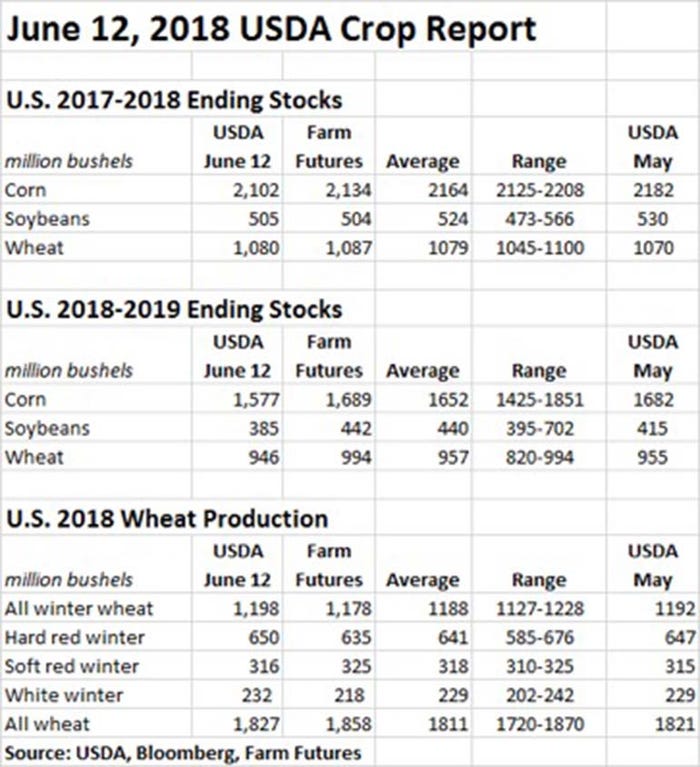

U.S. corn ending stocks for 2017/18 fell 70 million bushels from USDA’s May estimates, to 2.112 billion bushels. That fell below trade estimates that ranged between 2.125 billion and 2.208 billion bushels (including a Farm Futures projection of 2.134 billion bushels).

U.S. corn ending stocks for 2018/19 also fell, from USDA’s May estimates of 1.682 billion down to 1.577 billion bushels. That fell moderately below the average trade guess of 1.652 billion bushels. USDA reports that this number is largely reflected due to a 75-million-bushel increase in its export projections, which are tracking at the highest levels in a decade, at 2.300 billion bushels, thanks to record exports in April, with continued robust demand through May.

The agency also reports that projected corn used for ethanol in 2018/19 trended 50 million bushels, higher – offsetting a similar reduction in food/seed/industrial usage for sorghum.

If the resulting ending stocks for 2018/19 corn reach 1.577 billion bushels, it will fall to the lowest level in five years. USDA in turn raised its season-average farm price, which now ranges between $3.40 and $4.40 per bushel.

Elsewhere in the world, USDA lowered its corn production estimates in several key production areas. Russia’s production was lowered based on its government’s data on lower-than-expected planted area. South American production also ticked lower. Brazil’s production was also lowered by 78.7 million bushels to 3.346 billion bushels due to drought conditions in the country’s Center-West and South growing areas throughout May. And Argentina’s production potential fell from 1.299 billion bushels in May to 1.260 billion bushels.

Globally, the agency lowered its estimates for 2017/18 world corn ending stocks to 7.586 billion bushels and 2018/19 world corn ending stocks to 6.090 billion bushels.

“We anticipated USDA’s drop in old crop corn carryout due to stronger exports triggered in part by the smaller crops in South America. But the big question now is production,” Knorr says.

That also makes the agency’s June 29 acreage estimate loom ever-larger – especially if weather forecasts finally turn drier, he adds.

“July corn futures should tell the story about what the market thinks, with the 50% retracement of the selloff and 100-day moving average right at the $3.8975 gap from June 4 a major target,” he says.

Soybean

U.S. soybean ending stocks for 2017/18 were also lower, from USDA’s May estimates of 530 million bushels down to 505 million bushels. Trade estimates for this number ranged between 473 million and 566 million bushels, including Farm Futures’ almost-on-the-nose estimate of 504 million bushels.

That trend continued into 2018/19, with USDA projecting domestic soybean ending stocks moving from 415 million bushels down to 385 million bushels. USDA still assigns a fairly broad season-average price for next year, ranging between $8.75 and $11.25 per bushel.

USDA moved its 2017/18 world ending stocks for soybeans slightly higher, from May estimates of 3.388 billion bushels to 3.398 billion bushels. The agency’s 2018/19 soybean ending stocks also moved higher, from 3.186 billion bushels to 3.197 billion bushels.

USDA calls its latest South American production estimates unchanged from May, although it says Argentina’s production slipped by about 73 million bushels versus last month, with Brazil’s production gaining approximately the same amount.

“USDA’s forecast for soybeans especially bears watching,” Knorr says. “Even though the agency’s old crop carryout estimate was right in line with our forecast, it’s assuming very optimistic exports for the 2018/19 marketing year. Even if China begins buying U.S. soybeans at a normal pace in the fall, questions remain about overall demand there. A 6.2% increase in total Chinese imports may be too much, and we may face stiff competition again from Brazil as well.”

Wheat

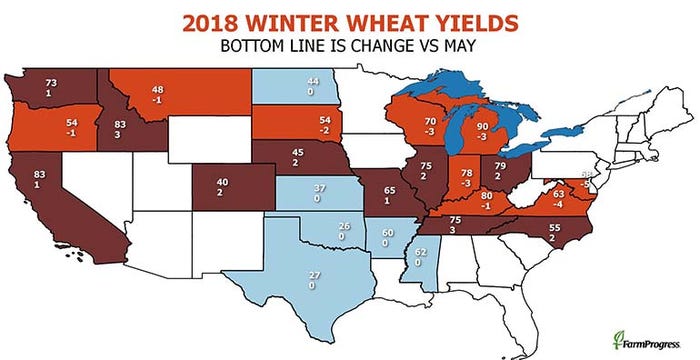

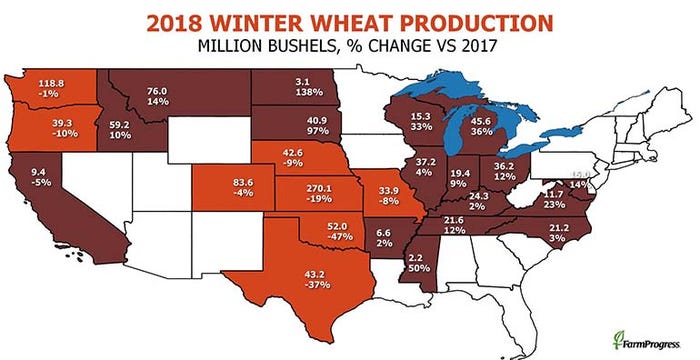

U.S. wheat ending stocks for 2017/18 rose slightly, meantime, from USDA’s May estimates of 1.070 billion bushels up to 1.080 billion bushels. Trade estimates ranged between 1.045 billion and 1.100 billion bushels, including a Farm Futures projection of 1.087 billion bushels. Domestic ending stocks for 2018/19 wheat trended lower, however, moving from 955 million bushels to 946 million bushels.

World ending stocks for 2017/18 wheat edged higher, from 9.939 billion bushels to 10.008 billion bushels. USDA also raised its projections for global 2018/19 wheat ending stocks, from 9.711 billion bushels to 9.780 billion bushels. Lower global consumption and trade could more than offset any production concerns, according to the agency – but ending stocks this year could still come in nearly 3% below last year’s record-breaking numbers.

“Wheat’s rally today could be important to maintaining enthusiasm from hedge funds,” Knorr says. “Today’s numbers from USDA’s were not at all bullish, but the market appears to be sensing that wheat is finally making a long-term turn.”

Production problems appear to be incessant in many parts of the world, Knorr says. No country (aside from Australia) faces a major disaster for now, but burdensome supplies among exports could finally be shrinking, he says.

“Winter wheat futures’ ability to rally into harvest is a positive sign,” he says.

About the Author(s)

You May Also Like