Sorghum Focus: Sorghum farmers should position themselves to capitalize on rallies in markets this summer.

June 13, 2022

On May 31, USDA reported 40% of the U.S. sorghum crop had been planted, compared to the five-year average of 43%. Rains have finally begun falling across much of the sorghum belt, and though we’ve got a long way to go to make up for lost moisture, things are off to a much better start than we thought possible just a few weeks ago.

With this kind of progress, many farmers are now shifting back into an offensive posture. This is exciting, given the current market will bring record pricing opportunities.

Start now

As always, the key for farmers looking to be successful marketers in 2022 is to be proactive. For farmers who haven’t begun making forward sales or buying put options, now is a good time to start. As I write this, December 2022 corn futures are trading at just over $6.90 per bushel. Sure, that’s down almost 70 cents from the mid-May peak, but how many times in history have U.S. farmers had a chance to price their crops at this level? Once — in the drought year of 2012, when most farmers had no grain to price. For all practical purposes, many farmers have never had an opportunity like this. Why gamble on a reversal of the short-term trend?

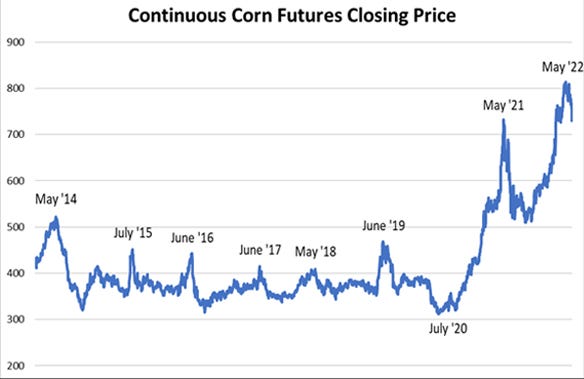

Certainly, there’s a huge caveat to a statement like that in a year like 2022. With talks of possible food shortages making their way into the mainstream press, gambling on higher commodity prices is probably a much less risky endeavor than normal. However, recent history points to good but short-lived opportunities coming around this time of year without fail. The chart below highlights this phenomenon.

Spring rally

Note that since 2014, each spring or early summer has seen a rally in the corn market. That’s nine chances in nine years to sell a crop early, many times at a profit. Some years, this rally came in May or even started in April. Some years, we were still waiting for it in July. And some years, the rally was lackluster. COVID-19 likely kept a lid on the July 2020 rally — but even then, the market gained 45 cents from the April low to the July high. This history serves as a strong signal from the market that farmers should sell rallies like the one we’re seeing today.

Taking advantage

What can be done to take advantage? Every situation is different, but there are a lot of options. (Farmers just need to remember not to take excessive risks while hedging. After all, the point of hedging is minimizing risk — not adding to it.) For those with irrigation or those in areas where the rains of the past few weeks have completely replenished the soil profile, delivering bushels this summer or fall may be virtually guaranteed. If that’s the case, forward sales are a great option. For those with more production risk, a smaller amount of forward selling is still a viable choice as is buying put options. In both cases, the size of the transactions can be scaled to match expected production or the amount of production guaranteed by crop insurance.

Regardless of the mechanism, farmers should move soon to take full advantage of this great market!

Duff is executive vice president for National Sorghum Producers. He can be reached by email at [email protected] or on Twitter @sorghumduff.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)