Strong dollar impacts commodities differently

Largest increases in commodity exchange rate indices occurred with livestock products.

In 2015, the trade-weighted U.S. Dollar Index finished the year 9% higher, but when it comes to how a “stronger dollar” affects commodities, the magnitude can vary, according to economists.

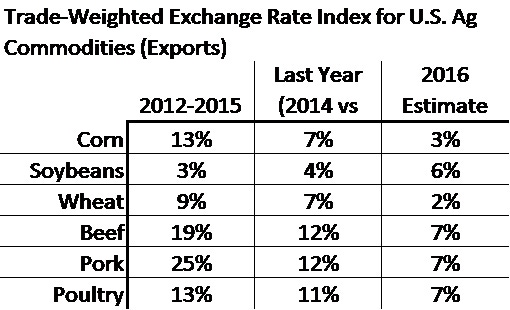

David Widmar, agricultural economist and researcher with the Center for Commercial Agriculture at Purdue University, said from 2012 to 2015, the index has increased as little as 3% in soybeans to as much as 25% for pork (Table).

“Overall, the impacts have been most significant on beef, pork and poultry, with each (showing) more than a 10% increase in the index values,” he said.

Widmar noted that index values were up substantially in 2015: Corn was up 7% for the year, and beef, pork and poultry each were up 11-12%.

The U.S. Department of Agriculture provides commodity-specific estimates for 2016. Comparing estimated 2016 levels to those observed in 2015, additional exchange rate strengthening is expected, although the rate of increase should be less than what was seen in 2015, Widmar noted.

The soybean exchange rate index, which saw fairly small changes throughout 2015, is set for a 6% increase in 2016. Corn and wheat are expected to increase 3% and 2%, respectively. Also, livestock exports are set to face strong increases in the exchange rates.

“Overall, however, the estimated increases for 2016 are mostly lower than what was observed in 2015 — soybeans being the exception,” Widmar said.

A strong, or expensive, dollar can makes U.S. exports costlier for international buyers to purchase. “This has made agricultural trade difficult recently and will be critical to monitor into 2016,” Widmar said.

Trade-Weighted Exchange Rate Index for U.S. Ag Commodities (Exports) |

|

Corn |

Soybeans |

Wheat |

Beef |

Pork |

Poultry |

Source: David Widmar

Rebalancing value

Bluford Putnam, managing director and chief economist at CME Group, said commodity-producing countries are suffering — both emerging markets as well as mature markets such as Australia and Canada.

Putnam said China's growth continues to decelerate, possibly growing only 5.5-6.0% in 2016 despite a target of 6.5%. Russia is in an oil-induced recession. Growth in the Euro zone may be 1-2%, which Putnam said is “better than stagnation yet not exciting.”

He explained that exchange rates in weakening countries are depreciating. “It is not a 'currency war'; it is just the natural market rebalancing of the value of countries whose fortunes have turned for the worse,” Putnam said.

Crop demand impact

Crop markets continue to struggle, with demand dropping off slightly. Chad Hart, Iowa State University agricultural economist, said while domestic demand continues to grow with the expansion of the livestock sector, international demand has faltered under the weight of a stronger U.S. dollar and lowered prospects for global economic growth.

Hart added that although feed demand is building with growing livestock herds, that growth is slowing. “Fed cattle and hog returns are projected to be around breakeven for much of 2016 and 2017, so the incentive to expand is diminishing,” he said.

Hart also said crop usage for biofuels will likely be stable for corn and should rise slightly for soybeans without any new plants.

The strength of the dollar looms large in the crop markets, Hart said. “Given the triple headlines of large global supplies, the strong dollar and weaker world economic growth, U.S. ag exports have taken a step back and may continue to erode in the next year,” he said.

Slowing global growth

Putnam said 2016 growth may disappoint the markets. “The combination of short-term disruptions, slow global growth and the long-term consequences of a big generation of baby boomers retiring and spending less all adds up to a disappointing outlook,” he said.

He expects U.S. economic activity in 2016 to slow to a disappointing 1.6% annual average real gross domestic product (GDP) growth rate.

“With the current round of oil price declines, both headline and core inflation may finish 2016 more or less converging in the 1.35-1.75% range, staying below the Federal Reserve's 2% long-term target,” Putnam said.

Subdued treasury bond yields also suggest that the Fed may delay the next short-term rate hike until this summer, and the effective federal funds rate may not climb above 1% until 2017.

Putnam noted that there are some shorter-term headwinds as well. Flooding throughout the Mississippi River Valley may shave 0.3-0.6% or more off the first-quarter 2016 real GDP. With barge traffic disrupted, upstream shippers may need to shift to rail, and the downstream flow of goods to ports is diminished.

“The effects are temporary, and the economy bounces back, but it is still a drag on the first half of 2016,” Putnam said, noting that "the dock strikes on the West Coast in the first quarter of 2015 did similar damage."

About the Author(s)

You May Also Like