Soybeans surge on bullish WASDE updates

Lower estimated yields drive up short-term prices.

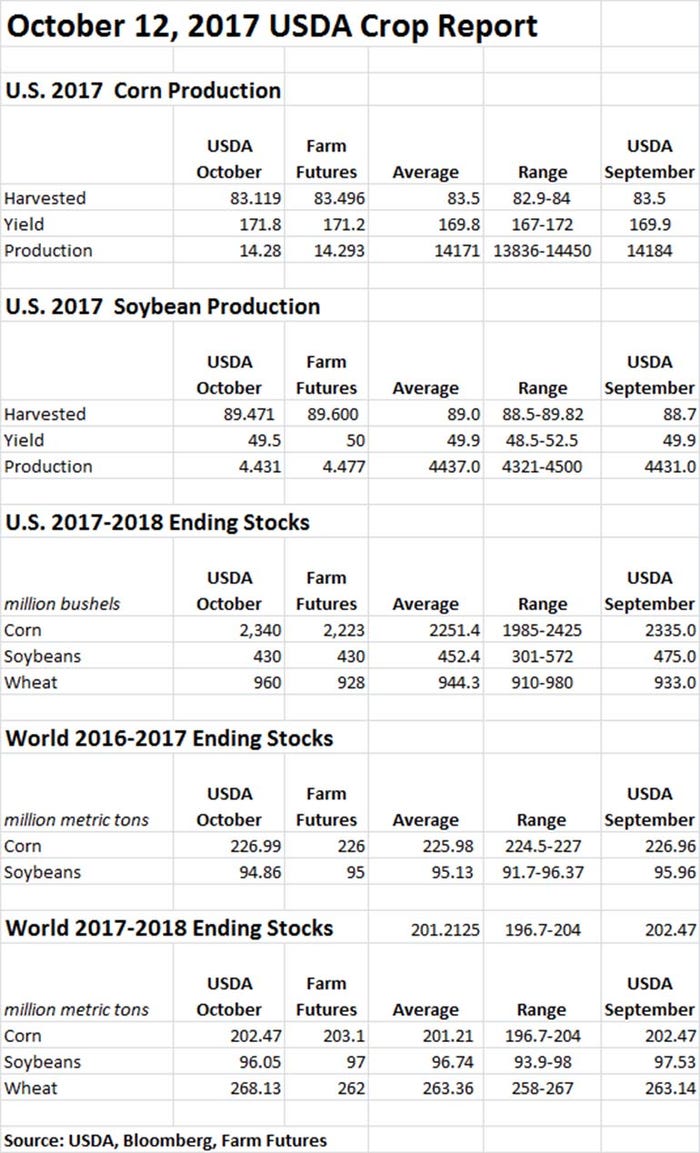

Ahead of Thursday’s USDA World Agricultural Supply and Demand Estimates (WASDE) report, a group of industry analysts predicted the agency would not revise its September soybean yield estimates of 49.9 bpa. But USDA downsized yields in its October report by 0.4 bpa to 49.5 bpa, pushing soybean prices more than 28 cents higher immediately following the report’s release.

Soybean production also came in slightly below trade estimates of 4.437 billion bushels, with 4.431 million bushels. Harvested area is still projected at a record 89.5 million acres, up 0.8 million from prior estimates. And 2017/18 supplies are now projected down 44 million bushels for ending stocks of 430 million bushels. That would make stocks-to-use ration the highest since 2006/07.

Globally, USDA estimates soybean production is down by around 22 million bushels, with gains from China and Mexico partially offsetting lower forecasts for Ukraine and Russia.

“Today’s numbers for soybeans are giving growers a chance to lock in some profitable prices on 2017 production if they’re confident about yield and can hedge to wait for basis to firm up,” says Farm Futures senior grain market analyst Bryce Knorr.

This is an opportunity that should not be bypassed without careful consideration, Knorr adds.

“While dry weather in parts of Brazil and potential for increased demand out of China may well take prices higher, it’s time for growers to take a gut check to see how much risk they can afford,” he says. “Implied volatilities for soybean options remain low, and at-the-money January puts cost 25 cents or less to provide some insurance.”

USDA estimates the season average price for 2017/18 soybeans at $8.35 to $10.05 per bushel, unchanged from a month ago.

Corn prices saw a more modest lift after the WASDE report was released, gaining 6-7 cents following the October updates. The average trade guess for corn yields was 169.8 bpa, with a range of 167 to 172 bpa. USDA came in on the high end of that range, with estimates of 171.8 bpa.

U.S. corn production is also forecast higher, up 96 million bushels from September for a total of 14.280 billion bushels. Supply and use changes essentially offset, with U.S. corn ending stocks up 5 million bushels from a month ago. Global corn stocks are down 1.5 million from a month ago, to 201.0 million.

“The key now may be demand, but we won’t get any fresh data on feed usage until January, so firming prices more may be difficult,” Knorr says. “Funds are short, but their covering may only last a couple of days until beans really take off.”

Season-average corn price received by producers was $2.80 to $3.60 per bushel, unchanged from last month.

Wheat prices saw 3- to 4-cent gains immediately following the October WASDE report. Ending stocks came in higher than USDA September estimates and on the high end of analysts’ trade estimates, at 960 million bushels. That’s still below October 2016 levels of 1.181 billion, however.

Wheat supplies are higher globally, due to higher production forecasts for Russia, the European Union and India and despite declines in Australia, which may deliver its lowest wheat output since 2008/09. Global ending stocks have reached record levels at 9.850 billion bushels, up around 183.7 million bushels from a month ago, according to USDA.

USDA narrowed the 2017/18 season average farm price 10 cents on each end to $4.40 to $4.80 per bushel, with the midpoint of $4.60 per bushel unchanged.

“Wheat continues to lag,” Knorr says. “It’s time to get rid of some old crop inventory because the market has little reason to rally until January.”

The next round of WASDE and Crop Production reports will be released on Nov. 9.

About the Author(s)

You May Also Like