Soybean, soyoil futures soar on solid demand

Afternoon report: Corn prices shift nearly 1% lower; wheat prices mixed on Friday.

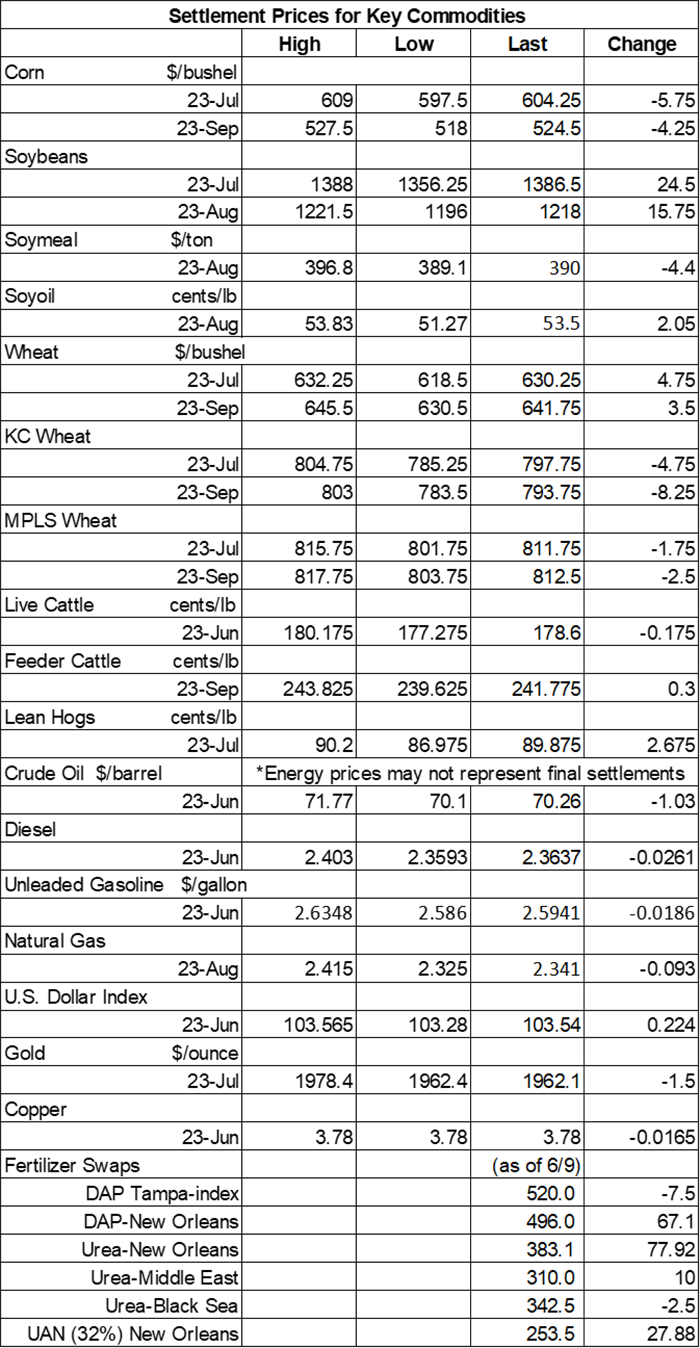

USDA’s June World Agricultural Supply and Demand Estimates (WASDE) report, out Friday morning, caused some ripples in the grain market today. Soybean and soyoil futures were the biggest benefactors, with the former firming 1.75% and the latter jumping more than 4% higher. CBOT wheat contracts also made moderate inroads, while corn prices eroded nearly 1% lower.

Rainy weather will land on most of the Plains and Midwest this weekend into early next week, with some areas set to gather another 0.75” or more during this time, per the latest 72-hour cumulative precipitation map from NOAA. Further out, the agency’s new 8-to-14-day outlook predicts more seasonally wet weather for the Northern and Central Plains between June 16 and June 22, with warmer-than-normal conditions likely for most of the Corn Belt.

On Wall St., the Dow moved another 61 points higher in afternoon trading to 33,895, although investors remain cautious ahead of the next round of inflation data and the next Federal Reserve meeting that will both happen next week. Energy futures faded into the red, with crude oil down 1.25% this afternoon to $70 per barrel amid lingering demand concerns. Diesel dropped more than 0.75%, with gasoline easing less than 0.5% lower. The U.S. Dollar firmed moderately.

On Thursday, commodity funds were net buyers of corn (+3,000), soybeans (+5,000), soyoil (+6,500) and CBOT wheat (+5,000) contracts but were net sellers of soymeal (-1,000).

Corn

Corn prices incurred moderate losses following a round of technical selling partly spurred by unsupportive supply and demand data from USDA’s latest WASDE report. July futures dropped 5.75 cents to $6.0450, with September futures down 4.25 cents to $5.2425.

Corn basis bids were steady to soft after eroding 2 to 20 cents lower across five Midwestern locations on Friday.

USDA did not amend its initial corn area and yield forecasts in today’s WASDE report, although the agency also noted it will release a key acreage report on June 30 that is populated with survey-based data for planted and harvested acres. USDA bumped up beginning stocks by 35 million bushels and lowered exports by 50 million bushels based on ongoing shipping data. There were not supply or usage changes for 2023/24, which meant ending stocks also increased by 35 million bushels. USDA’s season-average farm price was unchanged, at $4.80 per bushel.

Globally, USDA pegs world 2023/24 corn ending stocks at 12.361 billion bushels, up from May’s tally of 12.319 billion bushels and above the average trade guess of 12.328 billion bushels.

From Ohio to Minnesota to Kansas – just to name a few states – growers have been sharing their tales of overly dry conditions. Farm Futures grain market analyst Jacqueline Holland gathers these anecdotes together in Feedback From The Field, which is regularly updated throughout the season. Want to know what your fellow farmers have been talking about lately? Click here to get started.

Preliminary volume estimates were for 354,461 contracts, which was moderately below Thursday’s final count of 399,686.

Soybeans

Soybean prices nabbed double-digit gains today, thanks in large part to red-hot soyoil prices. July futures climbed 24.5 cents to $13.8775, with August futures up 18.25 cents to $12.9750. The rest of the soy complex was mixed. Soyoil futures jumped 4% higher, while soymeal futures trended more than 1% lower.

Soybean basis bids were steady across most Midwestern locations but did fall 10 cents lower at an Iowa river terminal on Friday.

Private exporters announced to USDA the sale of 7.2 million bushels of soybeans for delivery to unknown destinations during the 2022/23 marketing year, which began September 1.

Due to lower-than-expected exports, USDA notes higher beginning and ending stocks for 2023/24. Ending stocks are now expected to come in at 350 million bushels, up from 335 million in May and 5 million higher than the average trade guess. The season-average farm price is unchanged from a month ago, at $12.10 per bushel.

World ending stocks for 2023/24 increased modestly to 4.532 billion bushels, which was slightly higher than the average trade guess of 4.482 billion.

According to Argentina’s Buenos Aires grains exchange, the country’s 2022/23 soybean harvest will only come in around 771.6 million bushels after suffering through widespread weather challenges throughout the season. Harvest is around 94% complete, according to the exchange.

Preliminary volume estimates were for 275,749 contracts, sliding moderately below Thursday’s final count of 317,884.

Wheat

Wheat prices were mixed but mostly lower on a round of uneven technical maneuvering as traders digested the latest supply and demand data from USDA. September Chicago SRW futures added 3.5 cents to $6.4250, September Kansas City HRW futures fell 8.25 cents to $7.9550, and September MGEX spring wheat futures dropped 2.5 cents to $8.1550.

USDA upgraded its 2022/23 wheat production estimates to 1.665 billion bushels due to better prospects for hard red winter wheat production, with recent rains hopefully erasing at least some of the severe drought in some parts of the Plains. Average yields are expected to reach 44.9 bushels per acre, up 0.2 bpa from May. Ending stocks are now at 562 million bushels, up from 556 million bushels in May. The season-average farm price tilted 30 cents lower to $7.70 per bushel.

Globally, USDA expects larger supplies, more consumption, increased trade and larger stocks in 2023/24. Global ending stocks increased from 9.712 billion bushels in May up to 9.946 billion bushels – noticeably above the average trade guess of 9.723 billion bushels.

French farm office FranceAgriMer downgraded the country’s soft wheat quality ratings for the second consecutive week, moving another three points lower to 88% in good-to-excellent condition through June 5. That’s still far below year-ago totals of 66%, however. France is Europe’s top grain producer.

Finally, if you haven’t been to FarmFutures.com in a few days, our Friday feature “7 ag stories you can’t miss” is a quick way to catch up on the industry’s top headlines. The latest edition includes a damaged Ukrainian dam that is proving problematic for some of the country’s farmland, an inside look into the U.S. Drought Monitor and more. Click here to get started.

Preliminary volume estimates were for 228,383 CBOT contracts, tracking slightly higher than Thursday’s final count of 191,919.

About the Author(s)

You May Also Like