Report finds major ag companies improving water management

Meat and agricultural product industries continue to lag far behind packaged food and beverage industries.

A new report found a 10% improvement in the average score of the food sector’s management of water risk since 2015. The packaged food and meat industries made the biggest gains in improvement, at 16% and 20%, respectively.

"Feeding Ourselves Thirsty: Tracking Food Company Progress Toward a Water-Smart Future" ranks the 42 largest global food and beverage companies — mostly U.S. based — on how effectively they are responding to corporate water risks like water dependence, water security and operational water use efficiency (e.g., how they manage precious freshwater supplies) compared to 2015, when the first edition of the report was released by the nonprofit organization Ceres.

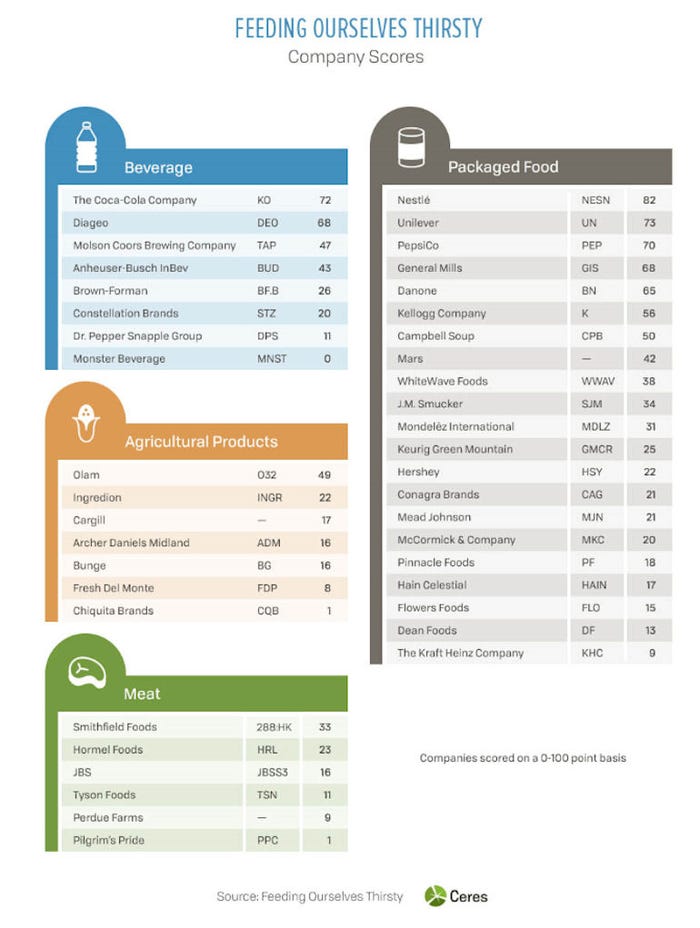

Companies were divided into four industry categories — packaged food, beverage, agricultural products and meat — and analyzed against actions in four categories of water risk management.

The average score for the 42 companies benchmarked was still only 31 points, and despite big gains, the meat and agricultural product industries continue to lag far behind the packaged food and beverage industries.

The top scoring companies, out of a possible score of 100, by industry were: Nestlé (packaged food), at 82, up from 64 in 2015; Coca-Cola (beverage), at 72, up from 67 in 2015; Smithfield Foods (meat), at 33, no change from 2015, and Olam (agricultural products), at 49 (not part of the 2015 analysis).

Top scorers in beverage and meat were unchanged from 2015; however, the top scorers in packaged foods and agricultural products in 2015 were, respectively, Unilever with 70 and Bunge with 29.

"Over 70% of the world’s irrigated land faces water shortage either chronically, seasonally or during dry periods, and that means our food supplies are at risk. Food companies need to step up sustainable management of water resources, including by working collaboratively with their agricultural suppliers,” explained Kate Brauman, lead scientist at the University of Minnesota Global Water Initiative.

The analysis found that, overall, companies need to improve most on governance and board oversight, wastewater management, integrating water risk into procurement processes and collaboration to protect watersheds.

In contrast, areas showing the most improvement since 2015 include integration of water risks into the business strategy, setting water targets, water accounting, risk assessment and sustainable sourcing programs. Companies making the strongest progress in these areas include General Mills and Unilever in risk assessment and Kellogg’s for its actions in sustainable sourcing.

“More than 85% of our water footprint is from growing and transporting crops and turning those crops in to food ingredients,” said Jerry Lynch, vice president and chief sustainability officer at General Mills. “This underscores the role we must play to address water stewardship issues in our agricultural supply chain. We continue to identify opportunities to increase efficiency and conservation upstream of our operations, which is where we can have the most impact.”

About the Author(s)

You May Also Like