Production costs drive farmer sentiment lower

Outlook for farmland values proves optimistic amid low interest rates and rising inflation concerns.

As farmers prepare for next spring, increases in input costs are weighing heavy on their minds. In addition to the dramatic rise in fertilizer prices, machinery, seed and fuel are also on the upswing.

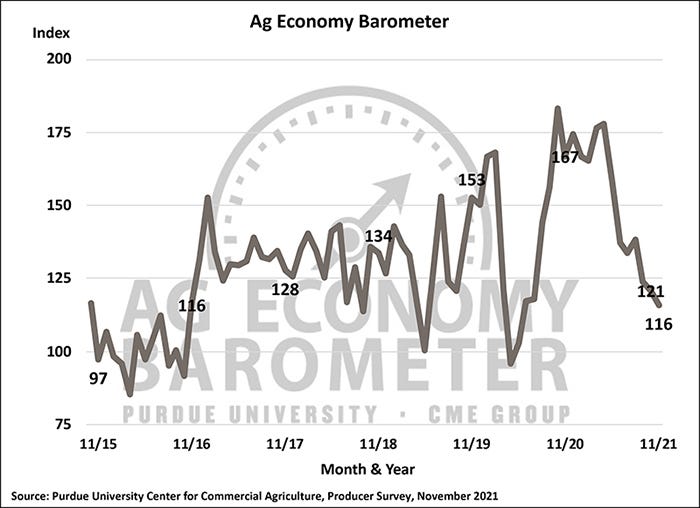

The Ag Economy Barometer slipped 5 points in November to a reading of 116, 30% lower than in November 2020. This decline in sentiments is driven by pessimism for current ag economy conditions as well as weak expectations for the future. November marked the lowest reading of 2021 for all three measures of producer sentiment.

Rising input costs

“Farmers are facing sharp rises in production costs coinciding with fluctuating crop and livestock prices, the prospect of changing environmental and tax policy, uncertainty over COVID-19, as well as a host of other issues, all of which are negatively impacting farmer sentiment,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture.

In November, 43% of survey respondents said they expect farm input prices to rise by more than 16% in the upcoming year. This compares with the actual average rate of farm input price inflation over the past decade of less than 2%. When asked what their biggest concerns are for their farming operation in the upcoming year, nearly half of survey respondents chose higher input costs.

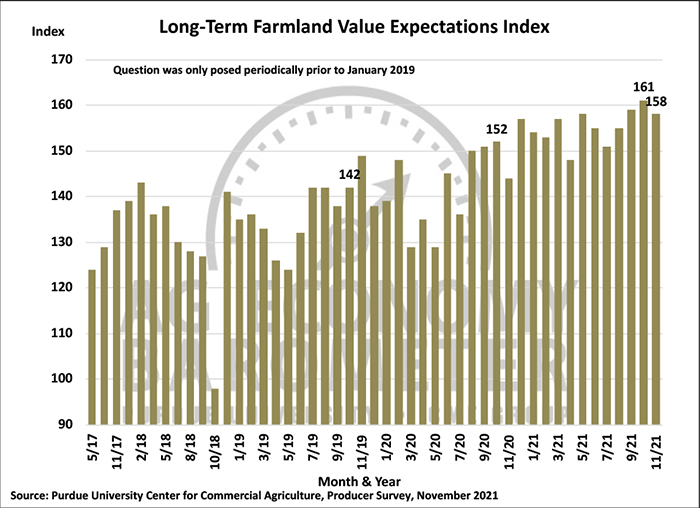

Farmland values

Farmers remain very optimistic about farmland values the next five years. Both the short-term and long-erm farmland value expectation indices remain near their peaks.

Strong 2021 crop cash flows, low interest rates and rising concerns about inflation continue to propel farmland values higher.

Despite concerns over rising input costs, 52% of corn and soybean producers expect cash rental rates to rise in 2022 compared with 43% in October. This marks the highest percentage of producers reporting that they expect rental rates in 2022 to rise since the May.

Policy concerns

Concerns about government policies impacting producers remain elevated. On the November 2021 survey, 82% of respondents said they expect more restrictive environmental regulations, 74% expect higher estate taxes, and 77% expect higher income taxes in the years ahead.

These percentages compare to results from the October 2020 survey when just 41% of producers expected more restrictive environmental regulations and 35% expected higher estate taxes over the next five years.

The Purdue University-CME Group Ag Economy Barometer sentiment index is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted from November 15 to 19, 2021.

Read the full Ag Economy Barometer report online.

Source: Purdue University and CME Group, which are solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like