Food values driving consumer decision-making

New International Food Information Council survey finds organic and natural foods and sustainability growing in priority, while taste and price remain biggest drivers.

“Food values” continue their growth as a factor in consumer decision-making, with organic foods becoming increasingly popular in purchasing choices, according to the 13th annual "Food & Health Survey," released by the International Food Information Council (IFIC) Foundation.

When shopping for foods and beverages, 29% buy those labeled “organic,” up from 25% in 2017. The increase is even more significant when people eat out: 20% said they eat at restaurants serving foods and beverages advertised as organic, compared to 14% last year.

Similarly, 37% of shoppers bought foods and beverages billed as “natural,” up from 31% in 2017, and 26% of consumers ate at restaurants serving natural food and beverage options, compared to 23% in 2017.

The importance of sustainability in food production also loomed larger in 2018, with 59% of consumers saying it’s important that the foods they purchase and consume be produced in a sustainable way, jumping up from 50% in 2017.

Out of those 59% who believe sustainability is important, the two most important individual factors of sustainability increased significantly over 2017: Reducing pesticides was the top priority for 33% of respondents in 2018, up from 27% in 2017, while ensuring an affordable food supply increased to 16% in 2018 versus 10% last year.

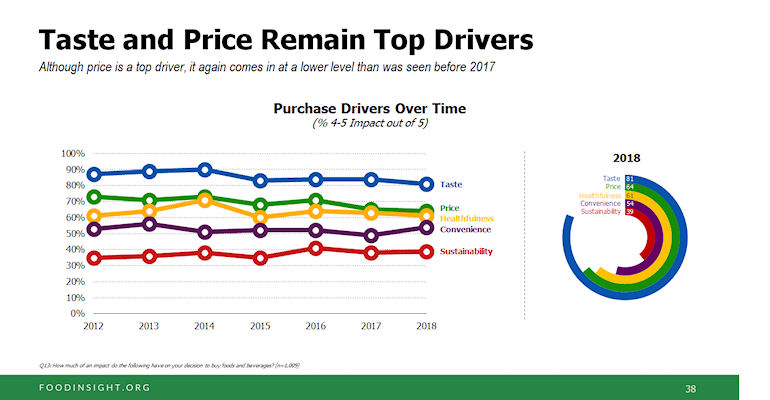

Taste, price still biggest drivers

The key drivers behind consumers’ food and beverage purchases are largely unchanged in 2018. Taste still reigns supreme (as it has every year the "Food & Health Survey" has been conducted), with 81% saying it has at least some impact on their buying decisions, followed by familiarity (a new addition in this year’s survey, at 65%), price (64%), healthfulness (61%), convenience (54%) and sustainability (39%).

Perhaps not surprising in the current communications environment, consumers are averse to artificial ingredients, at least compared to the alternatives. When asked to choose between two versions of the same product — an older one that includes artificial ingredients and a newer version that does not — seven in 10 (69%) chose the product with no artificial ingredients, while one-third (32%) chose the one containing artificial ingredients.

IFIC also asked those who preferred a product with no artificial ingredients how much they would be willing to pay versus a similar product with artificial ingredients that cost $1.00: 62% said they would pay up to 10% more ($1.10) for the product without artificial ingredients, 42% would pay up to 50% more ($1.50) and 22% would pay double the price ($2).

Context is also key in how consumers perceive the healthfulness of two products with otherwise identical nutritional content. When asked to identify the healthier of two products with the same Nutrition Facts Panel, 40% perceived one labeled “non-GMO” as healthier versus 15% for one with genetically modified ingredients, and 33% perceived a product with a shorter ingredient list as healthier than one with more ingredients (15%).

Trusted sources

This year and last year, IFIC asked consumers to rate the sources where they often get information about what to eat or avoid, as well as how much they trust those sources.

Among 14 sources listed, government agencies recorded far and away the biggest increases in both measures. In 2018, 19% of consumers said they often get such information from a government agency, nearly double the score of 11% in 2017, and 38% said they trust government agencies as an information source, up from 25% in 2017. (One caveat: This year’s question gave specific examples of agencies — such as the U.S. Department of Agriculture, Environmental Protection Agency, Food & Drug Administration and Centers for Disease Control & Prevention — whereas last year’s only mentioned government agencies in general.)

Friends/family members and personal health care professionals tied at 30% as the most relied-upon sources of information; however, health care professionals are far more trusted (66%) than friends and family (26%).

“Consumers continue to rely heavily on nutrition information sources they admit they don’t trust,” said Alexandra Lewin-Zwerdling, vice president for research and partnerships at the IFIC Foundation. “This may speak to the public confusion we have consistently found on topics of nutrition and food safety.”

In a couple of examples of a generational information gap, Americans ages 65 and older were more likely (76%) to trust a registered dietitian compared to adults age 35 and younger (65%). In addition, when asked which source of information most influenced their opinion on food safety issues, 44% of those ages 65 and older cited news articles or headlines, while only 16% of those ages 18-34 agreed.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)