COVID-19 weighs on U.S. ag trade outlook

U.S. agriculture export forecast still higher than last year despite USDA lowering outlook to $136.5 billion.

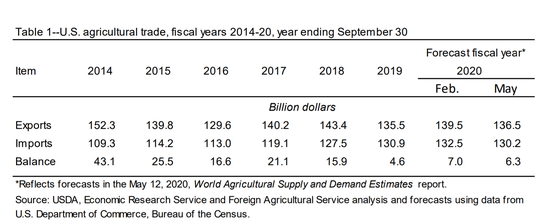

The COVID-19 pandemic has created shock waves across the globe, causing an unusually high level of economic uncertainty for the foreseeable future, especially in the global agriculture sector. The U.S. Department of Agriculture’s Economic Research Service recently released the “Outlook for U.S. Agricultural Trade,” lowering its projection of U.S. agricultural exports for Fiscal Year (FY) 2020 to $136.5 billion, down $3.0 billion from the February forecast but still one billion dollars more in business compared to 2019. USDA said the adjustment lower was primarily due to reductions in bulk commodities including soybeans, cotton, corn, and wheat.

According to the outlook, U.S. grain and feed exports in 2020 are forecast at $29.4 billion, down $300 million from the February projection, as lower wheat and corn exports more than offset higher sorghum exports. Corn exports are projected at $8.0 billion, down $500 million on lower unit values, which USDA said have been pressured by ample exportable supplies and weak domestic use for fuel ethanol. The forecast for wheat exports was lowered $300 million to $6.1 billion, as larger global supplies and uncompetitive U.S. pricing reduce prospective volume.

The oilseeds and products export forecast was reduced $1.6 billion to $25.5 billion. Projections for soybean exports were reduced $1.9 billion from the previous estimate to $16.5 billion for FY 2020 due in part to increasingly competitive Brazilian exports.

The cotton export forecast was lowered by $1.0 billion on lower volumes and unit values due to COVID-19 reducing foreign demand.

USDA left the livestock, poultry and dairy exports unchanged from the February projection of $32.4 billion, $2.0 billion more than in 2019, as stronger demand for pork and dairy products offset a decline for beef and poultry products.

The pork forecast was raised $200 million to $6.9 billion as higher volumes offset a small decline in unit values. Strong demand from China continues to drive growth in U.S. pork exports, USDA noted.

“We do see continuing strong demand for pork, in particular, due to African swine fever issues still in Asia,” said USDA’s chief economist Rob Johansson.

The beef forecast, on the other hand, was lowered nearly $300 million to $7.2 billion. USDA said lower volumes were only partially offset by the higher prices associated with tighter domestic supplies. Poultry and poultry products are forecast $100 million lower than was expected in February, to $5.5 billion on reductions in volumes and values for broiler meat.Dairy exports were raised $200 million to $6.2 billion as U.S. dairy export volumes, particularly for dry milk powder, which USDA said are expected to grow. U.S. dairy products are price competitive, and global import demand remains strong, the agency added.

U.S. agricultural imports in FY 2020 are projected at $130.2 billion, giving the U.S. a trade surplus of $6.3 billion, up from the 2019 surplus of $4.6 billion. The latest imports projection is down $2.3 billion from the February forecast, primarily due to expected decreases in imports of horticultural products such as beer, fresh fruit, and fresh vegetables, USDA said.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)