2021 farm income falls 8% on lower government payments

Government payments fall over 45% from 2020.

As expected, 2021 aggregate farm financials are going to look wildly different from 2020 in the pandemic era. USDA’s Economic Research Service released updated 2020 farm income forecasts and new 2021 income and financial projections earlier today.

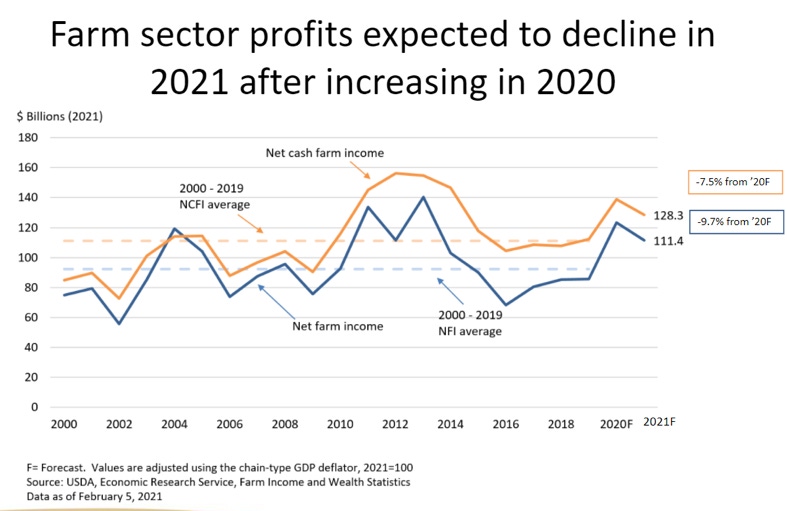

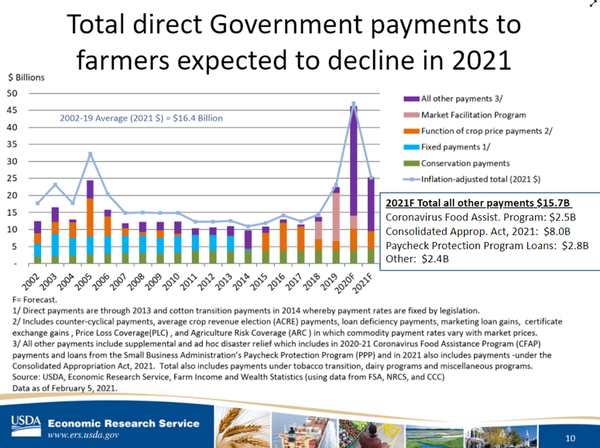

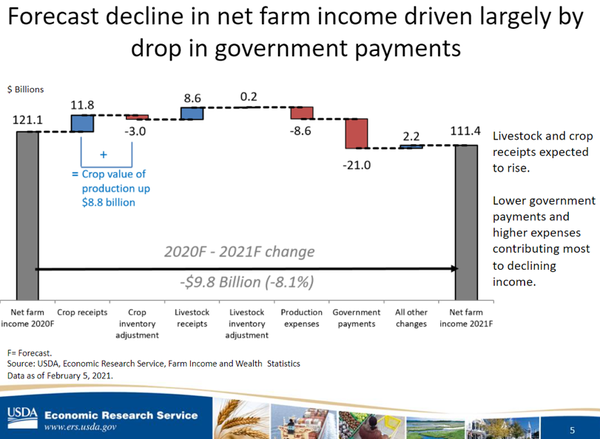

Projected 2021 net farm income will likely decline 8% from a year ago to $111.4 billion as reduced government aid programs send 2021 earnings estimates lower. USDA forecasts 2021 farm assistance payments at $25.3 billion – a 45% decline from 2020 aid levels and nearly 23% of 2021 net farm income.

“The largest contributor to lower net income in 2021 will be lower government dollars,” USDA-ERS senior economist Carrie Litkowski explained in a February 2021 Farm Income and Financial Forecasts webinar update.

Pandemic-related aid is expected to decrease significantly in 2021 but will remain well above the 18-year average of $16.4 billion. Litkowski pointed out that $8 billion in COVID-19 related aid is still available from the December 2020 stimulus package.

No new Market Facilitation Program (MFP) payments are expected to be disbursed to farmers in 2021, despite earlier news released today that China fell short on Phase 1 trade commitments.

However, the 2021 financial forecast is not as dire as it initially sounds. Farmers can look forward to more operating revenues in 2021 as cash receipts from commodity sales increase in 2021. But USDA is not assuming any further ad hoc payments in 2021 until stimulus legislation impacting farmers has been signed into law.

The report saw 2020 government payments hold steady at $46.3 billion – a record high for direct farm program payments. Net farm income for 2020 rose slightly from December 2020 estimates to $121.1 billion, with 38% of the earnings directly derived from government assistance.

New year, new outlook

With government payments forecast to fall $21.0 billion in 2021, farmers will largely be forced to turn to operating revenues to finance 2021 growing expenses. The recent price rallies in the commodity futures markets offer more financial opportunities to farmers since the rallies of the early 2010s.

If 2021 forecasts are realized, ERS estimates 2021 corn cash receipts will rise to $55 billion – the highest level since 2014. Soybean cash receipts are forecast 42% above the ten-year average at $48 billion. That could be the highest level since 2013.

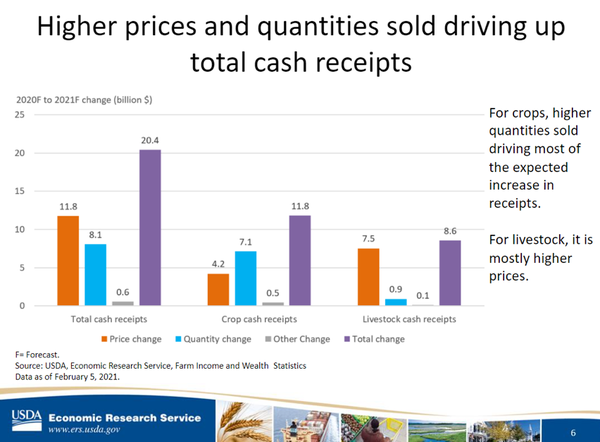

The higher prices will likely drive an increase in grain quantities sold compared to 2020. Cash receipts for corn and soybeans are projected to rise 12% and 22%, respectively. Cash receipts for wheat are only expected to rise 0.3% on the year.

Total crop cash receipts for 2021 are forecast to rise 11.8% on the year driven by a 7.1% increase in grain sale quantities. Of course, a 4.2% increase in prices likely won’t hurt either.

And it makes perfect sense after looking at the futures market for even a short period. Tight grain supplies have incentivized farmers to book more cash sales now versus a year ago. And the global and domestic demand likely won’t ease until prices surge even higher – or U.S. corn and soybean stockpiles run dry.

But it isn’t exactly common to see cash crop prices and quantities sold to rise in tandem. Litkowski notes that it’s possible, but “it’s not usually both.” Litkowski cites the COVID-19 pandemic, which continues to cause colossal macroeconomic disturbances around the globe, as the key reason for this economic anomaly. “We are in uncharted territory,” Litkowski mused.

Rising production costs

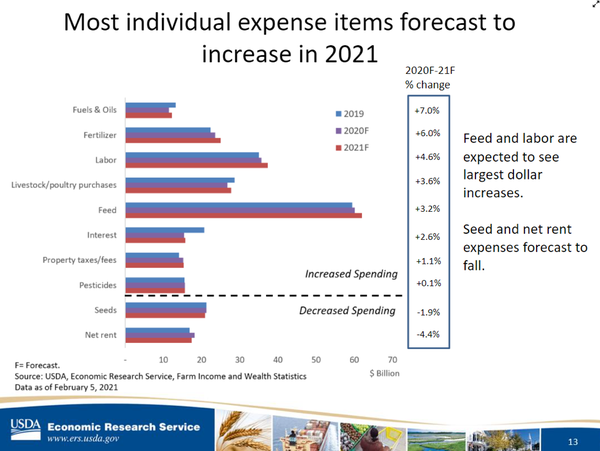

Of course, with rising commodity prices, it is only natural expenses will increase as well. USDA-ERS forecasts an 8.6% annual increase in production costs in 2021 to $354 billion, the first increase in production expenses since 2014 when factoring in inflation.

Fuel and input prices took off with grain prices in the second half of 2020 and will inevitably spill over into 2021. Many farmers booked forward sales of inputs while prices remained low late in 2020, which could potentially help offset shrinking profit margins in 2021.

Fuel and fertilizer expenses will see the largest cost increases in 2021, up 7% and 6%, respectively, from 2020. Rising grain prices will also increase feed costs by the most significant volume of all inputs. But despite higher cost of production factors, farmers can look forward to a 4.4% decrease in net rent in 2021.

Balance sheet remains stable

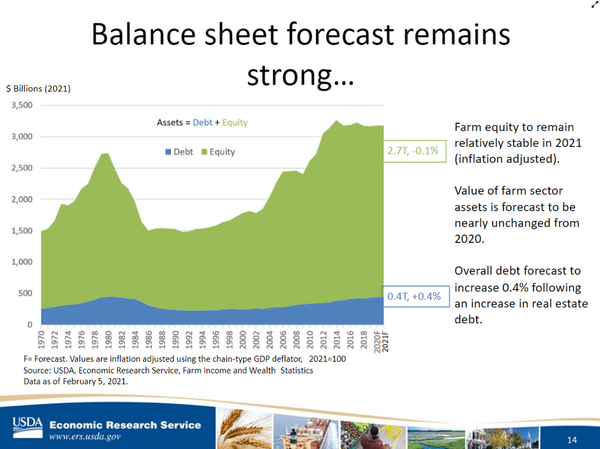

Even amid shrinking net farm income estimates for 2021, the aggregate farm balance sheet is expected to remain stable. Real estate assets, which account for 80% of total farm assets, are expected to increase slightly. Litkowski estimates a 0.6%, or $9 billion increase to U.S. farmland values, after inflation in 2021. It’s a modest increase, she notes, though data collected through the year will provide a more accurate estimate.

Rising real estate debts will drive a 0.4% annual increase in aggregate U.S. farm debt in 2021 to $442 billion. Farm debt estimates in 2021 remain low – only 13.9% of total farm assets – but it has incrementally been on the rise since the early 2000s.

Of more concern is an increase in the aggregate debt-to-equity ratio for the farm sector. Litkowski pointed to the ratio rising to 16.13% in 2021 – the highest ratio since the early 2000s. And while farm bankruptcies dropped 6% in 2020 from the previous year due to low interest rates, a rising debt service ratio suggests increased production revenues will quickly be allocated to servicing debt obligations.

For more information about USDA-ERS’s U.S. Farm Income and Wealth Statistics, including state-level data, visit the ERS website.

About the Author(s)

You May Also Like