It's a crazy world

The biggest mistake in the feed industry for the rest of this year will be getting caught with too much inventory at high price levels.

January 28, 2021

No matter what your politics, I would think almost everyone would agree that these are scary times. Instead of “bringing us together” as campaigned, changes since President Joe Biden took office have done just the opposite. The divide between people has become bitter and filled with hatred on both sides.

While campaigning that new policies would be designed to help the middle class, the exact opposite is happening. Closing the Keystone Pipeline and likely placing a moratorium on oil and natural gas leasing on federally owned land is going to cost thousands of jobs. To be replaced by building solar panels? I don’t think so. And be it right or be it wrong, the move to get away from oil and gasoline and going more to “clean” energy will also likely include, for the first time in many years, an increased federal tax on gasoline. This will hurt the middle class much more so than the upper class. Add a $15/hour minimum wage and unemployment is going to increase significantly.

Impact on agriculture

At this point, some of you are probably saying “this is interesting but what does it have to do with the price of grain and livestock?” Fair question. The simple answer is it that it has a lot to do with where agriculture as well as our general economy is headed. These are very emotional times and when people are emotional, markets are much more volatile. Fear, greed, and hope are the three human emotions behind the majority of commodity price moves. This one is not going to be any different.

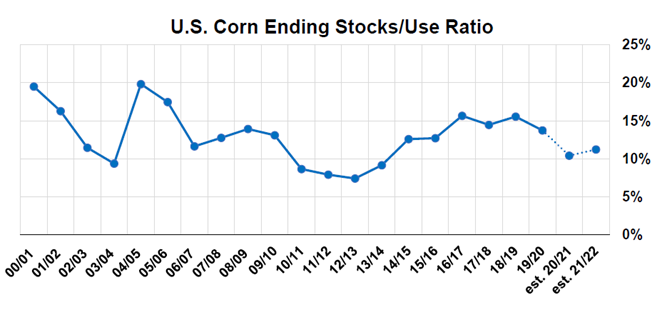

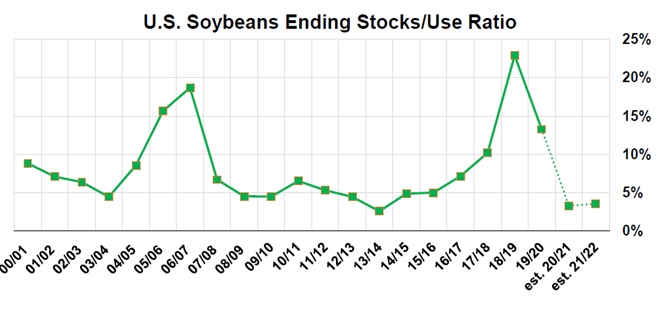

These are markets where just when you think you have them figured out, prices turn around and make you humble again. In many ways, this is a classic bull market in both corn and soybeans. But it takes fuel to keep bullish fires burning in a major move. Bull markets fall of their own weight in the absence of bullish news. The ending stocks-to-usage ratio in soybeans and corn are both at the lowest level since 2013/14. Bull markets die hard.

Many in our industry are concerned about running out of old-crop soybeans. That will not happen. But it could take higher prices to ration the supply. The top in corn and soybeans will likely not be any different than any other. It may not come until this summer or at least until after the crop is planted to make sure the market has enough acreage. One thing history has always indicated is that when prices are this high, producers ramp up production very quickly.

This market will peak when least expected. Could be caused by an “event”. When the top occurs, there will be very little reason. Some will look at it as a correction in the longer-term bull market. As a buyer or corn and soybean meal, the one thing to be careful of is getting caught with too much inventory at the top. It will happen. The market has already rallied enough that in my opinion, it is time to quit building inventory. Be happy with what you have bought and now start going on a hand to mouth basis. This market is much closer to a top than it is to a bottom. The biggest mistake in the feed industry for the rest of this year will be getting caught with too much inventory at high price levels.

You May Also Like