How fast markets can change

Corn market at risk of going back to where prices were trading before the bull market started.

May 24, 2021

Isn’t that the truth? From mid-August of 2020 until two weeks ago, the bulls were in control and the stars of the show in corn and the soy complex. Now, the glimmer on that star has dimmed considerably. The leaders of this bull market were the oilseeds, soybean oil, palm oil and canola oil. All of these have now what appears to be a confirmed top.

The current situation will likely unfold like other bull markets have. On the way up, bulls kept getting more and more bullish and buyers kept buying in advance due to fear of having to pay more later. Thus, they exaggerated the demand side. Demand always looks extremely strong on the way up.

Now those attitudes are going to change. On the downward slope of the price chart, buyers will take the attitude of “let’s wait for a while, we can probably buy it cheaper down the road.” All of a sudden it will look like demand is softening while prices are softening, which makes no sense to pure fundamental analysts. Demand has not changed, but buying patterns have. This is the way bull markets almost always unfold.

Weather

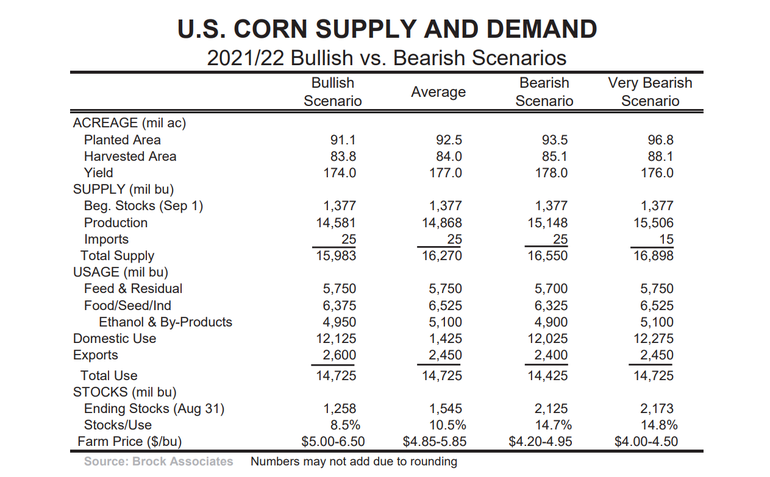

This will now become the key topic. Some of the weather forecasts calling for severe droughts this summer have already diminished. Corn acreage is going to be very high (see table below) as will be soybean acreage. There will be some weather scares along the way and the bulls will hang on tight, doubting the potential of a large crop. Odds are not in their favor.

Planted corn acreage is going to be high, with some forecasting planted acreage as high as 96.8 million. If that does occur and we just have a normal yield, carryover is going to be back well over two billion bushels. Throughout this bull market, there has never been a real shortage of corn. There has been tight farmer holding of corn, but the supplies have always been adequate. Now, with normal rainfall, the corn market is at risk of going back to where prices were trading before this bull market started. Basis levels also will soften.

As this is written, soybean meal is trading at a new calendar year low in the July futures. How can that be bullish? The trend is clearly down, and the trend is your friend. Soybean oil has carried the soy complex the entire way and now that it is faltering, there is no need to be an aggressive buyer of any of these products.

Making the shift

Emotionally and psychologically, it has always been difficult to make the shift from a bull to a bear market. Anyone who has started in this business since 2013 has never had to go through a market like this. This can be an emotional strain for that age group. This market reminds me of the market psychology that occurred in 1988 and 2012. The end result was the same both times… the beginning of a longer-term bear market.

The bulls will tout the increased purchases coming from China. This is for real. The bears will tout that with the onslaught of electric cars coming, the demand for ethanol will diminish. That is true as well but will be longer-term than the increased purchases from China. Looking down the road five years, corn demand for ethanol will be weaker but corn demand from China is going to stay strong with one offsetting the other.

The real near-term issue, however, is weather. Even for those who want to be believe a drought is coming, keep in mind that many plant varieties are much more drought resistant now than they were was 10 years ago. Plant in the dust and your bins will bust. That is the likely scenario this year.

You May Also Like