Corn, soybeans bounce back after Tuesday’s severe slump

Afternoon report: Wheat prices mixed but mostly higher on Wednesday.

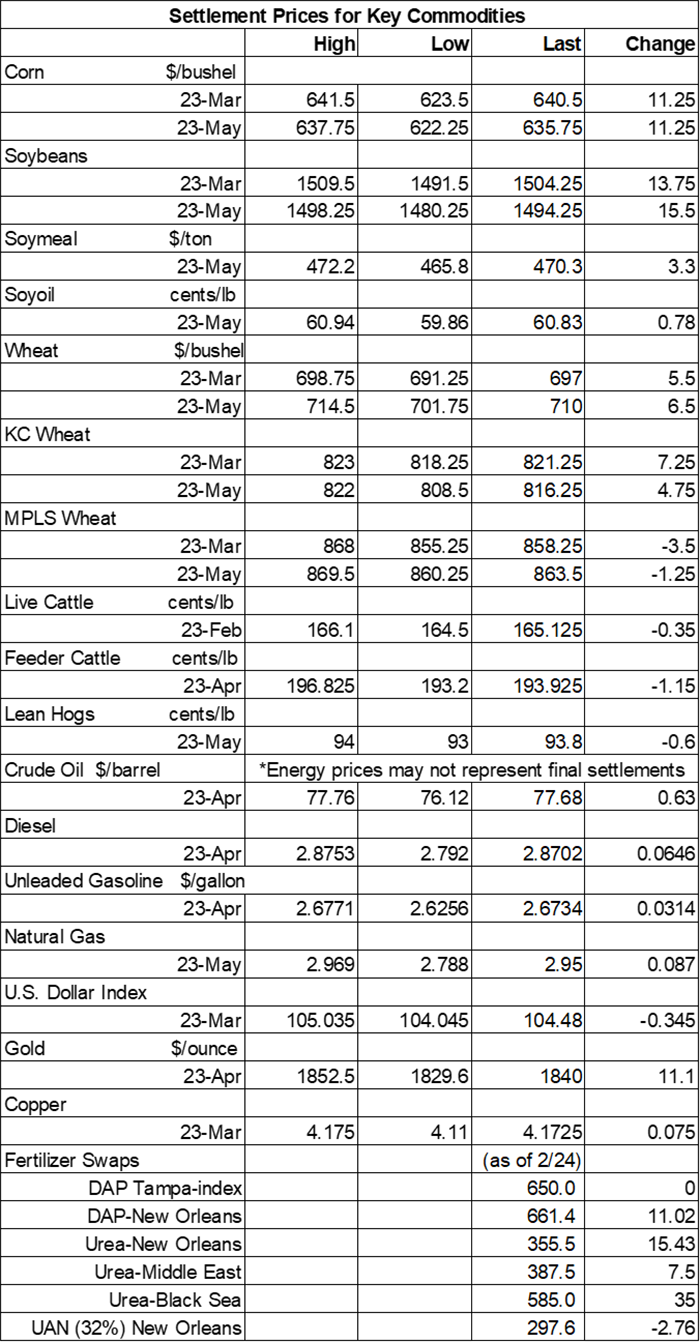

Grain prices were mixed but mostly higher on Wednesday, attracting some bargain buyers after suffering severe declines in recent sessions that left some contracts at multi-month lows. Nearby corn contracts improved 1.75%, while soybean futures firmed 1% today. Wheat prices were mixed but mostly higher – winter wheat trended moderately higher while spring wheat eased slightly lower.

The latest 72-hour cumulative precipitation map from NOAA shows a series of storms are expected to soak the Mid-South and Ohio River Valley between Thursday and Sunday, with large areas likely to receive another 1” to 2” or more for the rest of this week. NOAA’s latest 8-to-14-day outlook predicts more seasonally wet weather for most of the Corn Belt between March 8 and March 14, with cooler-than-normal conditions likely for most of the country during that time.

On Wall St., the Dow dropped 93 points in afternoon trading to 32,562 after 10-year bonds reached the highest levels since last November. There’s also ample speculation that the Federal Reserve will raise interest rates another 25 to 50 points higher this month. Energy prices pushed higher today, with crude oil up 0.75% in afternoon trading to $77 per barrel. Diesel rose 2.25%, with gasoline up around 1.25%. The U.S. Dollar softened moderately.

On Tuesday, commodity funds were net sellers of all major grain contracts, including corn (-13,500), soybeans (-19,000), soymeal (-8,000), soyoil (-2,000) and CBOT wheat (-3,000).

Corn

Corn prices moved moderately higher on Wednesday, attracting some bargain buyers after eroding to the lowest level since last August earlier this week. March futures rose 11.25 cents to $6.4075, with May futures up 6 cents to $6.3625.

Corn basis bids were steady to mixed across the central U.S. on Wednesday, moving as much as 5 cents higher at an Illinois river terminal and as much as 5 cents lower at a Nebraska processor today.

Ethanol moved lower in the week ending February 24, with a daily average of 1.003 million barrels, per the latest data from the U.S. Energy Information Administration, out earlier today. Stocks trended 3% lower week-over-week.

Meantime, the U.S. Environmental Protection Agency is proposing a rule that will allow gasoline sales that contain a higher percentage of ethanol in certain Midwestern states. Currently, EPA enforces a summertime ban on E15 due to supposed environmental impacts – however, research shows E15 does not increase smog more than E10, which is already sold year-round.

Prior to Thursday morning’s export report from USDA, analysts think the agency will show corn sales ranging between 19.7 million and 43.3 million bushels for the week ending February 23.

Grain traveling the nation’s railways totaled another 20,511 carloads last week. That brings cumulative totals for 2023 to 182,783 carloads, which is 3.6% below last year’s pace so far.

Ukraine’s total grain exports reached 5.2 million metric tons in February, which was slightly than year-ago totals. Total volume so far during the 2022/23 marketing year includes 732.2 million bushels of corn and 415.2 million bushels of wheat. Ukraine is among the world’s top exporters of both commodities.

Preliminary volume estimates were for 435,071 contracts, which was moderately above Tuesday’s final tally of 388,708.

Soybeans

Soybean prices captured double-digit gains and closed with gains of around 1% on Wednesday following a round of technical buying today after falling for the prior five consecutive sessions. March futures rose 13.75 cents to $15.0425, with May futures up 15.5 cents to $14.9450.

The rest of the soy complex was also firm. Soymeal futures made moderate inroads, while soyoil futures tracked around 1.25% higher today.

Soybean basis bids were mostly steady to firm after climbing 10 to 13 cents higher at two Midwestern processors and improving 2 to 3 cents at two other locations on Wednesday.An Iowa river terminal bucked the overall trend after shifting 2 cents lower today.

Ahead of the next weekly USDA export report, out tomorrow morning, analysts think the agency will show soybean sales ranging between 11.0 million and 38.6 million bushels for the week ending February 23. Analysts also expect to see soymeal sales ranging between 50,000 and 400,000 metric tons, plus up to 22,000 MT of soyoil sales.

New governmental data from Brazil shows the country exported 191.1 million bushels of soybeans in February, which is moderately below year-ago results of 230.4 million bushels. Brazil also exported 89.6 million bushels of corn last month.

Preliminary volume estimates were for 219,009 contracts, fading moderately below Tuesday’s final count of 275,147.

Wheat

Wheat prices were mixed but mostly higher following an uneven round of technical maneuvering on Wednesday. March Chicago SRW futures added 5.5 cents to $6.97, March Kansas City HRW futures gained 7.25 cents to $8.23, and March MGEX spring wheat futures dropped 3.5 cents to $8.6725.

Ahead of Thursday morning’s export report from USDA, analysts think the agency will show wheat sales ranging between 5.5 million and 25.7 million bushels for the week ending February 23.

Russian consultancy Sovecon trimmed its estimates for the country’s 2023 wheat production by around 25.7 million bushels for a new projection of 3.134 billion bushels, citing “challenging weather conditions.” Russia is the world’s No. 1 wheat exporter.

Additionally, Russia’s foreign ministry indicated earlier today that it will agree to extend a Black Sea deal that allows for safe passage of shipping vessels if its own agricultural export interests are given greater consideration. “[The] Russian side stressed that continuing the package agreement on grain is possible only if the interests of Russian agricultural and fertilizer producers in terms of unhindered access to world markets are taken into account,” according to a statement. The current deal is up for renewal and will otherwise expire on March 18.

Taiwan purchased 1.8 million bushels of milling wheat from the United States in a tender that closed earlier today. The grain is for shipment between April 19 and May 3.

Japan hopes to purchase 2.6 million bushels of feed wheat and 1.8 million bushels of feed barley in a simultaneous buy-and-sell auction that will take place on March 8. The grain is for arrival by the end of August if any purchases are made.

Preliminary volume estimates were for 92,477 CBOT contracts, easing slightly below Tuesday’s final count of 95,891.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)