Corn and wheat finish Friday’s session with solid gains

Afternoon report: Soybeans trend significantly lower today, in contrast.

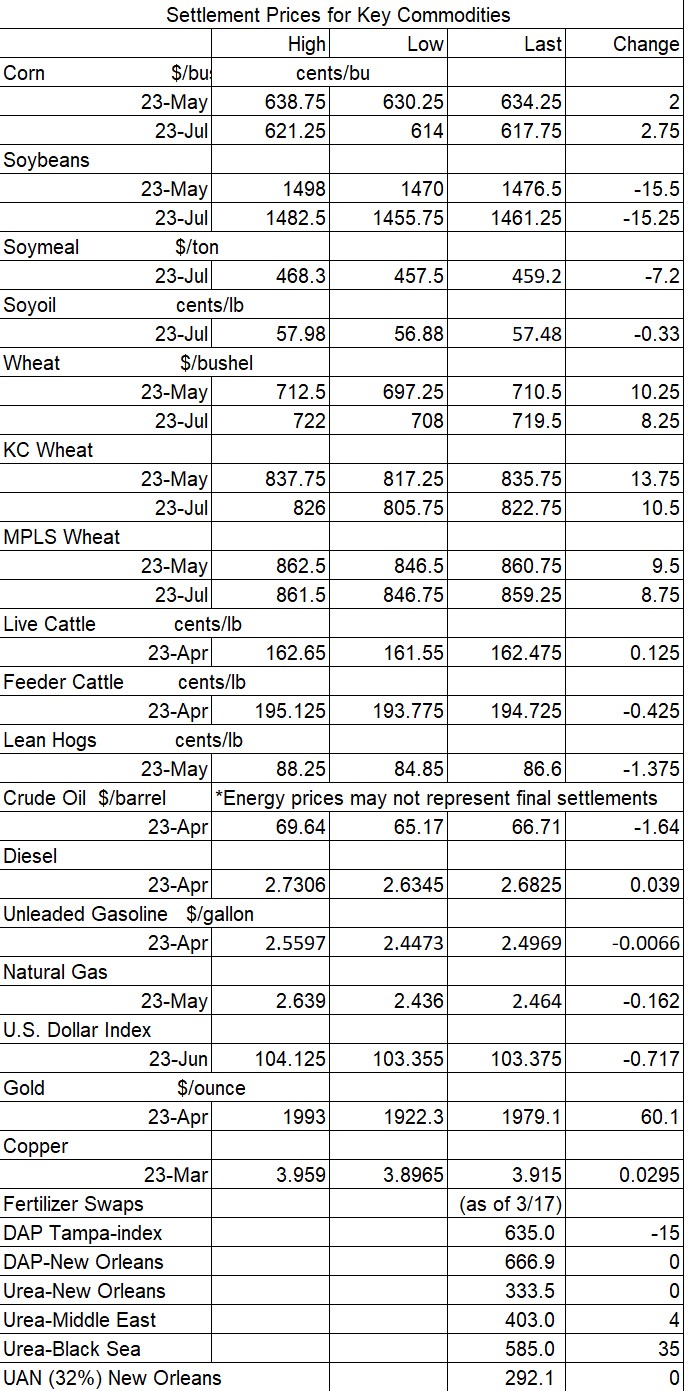

Grains were mixed but mostly higher as traders await updates on a Black Sea shipping deal that is up for extension on March 18. Corn prices saw moderate gains, while some wheat contracts were up more than 1.5% by the close. Soybeans failed to follow suit as a record-breaking Brazilian harvest continues to apply downward pressure.

Drier weather is in store for the central U.S. between Saturday and Monday, although the eastern Corn Belt will receive some additional moisture during this time, per the latest 72-hour cumulative precipitation map from NOAA. The agency’s new 8-to-14-day outlook predicts more seasonally wet weather for the eastern half of the country between March 24 and March 30, with drier-than-normal conditions developing in the Plains. Colder-than-normal conditions will be prevalent across the western half of the country.

On Wall St., the Dow eroded another 461 points lower in afternoon trading to 31,785 as investors remain rattled over a round of recent bank failures – the latest being turmoil at First Republic, whose stock prices were slashed by 25% today. Energy futures were mixed. Crude oil sank another 2.25% lower this afternoon to $66 per barrel on anxiety around the banking industry. Gasoline eased slightly lower, while diesel firmed 1.25%. The U.S. Dollar softened moderately.

On Thursday, commodity funds were net buyers of corn (+4,000), soybeans (+2,000) and soyoil (+5,000) contracts but were net sellers of soymeal (-3,000) and CBOT wheat (-1,500).

Corn prices trended higher after yet another flash sale to China was announced this morning (more on that below). Spillover strength from wheat lent additional support. May futures added 2 cents to $6.3475, with July futures up 2.75 cents to $6.19.

Corn basis bids were mostly steady to firm across the central U.S. on Friday after rising 2 to 7 cents higher at four Midwestern locations. A Nebraska processor bucked the overall trend after sliding 2 cents lower today.

Private exporters announced to USDA the sale of 7.5 million bushels of corn for delivery to China during the 2022/23 marketing year, which began September 1. This is the fourth consecutive day that China has made a flash sale of U.S. corn.

At the end of this month, USDA will release its highly anticipated Prospective Plantings report. “Uncertainty continues to reign supreme in all markets in 2023, but there are a few factors farmers can consider that may help steel marketing plans for any upheaval USDA’s March 31 report may cause,” according to Farm Futures grain market analyst Jacqueline Holland, who dug through historical trends and offered additional analysis – click here to learn more.

Looking for ideas to sharpen your grain marketing plan? Now is a great time to get started, according to Naomi Blohm, senior market adviser with Stewart Peterson. “Heading into spring and before you get busy planting in the fields, make sure you are ready to go with your marketing strategies for your farm,” she notes. “That final ‘spring rally’ can come and go in a frenzy, and you need to be ready with your plan.” Blohm offers five helpful pointers in yesterday’s Ag Marketing IQ blog – click here to learn more.

Technology has made life easier in an almost countless number of ways, but it is also causing some disruptions in traditional tenant-owner relationships that can be downright aggravating. Join Farm Futures executive editor Mike Wilson as he charts the frustrating journey of Illinois farmer Dan Luepkes, who nursed some poorly functioning rented farmland back to profitability, only to have the opportunity to continue renting it taken away. Click here to learn more.

Preliminary volume estimates were for 247,476 contracts, fading moderately below Thursday’s final count of 311,004.

Soybean prices incurred double-digit losses on Friday, moving more than 1% lower by the close. The record-breaking Brazilian harvest applied plenty of downward pressure, and faltering crude oil prices added to today’s technical setback. May futures lost 15.5 cents to $14.76, with July futures down 15.25 cents to $14.6075.

The rest of the soy complex was also in the red today. Soymeal futures saw sharp cuts of around 1.75%, while soyoil futures trended around 0.5% lower.

Soybean basis bids inched a penny higher at an Ohio elevator and improved 4 cents at an Iowa river terminal while holding steady elsewhere across the central U.S. on Friday.

Argentina’s Buenos Aires grains exchange made another sharp reduction to its 2022/23 soybean production estimates yesterday, which has now fallen to 918.6 million bushels, due to prolonged hot, dry weather throughout much of the season. That puts this season’s output as the lowest since 1999/00.

A new study from the University of Nevada, Reno shows farmers and ranchers are suffering stress-related health issues at a higher rate than the general population. This is attributed to a variety of factors, including rising production costs, increased workloads and market price uncertainties. The study was funded by a USDA NIFA grant in an effort to develop programs to assist farmers and ranchers with dealing with these issues. Click here to learn more.

Preliminary volume estimates were for 219,525 contracts, shifting 12% above Thursday’s final count of 195,421.

Wheat prices gathered solid gains on Friday as the probable extension for a critical Black Sea shipping deal looms. Russia is calling for a 60-day extension, while Ukraine prefers a 120-day extension. May Chicago SRW futures gained 10.25 cents to $7.0825, May Kansas City HRW futures rose 13.75 cents to $8.3350, and May MGEX spring wheat futures added 9.5 cents to $8.5850.

French farm office FranceAgriMer reported that the country’s 2022/23 soft wheat crop quality has been stable this past week, with 95% rated in good-to-excellent condition through March 13. The country’s winter barley crop is also in fantastic shape, with 92% rated in good-to-excellent condition over the same period.

Never sign a carbon contract (or any contract, for that matter) without closely reading the payment terms, possible extensions and termination penalties. Max Armstrong caught up with Extension ag law specialist Tiffany Lashmet about this topic in today’s Farm Progress America – click here to listen.

Preliminary volume estimates were for 97,070 CBOT contracts, which was moderately above Thursday’s final count of 66,488.

About the Author(s)

You May Also Like