Brazil’s record-breaking crop remains in focus

Afternoon report: Grain prices spill back into the red on Wednesday.

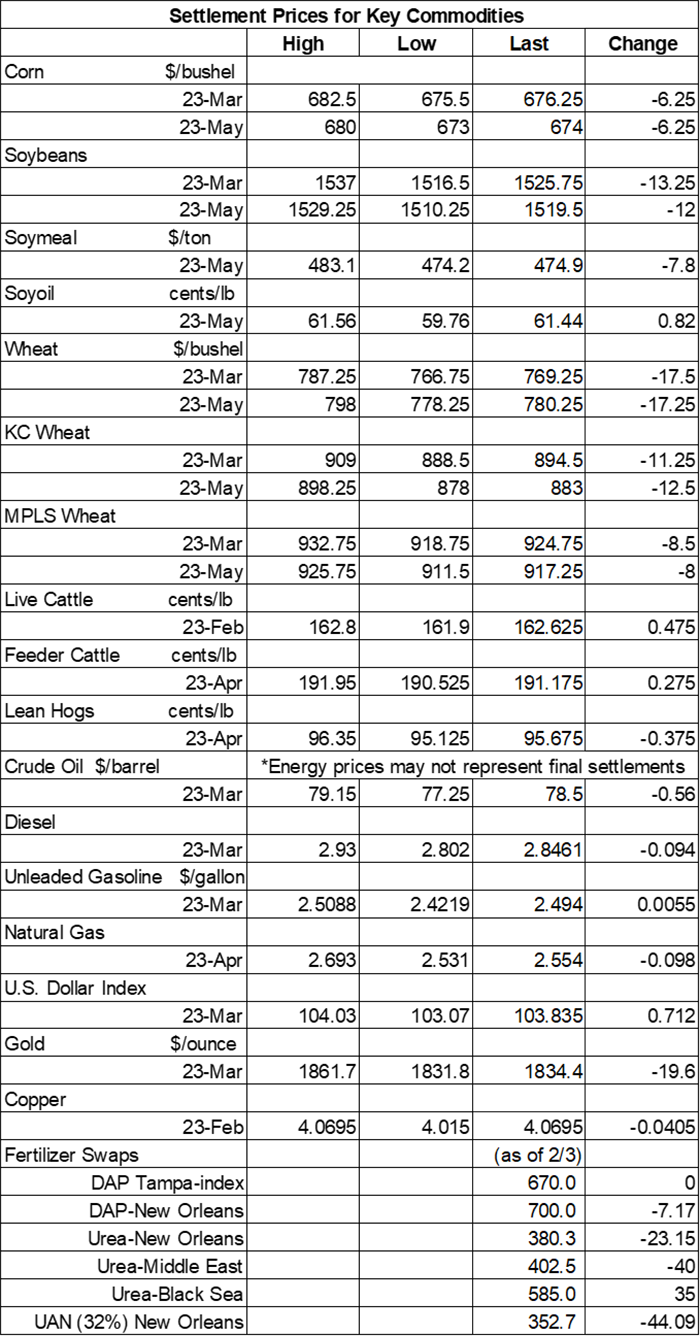

Expectations for record Brazilian production kept soybean prices in the red again today after incurring a double-digit setback. Corn prices lost nearly 1% as traders shrugged off a large sale to Mexico announced this morning. Wheat prices also suffered variable losses that ranged from 0.75% to 2.25% on lingering concerns that prices are high enough that they are locking U.S. grain out of some key global markets.

The Ohio River Valley will see ample rainfall later this week, while other parts of the central U.S. will remain relatively dry in comparison between Thursday and Sunday, per the latest 72-hour cumulative precipitation map from NOAA. The agency’s new 8-to-14-day outlook predicts widespread wet weather for the Midwest and Plains between February 22 and February 28, with colder-than-normal conditions likely for the Northern Plains and upper Midwest as the month draws to a close.

On Wall St., the Dow dipped 21 points lower to 34,067 as investors attempted to balance a better-than-expected retail sales report against yesterday’s hotly anticipated consumer price index updates. Energy futures were mixed but mostly lower. Crude oil eased 0.3% lower in afternoon trading to stay just below $79 per barrel. Diesel tumbled more than 3% lower, meantime, while gasoline firmed 0.4%. The U.S. Dollar firmed moderately.

On Tuesday, commodity funds were net buyers of soyoil (+1,000) contracts but were net sellers of corn (-2,000), soybeans (-4,000), soymeal (-2,000) and CBOT wheat (-3,000).

Corn

Corn prices faded moderately lower after lingering recession concerns and spillover weakness from other commodities spurred a round of technical selling on Wednesday. March futures fell 6.25 cents to $6.76, with May futures down 6 cents to $6.7375.

Corn basis bids held steady across most Midwestern locations on Wednesday but did trend 8 cents higher at an Indiana ethanol plant and 5 cents lower at a Nebraska processor today.

Private exporters announced to USDA the sale of 8.4 million bushels of corn for delivery during the 2022/23 marketing year, which began September 1.

Ethanol production made modest improvements in the week ending February 10, with a daily average of 1.014 million barrels, per the latest data from the U.S. Energy Information Administration. It also marked the fifth consecutive week that production stayed above the 1-million-barrel-per-day benchmark. Stocks increased 4% and are now at a 45-week high.

Prior to Thursday morning’s export report from USDA, analysts expect the agency to show corn sales ranging between 23.6 million and 55.1 million bushels for the week ending February 9.

The National Oilseed Processors Association (NOPA) released its January soy crush report this morning, noting a total volume of 179.007 million bushels. That’s 0.8% above December’s total but 1.8% lower year-over-year. It was also below the average trade guess of 181.656 million bushels. Soyoil stocks through January 31 rose to 1.829 billion pounds, a monthly gain of 2.1%.

Refinitiv Commodities Research slightly reduced its estimates for Brazil’s 2022/23 corn production to 4.980 billion bushels, citing some planting delays in a few key production regions. Through February 11, Brazil’s first corn crop harvest was 11% complete, and second corn plantings were at 20.4%.

Grain traveling the nation’s railways totaled 21,241 carloads last week. That brings cumulative totals for 2023 at 140,408 carloads, which is 1.4% below last year’s pace so far.

Preliminary volume estimates were for 192,982 contracts, sliding 32% below Tuesday’s final count of 283,907.

Soybeans

Soybean prices suffered a double-digit setback, trending more than 0.75% lower on a round of technical selling on Wednesday. March futures dropped 13.25 cents to $15.2425, with May futures down 12 cents to $15.18.

The rest of the soy complex was mixed once again. Soymeal futures eroded 2% lower, while soyoil futures trended 1.25% higher.

Soybean basis bids were steady across most Midwestern locations on Wednesday but did shift 5 cents higher at an Indiana processor today.

Ahead of tomorrow morning’s export report from USDA, analysts think the agency will show soybean sales ranging between 14.7 million and 40.4 million bushels for the week ending February 9. Analysts also expect to see soymeal sales ranging between 100,000 and 325,000 metric tons last week, plus up to 10,000 MT of soyoil sales.

With drought threatening Argentina’s grain crops, India has bumped up its soymeal exports. As much as 500,000 metric tons may be shipped out in February and March, according to multiple exporters. “If global prices sustain at the current level, then India could easily export more than 2 million tons in 2022/23,” according to one of those sources.

Between historically tight supplies, a war that has disrupted shipping lanes, drought in Argentina and a looming surge in biodiesel demand, how is the market not more bullish on soybeans, wonders Bill Biedermann, hedging strategist with AgMarket.net. “But the market doesn’t always agree with me for some reason,” he adds. “The market has been trading these stories for nearly a year.” Click here to catch up on Biedermann’s latest commentary and analysis.

Preliminary volume estimates were for 250,066 contracts, moving slightly ahead of Tuesday’s final count of 236,171.

Wheat

Wheat prices faced variable losses on the heels of another round of technical selling on Wednesday. Most contracts were down double digits. March Chicago SRW futures lost 17.5 cents to $7.6850, March Kansas City HRW futures fell 11.25 cents to $8.9475, and March MGEX spring wheat futures dropped 8.5 cents to $9.2350.

Prior to Thursday morning’s export report from USDA, analysts expect the agency to show combined old and new crop wheat sales between 5.5 million and 18.4 million bushels for the week ending February 9.

Russian consultancy Sovecon fractionally raised its forecast for 2022/23 wheat exports to 1.624 billion bushels. Russia is the world’s No. 1 wheat exporter.

French FarmAgriMer trimmed its outlook for the country’s 2022/23 soft wheat exports outside of the European Union to 384.0 million bushels, citing competition in the Black Sea region. That expected volume is still 19% higher year-over-year, however.

China is planning another auction to sell 5.1 million bushels of its state imported wheat reserves on February 22. China has offered a series of similarly sized auctions over the past few months in an attempt to boost local supplies and tamp down high prices.

Thailand has purchased 2.2 million bushels of animal feed wheat, likely sourced from Australia, in a purchase that concluded on Tuesday. The grain is for shipment in July.

Preliminary volume estimates were for 134,103 CBOT contracts, tracking slightly below Tuesday’s final count of 145,771.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)