Black Sea deal extension sinks grain prices

Afternoon report: That news, plus a large cancellation, tanked grain prices on Wednesday.

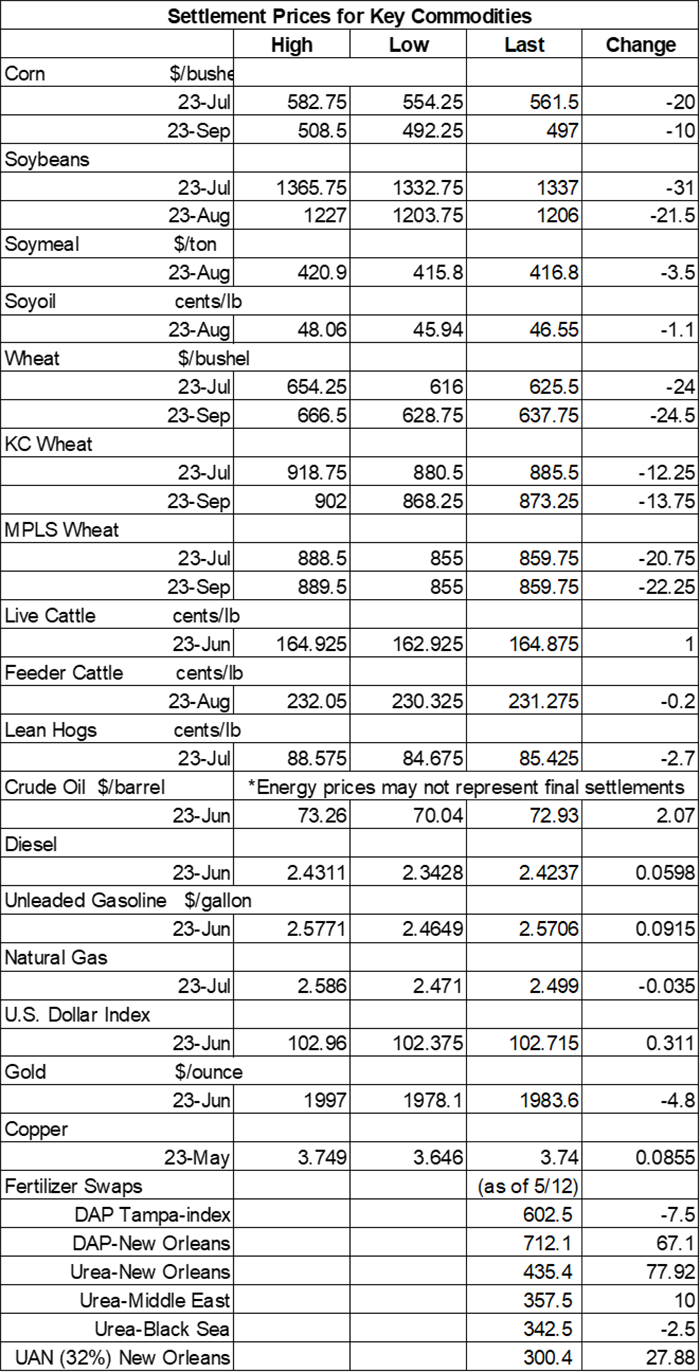

Grain prices suffered heavy losses on Wednesday after an extension for a critical Black Sea shipping deal was finally inked today, giving Ukrainian shipping vessels another 60 days to safely export grain and keep it on the board as a major global competitor for U.S. grain. That news, along with mostly favorable spring planting weather, kept grain prices severely in the red today. Corn, soybeans and wheat all faced double-digit declines, with Chicago SRW wheat contracts facing the most downside.

Nearly all of the central U.S. will gather at least some measurable moisture between Thursday and Sunday, according to the latest 72-hour cumulative precipitation map from NOAA. Parts of Oklahoma and Arkansas could see the largest totals during this time, with some fields likely to get 1” or more through the weekend. NOAA’s new 8-to-14-day outlook predicts more seasonally wet weather for the Plains and upper Midwest between May 24 and May 30, with warmer-than-normal conditions likely for the Corn Belt as the month draws to a close.

On Wall St., the Dow climbed 410 points higher in afternoon trading to 33,422 on optimism that ongoing debt ceiling negotiations will prove fruitful. Demand optimism helped energy futures move higher, with crude oil rising 2.75% this afternoon to $72 per barrel. Diesel trended 2.5% higher, while gasoline jumped nearly 4% higher. The U.S. firmed moderately.

On Tuesday, commodity funds were net sellers of all major grain contracts, including corn (-8,000), soybeans (-15,000), soymeal (-2,000), soyoil (-6,000) and CBOT wheat (-3,000).

Corn

Corn prices eroded significantly lower following a round of technical selling that was due to a variety of issues, including fast planting pace in the United States, worries about exports amid stiff global competition and more. July futures lost 20 cents to $5.6125, with September futures down 10 cents to $4.9650.

Corn basis bids were mostly steady to soft across the central U.S. after sliding 9 to 16 cents lower at three Midwestern locations on Wednesday. An Indiana ethanol plant bucked the overall trend after improving 5 cents today.

Private exporters announced to USDA the cancellation of corn sales totaling 10.7 million bushels, which were originally scheduled for delivery during the 2022/23 marketing year that began September 1.

A critical Black Sea shipping deal that was otherwise set to expire on May 18 has been extended for another 60 days, according to an announcement by Turkey’s President Erdogan earlier today. The United Nations and Turkey brokered the initial deal last July and have been active participants in negotiations for multiple extensions. The deal is absolutely vital for Ukraine, which ships hundreds of millions of bushels via the Black Sea annually.

Meantime, U.N. Secretary General Antonio Guterres also indicated today that negotiations will continue regarding outstanding issues Russia has with its own grain and fertilizer exports. “Looking ahead, we hope that exports of food and fertilizers, including ammonia, from the Russian Federation and Ukraine will be able to reach global supply chains safely and predictably,” he says.

Ethanol production moved moderately higher in the week ending May 12 but stayed below the 1-million-barrel-per-day benchmark for the fourth consecutive week after posting a new daily average of 987 million barrels, per the latest data from the U.S. Energy Information Administration, out Wednesday morning. Stocks fell to a 24-week low.

Prior to Thursday morning’s export report from USDA, analysts expect the agency to show corn sales ranging between net cancellations of 17.7 million bushels and net sales of 23.6 million bushels for the week ending May 11.

South Korea purchased 2.7 million bushels of animal feed corn, sourced either from South America or South Africa, in a private deal that closed on Tuesday. The grain is for shipment between late August and late September, depending on origin.

Preliminary volume estimates were for 510,799 contracts, jumping well above Tuesday’s final count of 278,747.

Soybeans

Soybean prices incurred losses of more than 2% on a round of technical selling that was triggered by fast U.S. plantings and a record-breaking Brazilian crop. July futures dropped 31 cents to $13.33, with August futures down 26.75 cents to $12.7150. The rest of the soy complex also sank lower on Wednesday. Soymeal futures closed with losses of around 0.75%, while soyoil futures spilled 2.5% lower.

Soybean basis bids improved 5 cents at an Indiana processor while trending 5 to 10 cents lower at two other Midwestern locations and holding steady elsewhere across the central U.S. on Wednesday.

Prior to tomorrow morning’s USDA export report, analysts think the agency will show soybean sales ranging between zero and 22.0 million bushels for the week ending May 11. Analysts also think the agency will report another 50,000 to 525,000 metric tons of soymeal sales last week, plus up to 20,000 MT of soyoil sales.

Land O’Lakes reported today that the country had paid out $5.1 million to 273 farmers who were enrolled in a 2022 carbon program that the company says sequestered around 262,000 metric tons of carbon from their sustainable farming practices. Microsoft is among the largest purchasers of these credits.

Preliminary volume estimates were for 253,891 contracts, shifting slightly above Tuesday’s final count of 236,007.

Wheat

Wheat prices faced heavy losses following another round of technical selling on Wednesday. Rains coming to the Plains and Ukraine’s shipping deal extension were the main culprits for today’s cuts. September Chicago SRW futures lost 24.5 cents to $6.3575, September Kansas City HRW futures dropped 13.75 cents to $8.7075, and September MGEX spring wheat futures fell 22.25 cents to $8.5825.

Ahead of Thursday morning’s export report from USDA, analysts anticipate seeing wheat sales ranging between 9.2 million and 20.2 million bushels for the week ending May 11. Actual volume will need to make it near the middle of those estimates to best the prior week’s tally of 13.2 million bushels.

French farm office FranceAgriMer slightly raised its 2022/23 wheat ending stocks to 99.9 million bushels. That’s due to a slight reduction in expected exports for Europe’s top grain producer, which is now estimated at 613.3 million bushels.

The Philippines issued an international tender to purchase 1.5 million bushels of animal feed wheat from optional origins that closes later today. The grain is for shipment in July.

Preliminary volume estimates were for 159,307 CBOT contracts, which was moderately higher than Tuesday’s final count of 107,373.

About the Author(s)

You May Also Like