Weekly Export Sales – uphill battles continue

Soybeans move lower despite solid round of export data

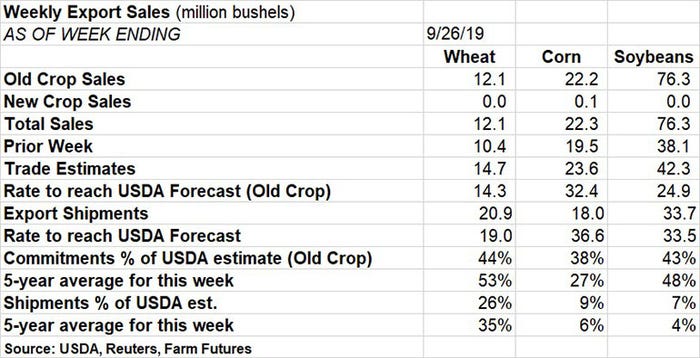

Soybean export sales doubled for the week ending September 26, but grain markets nonetheless shrugged off that bullish bit of data from USDA’s latest export report, out Thursday morning.

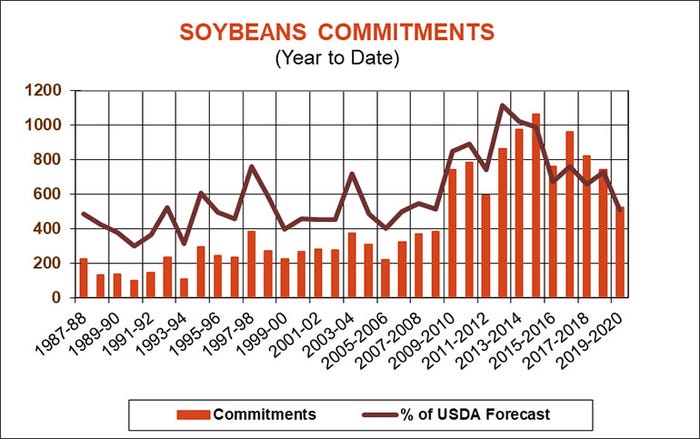

“The market’s disappointing reaction to what seemed like positive export news for soybeans underscores the uphill battle prices face,” says Farm Futures senior grain market analyst Bryce Knorr. “Chinese purchases are four-and-a-half times the level done last year at this time when the extent of the trade war was hitting home for farmers. But overall commitments of soybeans are still at the lowest level 11 years, a reminder that total demand isn’t growing quickly, helping push November futures back below the 200-day moving average.”

Total soybean exports last week were for 76.3 million bushels, which was substantially higher than the prior week’s tally of 38.1 million bushels and trade estimates of 42.3 million bushels. The weekly rate needed to match USDA forecasts also moved lower, to 24.9 million bushels.

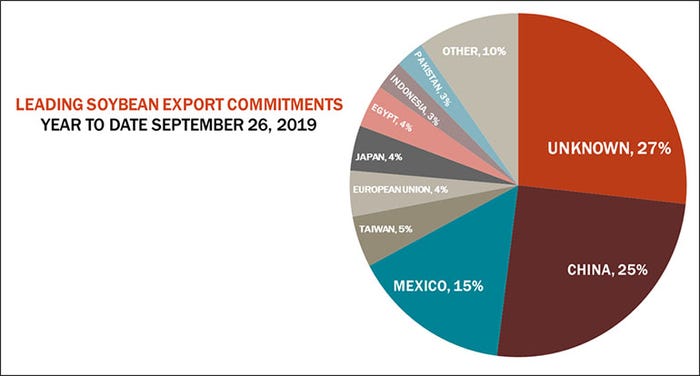

Soybean export shipments were for 33.7 million bushels, meantime. As the 2019/20 marketing year rolls along, unknown destinations remain the No. 1 home for U.S. soybean export commitments, with 27% of the total. Other leading destinations include China (25%), Mexico (15%) and Taiwan (5%).

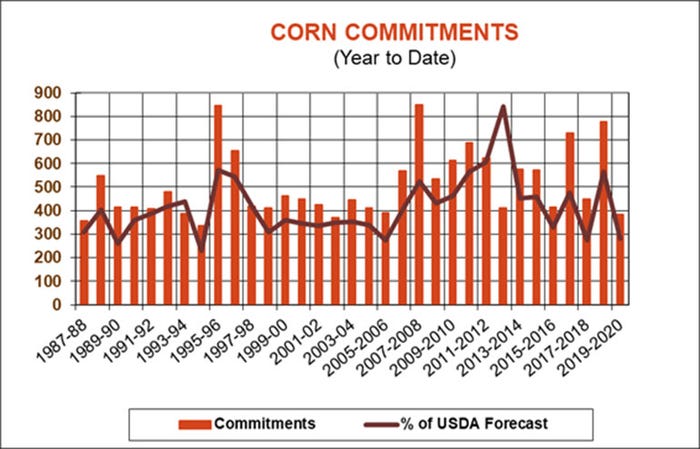

Corn exports last week were relatively disappointing, Knorr says.

“Export sales improved to 22.3 million bushels, but that’s still 10 million below the rate forecast by USDA for the 2019 crop,” he says. “Total commitments are at the lowest point in 17 years as buyers take what’s left of a big crop in Brazil at lower prices.”

Last week’s tally was a small improvement over the prior week’s total of 19.5 million bushels but slightly behind trade estimates of 23.6 million bushels. The weekly rate needed to meet USDA forecasts moved higher, to 32.4 million bushels.

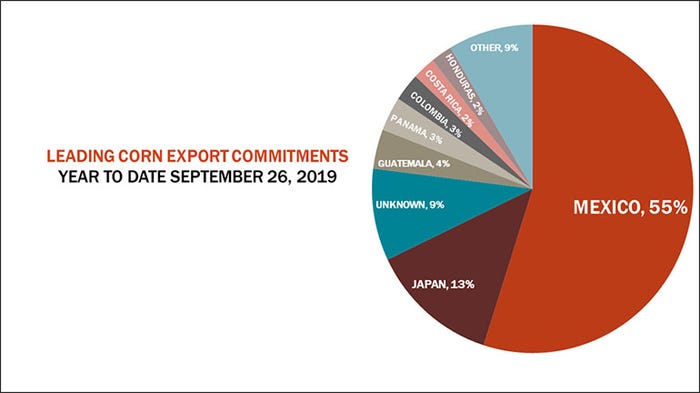

Corn export shipments were also a tepid 18.0 million bushels last week. Mexico continues to dominate all destinations for U.S. corn export commitments in 2019/20, with 55% of the total. Other top destinations include Japan (13%), unknown destinations (9%) and Guatemala (4%).

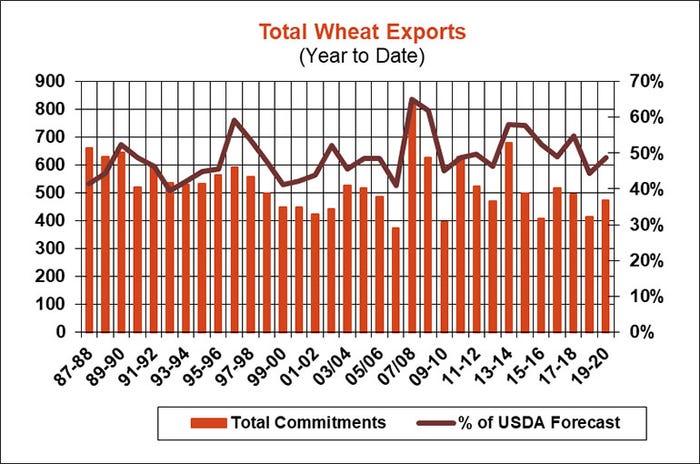

Wheat export sales showed another tepid round of data last week, notching 12.1 million bushels. That was slightly better than the prior week’s total of 10.4 million bushels but below trade estimates of 14.7 million bushels. The weekly rate needed to match USDA forecasts moved up to 14.3 million bushels.

“Wheat business improved, but only nominally,” Knorr says. “Wheat business overall isn’t terrible, but it’s not great, either, which is what the market needs to keep its fall rally alive.”

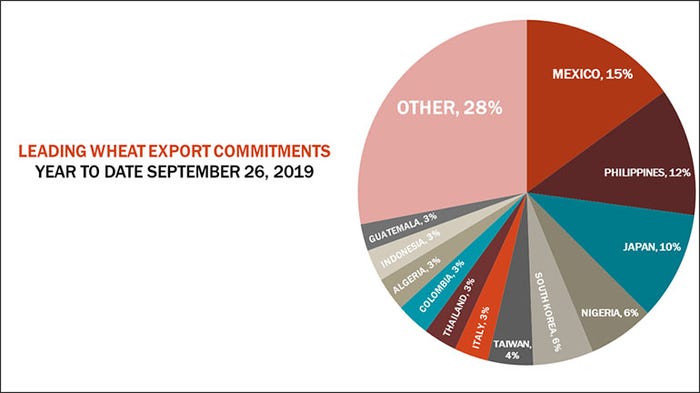

Wheat export shipments were somewhat better, at 20.9 million bushels. Mexico is the No. 1 destination for U.S. wheat export commitments in 2019/20 so far, with 15% of the total. Other top destinations include the Philippines (12%), Japan (10%), Nigeria (6%) and South Korea (6%).

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)