Corn prices heat up on weather, war worries

Afternoon report: Soybeans and winter wheat prices also trend higher on Tuesday.

July 18, 2023

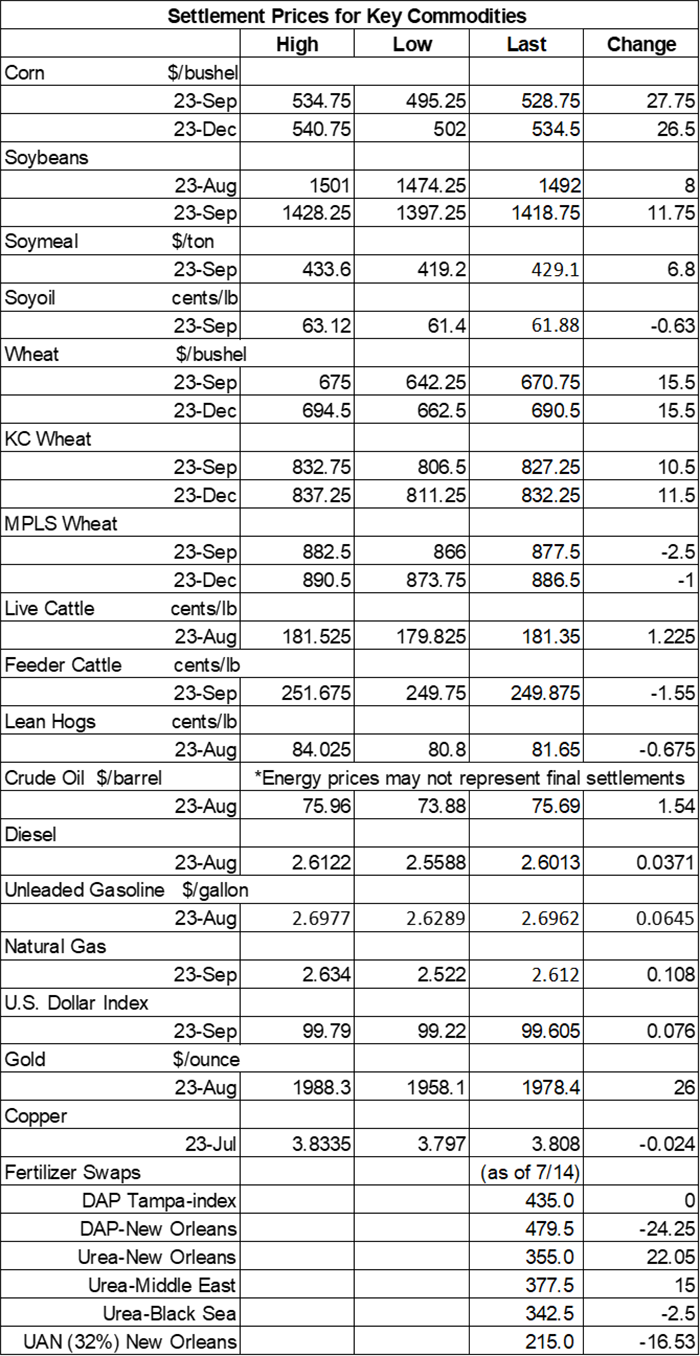

A day after Russia failed to renew a deal that allows for safe passage of shipping vessels in the Black Sea, the country launched missile and drone strikes that damaged a Ukrainian port (among other things) in Odesa. The added geopolitical tensions in the region was enough to restart a rally in the grain markets on Tuesday. Corn prices grabbed the biggest gains, closing more than 5% higher. Winter wheat prices were up around 1.25% to 2.5%, while soybeans trended 0.5% to 0.75% higher. Spring wheat prices failed to follow suit, easing 0.25% lower.

Rains will be variable across the central U.S. between Wednesday and Saturday. Parts of eastern Iowa and central Illinois won’t find any measurable moisture, while parts of Kansas and Nebraska could see another 1” to 2” later this week, per the latest 72-hour cumulative precipitation map from NOAA. Meanwhile, the agency’s new 8-to-14-day outlook predicts seasonally dry weather returning to the Plains and western Corn Belt between July 25 and July 31, with warmer-than-normal conditions likely for the entire U.S. next week.

On Wall St., the Dow jumped 375 points higher to 34,961 on strong corporate earnings from the banking sector. Energy futures also pushed higher, with crude oil up more than 1.75% this afternoon to reach $75 per barrel. Diesel firmed 1.5%, with gasoline up more than 2%. The U.S. Dollar firmed slightly.

On Monday, commodity funds were net buyers of soybeans (+4,500) and soymeal (+3,500) contracts but were net sellers of corn (-6,500), soyoil (-2,000) and CBOT wheat (-2,500).

Corn

Corn prices jumped higher on Tuesday as traders returned their focus to geopolitical turmoil in the Black Sea region and expectations for a hotter-than-normal second half of July as this season’s crop moves into the critical pollination phase. September futures climbed 27.75 cents to $5.27, with December futures up 26.5 cents to $5.3250.

Corn basis bids were steady to firm after rising 2 to 8 cents higher across three Midwestern locations on Tuesday.

Corn quality trended another two points higher last week, with 57% now rated in good-to-excellent condition. That also mirrored analyst expectations. Another 30% is rated fair (down one point from last week), with the remaining 13% rated poor or very poor (also down one point from last week). Of the top 18 production states, North Carolina (81%) has the highest quality crop at this point.

Physiologically, 47% of the crop is now silking, up from 22% a week ago and favorable to the prior five-year average of 43%. And 7% has reached dough stage, up from 2% last week and slightly ahead of the prior five-year average of 6%.

Through July 11, 87.9% of the Midwest was experiencing at least some level of drought, according to the latest updates from the U.S. Drought Monitor. “The main question often asked is, ‘How much yield potential am I losing?’ It’s a difficult question to answer because the nature of drought varies from one year to another, according to Dan Quinn and Tom Bechman. They explored, among other things, how corn quality ratings shaped up in other drought years, including 2002, 2007, 2012 and 2020. Click here to learn more.

China’s corn imports in June were down 16.3% year-over-year after reaching 72.8 million bushels. Total Chinese corn imports during the first half of 2023 are down 11.5% versus 2022’s pace so far, with 473.6 million bushels.

Iran issued an international tender to purchase 7.1 million bushels of animal feed corn from optional origins that closes on Wednesday. The grain is for shipment in August and September.

Preliminary volume estimates were for 420,125 contracts, moving well ahead of Monday’s final count of 282,173.

Soybeans

Soybean prices followed other grains higher on Tuesday, but gains were somewhat muted after USDA showed better-than-expected quality ratings in its latest crop progress report. August futures added 8 cents to $14.92, with September futures up 11.75 cents to $14.19.

The rest of the soy complex was mixed. Soymeal prices tracked nearly 2% higher, while soyoil prices faded around 1% lower today.

Soybean basis bids were mostly steady across the central U.S. on Tuesday but did tilt 10 cents lower at an Illinois river terminal today.

Analysts were expecting USDA to raise soybean quality ratings by another two points, but the agency served up a four-point gain, with 55% of the crop now rated in good-to-excellent condition. Another 32% is rated fair (down two points from last week), with the remaining 13% rated poor or very poor (down two points from last week).

Physiologically, 56% of the crop is now blooming, up from 39% last week and moderately above the prior five-year average of 51%. And 20% is now setting pods, up from 10% a week ago and slightly swifter than the prior five-year average of 17%.

Preliminary volume estimates were for 232,731 contracts, which was moderately above Monday’s final count of 167,730.

Wheat

Wheat prices were mixed but mostly higher on reports of infrastructure damage at a Ukrainian port in Odesa following a missile strike there. However, an unexpected jump in spring wheat crop quality kept those contracts in the red. September Chicago SRW futures climbed 15.5 cents to $6.6925, September Kansas City HRW futures rose 10.5 cents to $8.2575, and September MGEX spring wheat futures eased 2.5 cents to $8.7575.

Winter wheat harvest progress moved from 46% a week ago up to 56% through Sunday. That was slightly below the average trade guess of 57% and noticeably slower than the prior five-year average of 69%.

Analysts expected to see steady spring wheat quality ratings, but they jumped four points higher, instead. That means 51% of the crop is now rated in good-to-excellent condition. Another 35% is rated fair (down two points from last week), with the remaining 14% rated poor or very poor (down two points from last week). Physiologically, 86% of the crop is now headed, up from 72% last week.

China’s wheat exports during the first half of 2023 are trending substantially above last year’s pace so far. June exports reached 30.1 million bushels, bringing year-to-date totals up to 294.3 million bushels. That’s a year-over-year increase of 62.1 million bushels.

Japan issued a regular tender to purchase 3.9 million bushels of food-quality wheat from the United States, Canada and Australia that closes on Thursday. Of the total, 45% is expected to be sourced from the U.S. The grain is for shipment in September.

Preliminary volume estimates were for 87,721 CBOT contracts, shifting moderately below Monday’s final count of 113,097.

You May Also Like

.jpg?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)