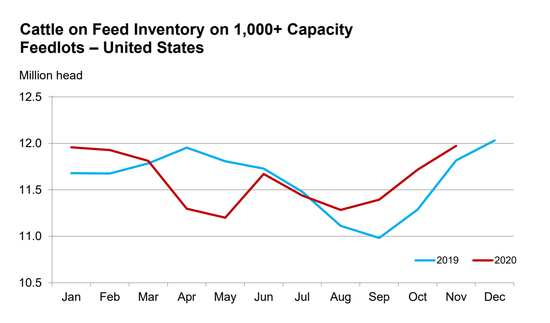

‘Cattle on Feed’ shows slight rise in inventory

Feedlot inventories mostly follow seasonal patterns after effects of pandemic in April and May.

The U.S. Department of Agriculture released the latest “Cattle on Feed” report this week, showing that the inventory for feedlots with capacity of 1,000 head or more totaled 12.0 million head on Nov. 1, 2020, a 1% rise from Nov. 1, 2019. The inventory was near what trade analysts had estimated. USDA said it is the highest Nov. 1 inventory since the series began in 1996.

American Farm Bureau Federation economist Michael Nepveux explained that November typically continues the fall buildup of animals after September lows. This year, he said it looks as though this seasonality is playing out once again.

“After strong impacts from the pandemic in April and May, the number of cattle on feed has largely followed seasonal patterns but, since August, has been running above recent years’ levels,” he noted.

Placements in feedlots during October totaled 2.19 million head, 11% below 2019. The average trade estimate was for a 9% decline. Net placements were 2.13 million head.

Nepveux said a large driver of the pullback in placements was the fact that October 2019 placements were the highest in nearly a decade. He further pointed out that placements have been running ahead of year-ago levels since they recovered after declines in April and May at the height of the COVID-19 pandemic.

During October, placements totaled 570,000 head for cattle and calves weighing less than 600 lb., 495,000 head for those weighing 600-699 lb., 465,000 head for those weighing 700-799 lb., 387,000 head for those weighing 800-899 lb., 185,000 head for those weighing 900-999 lb. and 90,000 head for those at 1,000 lb. and greater.

Marketings of fed cattle during October totaled 1.87 million head, only slightly below 2019 and in line with the average pre-report trade estimate.

Nepveux said the November report is considered relatively neutral to bullish.

“While an 11% decline in placements is bullish for future supplies of fed cattle, this was widely expected by the industry,” he noted. “The overall supply of cattle on feed is up moderately over 2019, and the number of animals marketed throughout October is even with a year ago.”

Looking ahead, he said the big question is the level of resurgence in COVID-19 cases throughout the winter.

“The packing industry should have gotten better at managing this challenge after the crash course in the spring, but whether or not plants have to be closed is still a risk, albeit hopefully a lower one,” Nepveux said.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)