July weather heats up corn, soybean prices

Afternoon report: Wheat prices mixed but mostly lower to start the week.

July 10, 2023

Grain prices were mixed but mostly higher as traders remain focused on the latest weather forecasts. Here’s a bit of trivia that’s relevant right now – most of the U.S. statistically sees the hottest day of the year land somewhere between July 15 and July 31, and current mid-range forecasts are predicting hotter-than-normal temperatures for the Midwest and Plains later this month. Consequently, corn and soybean prices made solid inroads on Monday. Wheat largely failed to follow suit, although MGEX spring wheat prices did manage moderate gains today. Traders are also looking ahead to USDA’s next World Agricultural Supply and Demand Estimates (WASDE) report, out Wednesday morning.

A band of upcoming storms stretching from Iowa through Kentucky could deliver another 1” to 2” or more additional rainfall between Tuesday and Friday, per the latest 72-hour cumulative precipitation map from NOAA. And most of the Corn Belt will receive at least some measurable moisture during this time. Further out, NOAA’s updated 8-to-14-day outlook predicts near-normal precipitation for most of the central U.S. between July 17 and July 23, with warmer-than-normal conditions likely for nearly all of the United States next week.

On Wall St., the Dow improved 177 points in afternoon trading to 33,912 as investors await the next round of inflation data, which will be released on Wednesday and Thursday. Energy futures faded lower, with crude oil down around 1% to $73 per barrel. Diesel was fractionally in the red, with gasoline spilling 0.5% lower. The U.S. Dollar softened moderately.

On Friday, commodity funds were net sellers of all major grain contracts, including corn (-7,000), soybeans (-7,000), soymeal (-3,000), soyoil (-2,500) and CBOT wheat (-3,000).

Corn

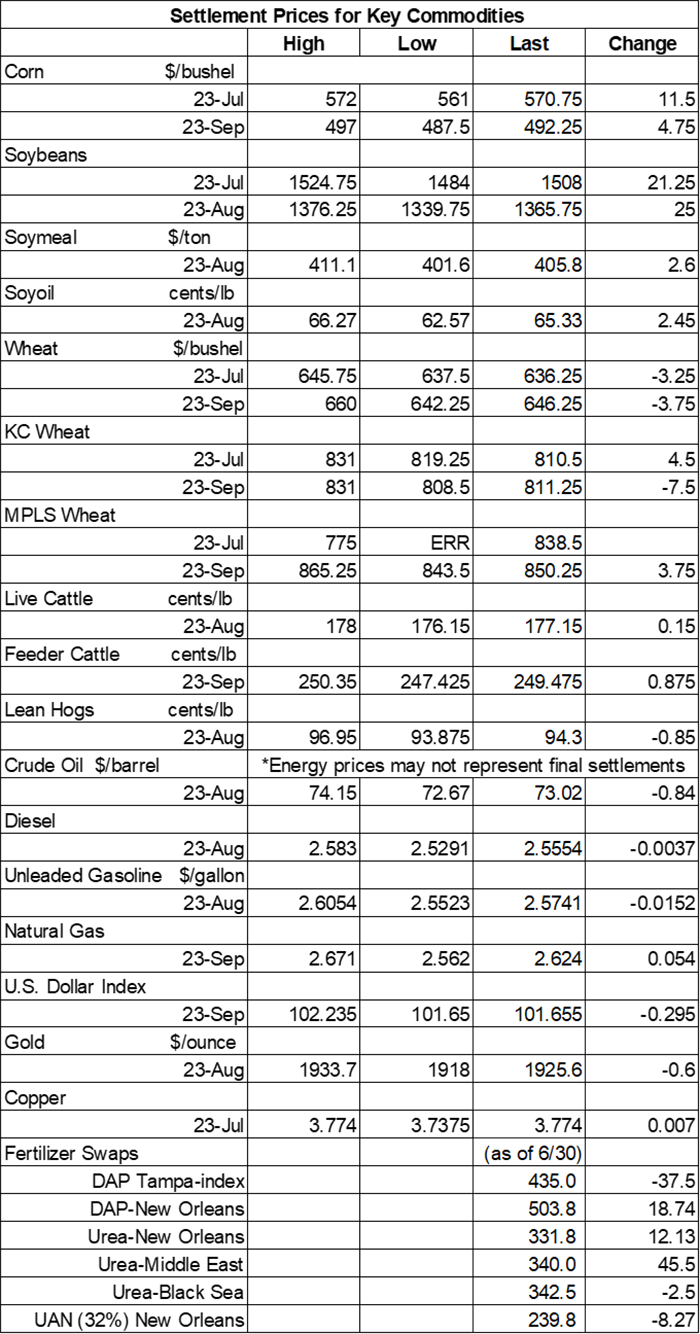

Corn prices made moderate inroads on a round of technical buying largely inspired by hotter-than-normal weather in the mid-range forecasts, with spillover strength from soybeans lending additional support today. July futures rose 11.5 cents to $5.72, with September futures up 4.75 cents to $4.92.

Corn basis bids were mostly steady across the central U.S. to start the week but did trend 10 cents higher at an Iowa river terminal and 5 cents higher at an Illinois processor on Monday.

Corn export inspections were disappointing after only reaching 13.4 million bushels last week. That was below the entire set of trade estimates, which ranged between 19.7 million and 35.4 million bushels. Mexico, Japan, Colombia, Venezuela and Guyana were the top five destinations. Cumulative totals for the 2022/23 marketing year are still substantially below last year’s pace, with 1.319 billion bushels.

Ahead of the next crop progress report from USDA, out Monday afternoon and covering the week through July 9, analysts expect the agency to show corn quality improving by two points, with 53% of the crop in good-to-excellent conditions. Individual trade guesses ranged between 50% and 54%.

Ahead of Wednesday’s WASDE report from USDA, analysts are expecting to see corn production estimates fade fractionally lower, to 15.234 billion bushels and assume average yields of 176.6 bushels per acre. That’s sharply lower than USDA’s June estimate of 181.5 bpa, but higher-than-expected total plantings have left production estimates virtually unchanged.

“The July 12 WASDE reveals how USDA interprets new data for both old and new crop balance sheets,” notes grain market analyst Bryce Knorr. “While these July reports normally aren’t known for changes, the numbers this time could be scrambled in myriad ways.” Knorr explores some potential outcomes in today’s Ag Marketing IQ blog – click here to learn more.

Brazilian consultancy AgRural estimates that 27% of the country’s second corn crop has been harvested through July 6, up from 17% in the prior week. That’s noticeably below last year’s pace of 41%. However, AgRural also expects this season’s second corn crop will reach a new record production of 4.051 billion bushels.

Preliminary volume estimates were for 186,107 contracts, sliding slightly below Friday’s final count of 209,062.

Soybeans

Soybean prices strengthened considerably despite a tepid round of export inspection data this morning, as traders remain focused on much lower-than-expected plantings, which have introduced fresh doubts over this season’s true production potential. July futures rose 21.25 cents to $15.0675, with August futures up 25.5 cents to $14.5325.

The rest of the soy complex was also firm. Soymeal prices managed gains of around 0.5%, while soyoil prices jumped 4% higher today.

Soybean basis bids were mostly steady to soft after dropping 5 to 15 cents lower across four Midwestern locations on Monday. An Iowa processor bucked the overall trend after climbing 30 cents higher today.

Soybean export inspections made it to 8.7 million bushels last week. That was to-ward the lower end of trade estimates, which ranged between 4.6 million and 14.7 million bushels. Germany, Italy, Japan, Mexico and Indonesia were the top five destinations. Cumulative totals for the 2022/23 marketing year are still modestly below last year’s pace after reaching 1.825 billion bushels.

Prior to this afternoon’s crop progress report from USDA, analysts think the agency will show soybean quality improving by two points, with 52% of the crop in good-to-excellent condition through July 9. Individual trade guesses ranged between 49% and 53%.

Prior to Wednesday morning’s WASDE report from USDA, analysts think the agency will lower 2023 soybean production by 257 million bushels due to a drop in expected plantings, with a new estimate of 4.253 billion bushels. That also assumes an average yield of 51.4 bushels per acre.

Preliminary volume estimates were for 155,604 contracts, easing slightly below Friday’s final count of 159,996.

Wheat

Wheat prices were mixed but mostly lower on an uneven round of technical maneuvering after traders largely shrugged off a solid round of export inspection data this morning. September Chicago SRW futures dropped 3.75 cents to $6.4575, September Kansas City HRW futures fell 7.5 cents to $8.1075, and September MGEX spring wheat futures added 3.75 cents to $8.5150.

Wheat export inspections were better than expected last week after reaching 15.4 million bushels. That was above the entire set of trade guesses, which ranged be-tween 7.3 million and 14.7 million bushels. The Philippines, Colombia, Mexico, Chile and Indonesia were the top five destinations. Cumulative totals for the 2023/24 marketing year have started off moderately slower than last year’s pace so far, with 55.8 million bushels.

Prior to Monday afternoon’s crop progress report from USDA, analysts aren’t expecting the agency to make any changes to its winter wheat quality ratings, with 40% still in good-to-excellent condition through July 9. Harvest is expected to move from 37% complete a week ago up to 51% through Sunday. Spring wheat quality ratings may shift one point higher, with 49% in good-to-excellent condition.

And finally, medical emergencies can (and sometimes do) happen in the field or on the farm. Here are some thoughts about revisiting safety protocols and what you carry in your safety kits on your operation – click here to get started.

You May Also Like