Soybeans find additional momentum on Monday

Afternoon report: Wheat prices also in the green today, with corn prices lightly mixed.

Grain prices were mixed but mostly higher to start the week. Soybeans found the most upside despite a tepid round of grain export inspection data from USDA, capturing double-digit gains on spillover support from surging energy futures. Wheat prices also stayed in the green today, with some contracts up as much as 0.5%. Corn prices struggled to find much traction, closing with lightly mixed results.

More wet weather is coming to large portions of the Corn Belt between Tuesday and Friday, per the latest 72-hour cumulative precipitation map from NOAA. Large portions of the Dakotas, Minnesota and Michigan could gather another 1” or more later this week. NOAA’s new 8-to-14-day outlook predicts a return to seasonally dry weather for the Northern and Central Plains between April 7 and April 13, with colder-than-normal conditions likely for most of the central U.S. during this time.

On Wall St., the Dow improved another 290 points in afternoon trading to reach 33,564, although the markets are hyper aware of the fact that OPEC+ announced production hikes that sent energy futures soaring today. Crude oil was up more than 6% this afternoon on the news, surpassing $80 per barrel. Gasoline rose nearly 3% higher, with crude oil up around 1.75%. The U.S. Dollar softened moderately.

On Friday, commodity funds were net buyers of all major grain contracts, including corn (+5,000), soybeans (+11,000), soymeal (+3,500), soyoil (+3,500) and CBOT wheat (+1,000).

Corn

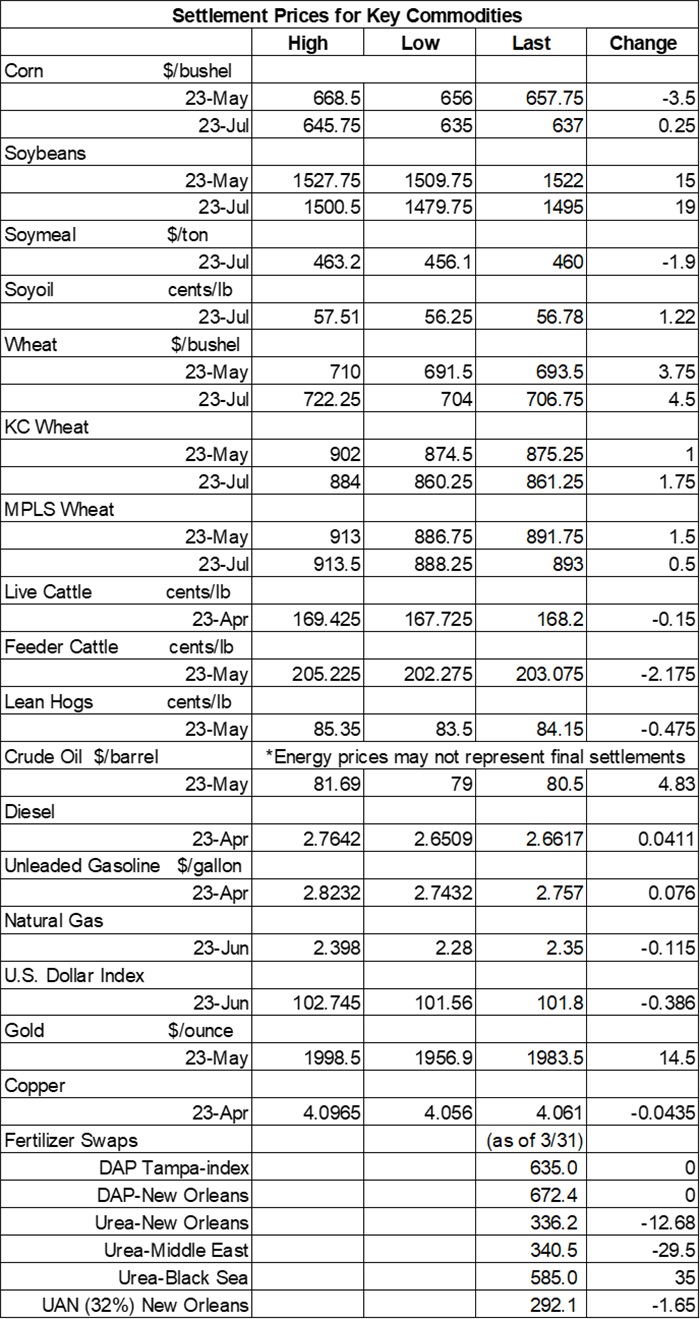

Corn prices struggled despite some bullish signals on Monday, including a flash sale announced to Mexico this morning. Prices were moderately higher in the morning but eventually eroded lower and closed with mixed results. May futures dropped 3.5 cents to $6.57, while July futures inched 0.25 cents higher to $6.3625.

Corn basis bids were steady to mixed across the central U.S. after climbing as much as 20 cents higher at an Iowa processor while spilling as much as 10 cents lower at a Nebraska processor on Monday.

Private exporters announced the sale of 5.9 million bushels of corn for delivery to Mexico during the 2023/24 marketing year, which begins September 1.

Corn export inspections made it to 43.2 million bushels, which was a week-over-week improvement of 59%. It was also on the higher end of trade estimates, which ranged between 27.6 million and 47.2 million bushels. Mexico was the No. 1 destination, with 15.3 million bushels. Cumulative totals for the 2022/23 marketing year are still trending significantly below last year’s pace, with 762.5 million bushels.

Preliminary volume estimates were for 324,516 contracts, fading moderately below Friday’s final count of 472,916.

Soybeans

Soybean prices improved another 1% to 1.25% higher on Monday after red-hot energy prices generated some technical buying today. May futures rose 15 cents to $15.2050, with July futures up 19 cents to $14.9450.

The rest of the soy complex was mixed. Soyoil futures climbed more than 2% higher, while soymeal futures retreated nearly 0.5% lower today.

Soybean basis bids were steady to mixed on Monday after firming 3 to 10 cents higher across four Midwestern processors while trending as much as 10 cents lower at an Illinois river terminal today.

Private exporters announced the sale of 20,000 metric tons of soyoil for delivery to unknown destinations during the current marketing year.

Soybean export inspections were relatively disappointing last week, with 18.3 million bushels. That was 44% below the prior week’s tally, and it was also toward the lower end of trade estimates, which ranged between 11.0 million and 34.9 million bushels. China was the No. 1 destination, with 10.9 million bushels. Cumulative totals for the 2022/23 marketing year are still slightly above last year’s pace so far, with 1.670 billion bushels.

Brazilian consultancy AgRural reported that 76% of the country’s 2022/23 soybean crop has been harvested through March 30. That’s five points below the prior year’s pace of 81% so far. Most entities are predicting a record-breaking effort of around 5.5 to 5.6 billion bushels this season.

Preliminary volume estimates were for 244,706 contracts, trending moderately below Friday’s final count of 333,748.

Wheat

Wheat prices moved modestly higher as traders awaited fresh crop conditions information from USDA, out later today. May Chicago SRW futures gained 3.75 cents to $6.96, May Kansas City HRW futures picked up a penny to $8.7875, and May MGEX spring wheat futures added 1.5 cents to $8.9725.

Wheat export inspections were lackluster after only reaching 6.2 million bushels last week. It was also below the entire range of trade guesses, which came in between 11.0 million and 16.5 million bushels. The Philippines topped all destinations, with 2.4 million bushels. Cumulative totals for the 2022/23 marketing year are slightly below last year’s pace so far, with 619.5 million bushels.

Ahead of the first crop progress report of 2023, out later this afternoon, analysts expect USDA to show 31% of the 2022/23 winter wheat crop in good-to-excellent condition through April 2. “Short- and long-term extreme and exceptional drought ... increased in coverage in the Texas Panhandle, the Oklahoma Panhandle and parts of northwest Oklahoma, the latter of which has recently experienced blowing dust and sand and a struggling winter wheat crop,” according to the latest U.S. Drought Monitor report.

European Union crop monitoring service MARS expects Ukraine’s 2023 wheat production to trend 6% below the prior five-year average to an estimated 936.2 million bushels. Per-acre yields are expected to improve 6% this season, while total plantings are likely to be down 11% from the historical average.

Russian consultancy Sovecon estimates that the country’s wheat exports in March reached 165.3 million bushels. That would be a 55% improvement from February’s tally and the largest monthly total in more than a year, if realized. Russia is the world’s No. 1 wheat exporter.

Meantime, Louis Dreyfus Company is the latest group to announce it will no longer process Russian exports starting in the 2023/24 marketing year, which begins July 1. “Louis Dreyfus Company (LDC) will cease grain exports … as export challenges continue to increase in the country, and is also assessing options for the transfer to new owners of its existing Russian business and grain assets,” the company said in a statement. Cargill and Viterra made similar announcements last week.

China sold 4.7 million bushels of its imported state wheat reserves at an auction held on March 29. That was approximately 93% of the total available for sale. China has offered a series of similarly sized wheat auctions in recent months in an attempt to boost local supplies and cool high prices.

Preliminary volume estimates were for 105,025 CBOT contracts, firming slightly above Friday’s final count of 99,359.

About the Author(s)

You May Also Like