Grains extend losses as selloff continues

Afternoon report: Corn, soybeans and wheat spill lower for the third consecutive session.

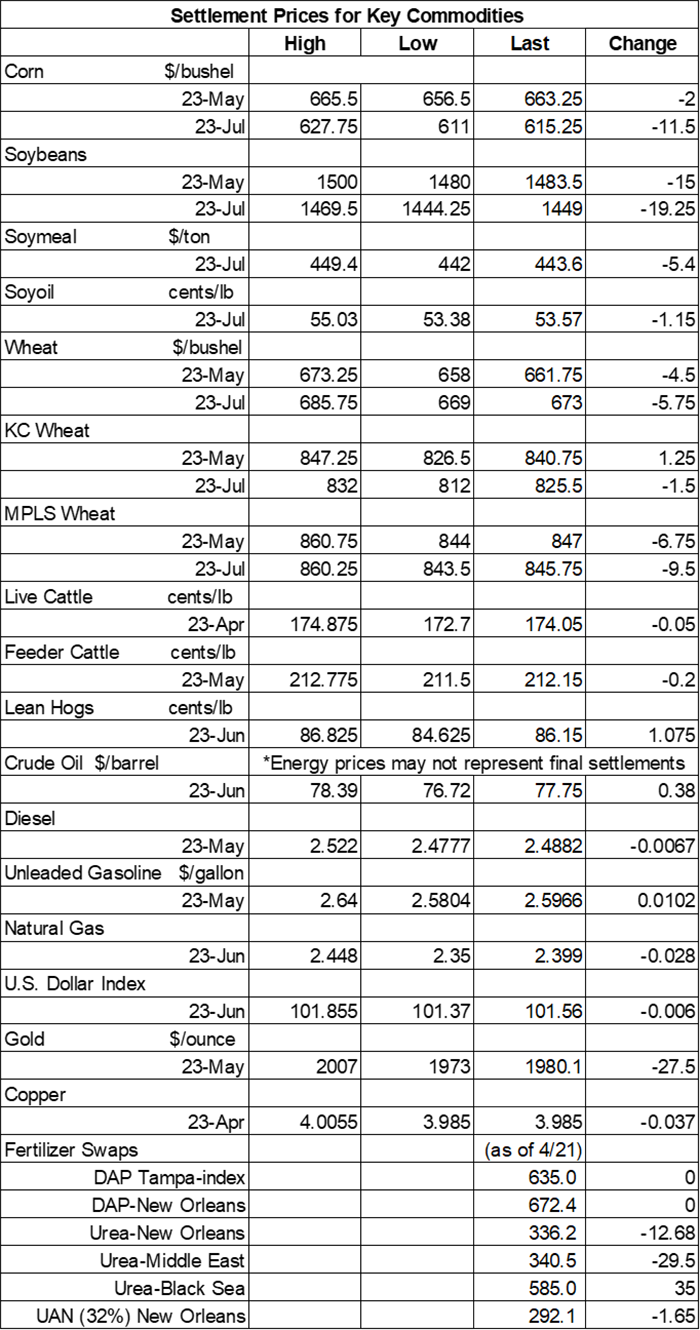

Technical selling that sliced grain prices on Wednesday and Thursday continued today as U.S. planting progress, record-breaking production in Brazil and other factors have created a bearish environment for now. July corn futures fell more than 1.75% and ended the week with 3.2% losses. Soybeans also suffered a moderate setback today, eroding another 1% lower. Wheat losses were mixed but mostly lower, with some contracts down more than 1%.

Drier weather is likely moving forward for the Northern Plains and parts of the western Corn Belt, according to the latest 72-hour cumulative precipitation map from NOAA, covering Saturday through next Tuesday. Parts of the eastern Corn Belt could gather another 0.5” or more during this time, however. NOAA’s new 8-to-14-day outlook predicts seasonally dry weather for most of the Midwest between April 28 and May 4, with colder-than-normal conditions likely for the central U.S.

On Wall St., the Dow was near-even after sliding 10 points lower in afternoon trading to 33,775. The latest corporate earnings reports have been fairly solid, and investors are now waiting to see if the Federal Reserve will pull the trigger on an additional interest rate hike in May. Energy futures were mixed but mostly higher. Crude oil added 0.75% this afternoon to move closer to $78 per barrel. Diesel eased 0.25% lower, while gasoline firmed by more than 0.5%. The U.S. Dollar softened slightly.

On Thursday, commodity funds were net sellers of all major grain contracts for the second consecutive session, including corn (-7,000), soybeans (-5,500), soymeal (-1,500), soyoil (-2,000) and CBOT wheat (-4,500).

Corn

Corn prices continued to spill lower on Friday on yet another round of technical selling as traders expect corn planting progress to pick up and remain watchful for what is likely a record-breaking crop in Brazil. May futures dropped 2 cents to $6.6175, while July futures lost 11.5 cents to $6.1450.

Corn basis bids remained steady across the central U.S. as farmer sales have been sluggish this week.

Multiple European countries are imposing temporary bans on several Ukrainian agricultural commodities because they say an influx of Ukrainian supplies are negatively affecting local prices. That includes corn and wheat import bans for Poland, Slovakia, Hungary and Bulgaria.

Two South Korean importers purchased 8.1 million bushels from optional origins in international tenders that closed earlier today. Some of the grain is expected to be sourced from South America or South Africa. The grain is for arrival in September and October. A third buyer purchased 2.7 million bushels of animal feed corn, likely sourced from South America, that closed in a private deal today. That grain is for arrival by the end of September.

Does planting early provide a yield advantage or is there a more optimal window? Farm Futures grain market analyst Jacqueline Holland pored over some historical data to investigate. What she found – over the past seven years, only two out of seven years that enjoyed an early start led to record yields at the time: 2004 (160.3 bpa) and 2016 (174.6 bpa). “Quick start years like 2012 should remind farmers that other factors play a role throughout the growing season, so it may not pay to invest too much time worrying about early start dates,” she notes. Click here for more of Holland’s analysis.

Preliminary volume estimates were for 418,257 contracts, trending moderately above Thursday’s final count of 365,600.

Soybeans

Soybean prices faced a moderate technical setback, due partly to the fact that comparatively low Brazilian prices are making U.S. beans uncompetitive. May futures dropped 15 cents to $14.8250, with July futures down 19.25 cents to $14.4925.

The rest of the soy complex eroded lower, too. Soymeal futures were down around 1.25%, while soyoil futures lost more than 2%.

Soybean basis bids held steady across the central U.S. on Friday.

China’s soybean imports from the United States in March climbed 43% higher year-over-year, according to the latest customs data out earlier today. The U.S. sold 177.5 million bushels of soybeans to China last month. Brazil’s late harvest has severely curbed its exports to China in March, meantime, falling 42% lower year-over-year to 61.4 million bushels.

China is by far the world’s top importer of soybeans. The United States is typically known as a soybean exporter, but lucrative prices in Brazil led to Bunge and The Andersons recently purchasing a combined 2.9 million bushels. “The discount is like $2 a bushel coming out of Brazil,” according to Michael Cordonnier, president of the Soybean and Corn Adviser consultancy. “They say that is enough to pay for the transportation costs. The ports are working as fast as they can.”

In the latest edition of Farm Progress America, broadcaster Max Armstrong explores some of the new ways that next-generation farmers are building ag businesses. Click here to listen.

Preliminary volume estimates were for 319,494 contracts, moving moderately above Thursday’s final harvest of 262,914.

Wheat

Wheat prices followed other grains lower on Friday, with most contracts facing moderate cuts. July Chicago SRW futures dropped 5.75 cents to $6.7425, July Chicago SRW futures eased 1.5 cents to $8.2525, and July MGEX spring wheat futures fell 9.5 cents to $8.4575.

France’s soft wheat ratings declined slightly in the week through April 17, with 93% of the crop in good-to-excellent condition during that time. Corn plantings for Europe’s top grain producer reached 20% during the same time, up from 12% a week ago but well below the prior five-year average of 31%.

Russian consultancy IKAR expects the country’s 2023 wheat harvest to reach 3.086 billion bushels, with exports likely to come in around 1.506 billion bushels for the 2023/24 marketing year. Russia is the world’s top wheat exporter.

Haven’t ventured over to FarmFutures.com in a few days? We’ve got you covered with our regular Friday feature, “7 ag stories you can’t miss,” which collects the industry’s top headlines. The latest batch of content gives updates on U.S. crop planting progress, a new right-to-repair bill in Colorado, a series of import bans that affects Ukraine and more. Click here to get started.

Preliminary volume estimates were for 120,386 CBOT contracts, which was modestly higher than Thursday’s final count of 112,912.

About the Author(s)

You May Also Like