Corn and soybeans extend gains on Wednesday

Afternoon report: Wheat prices finish with mixed (but mostly lower) results.

Grain prices were mixed but mostly firm as traders begin to move away from the latest supply and demand data from USDA, which the agency released on Tuesday morning, and return to focusing on South American production trends and U.S. weather forecasts. Corn and soybean prices continued to trend higher today, as did CBOT wheat futures. Kansas City HRW and MGEX spring wheat futures failed to follow suit, however, ending the session with moderate losses.

Wetter weather is on its way to large parts of the Corn Belt later this week, with some areas set to gather another 0.75” or more between Thursday and Sunday, per the latest 72-hour cumulative precipitation map from NOAA. Further out, the agency’s new 8-to-14-day outlook predicts a continuation of wetter-than-normal conditions for the central U.S. between April 19 and April 25, with seasonally warm weather also likely during this time.

On Wall St., the Dow moved 75 points in afternoon trading to 33,760 after the March consumer price index inched 0.1% higher, versus analyst expectations of 0.2%. There are still some concerns that the Fed will initiate additional interest rate hikes later this year, however. Energy futures trended higher, with crude oil up 2% to $83 per barrel this afternoon on tightening global stocks. Diesel rose 1.25% higher, with gasoline up around 0.25%. The U.S. Dollar softened moderately.

On Tuesday, commodity funds were net buyers of soybeans (+5,000), soymeal (+4,500) and soyoil (+1,500) contracts but were net sellers of corn (-2,000) and CBOT wheat (-4,000).

Corn

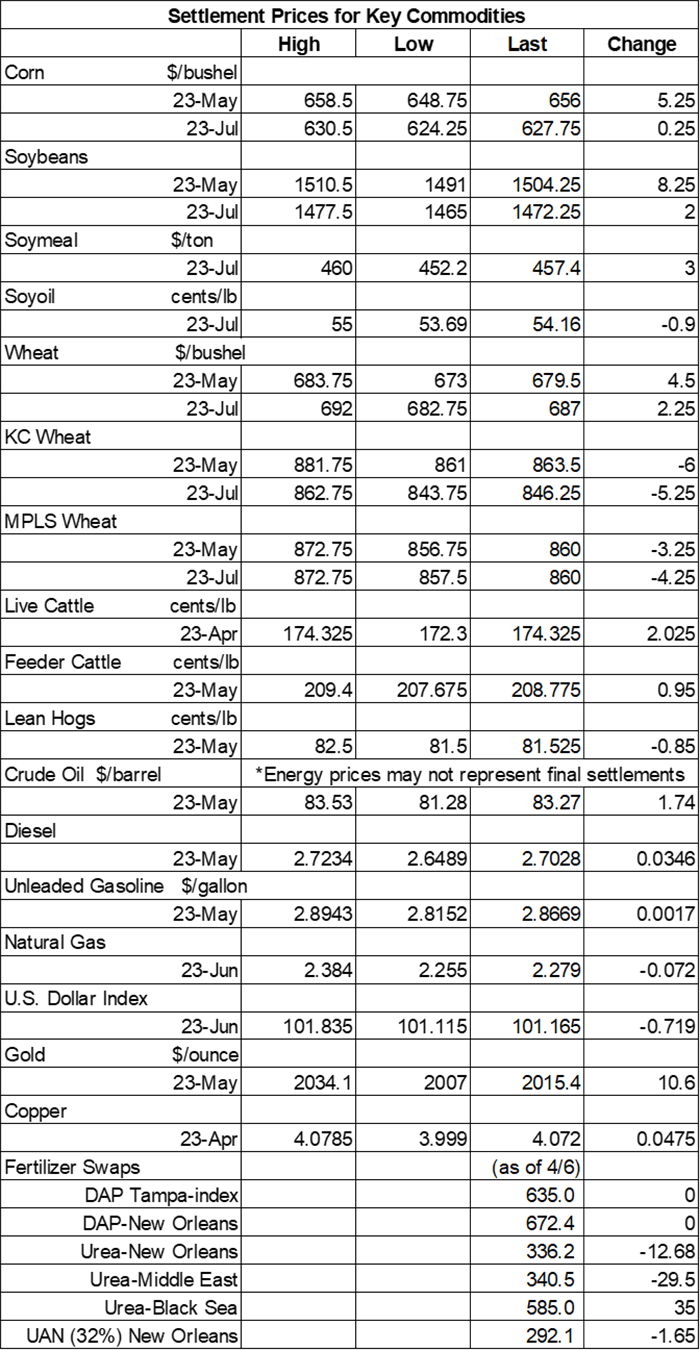

Corn prices tested mild to moderate gains after another round of technical buying on Wednesday. May futures added 5.25 cents to $6.5625, while July futures inched 0.25 cents higher to $6.28.

Corn basis bids were steady to mixed across the central U.S. after sliding 3 cents lower at an Iowa ethanol plant while firming 1 to 10 cents at two other Midwestern locations on Wednesday.

Ethanol production faded to a daily average of 959,000 barrels for the week ending April 7, per the latest data from the U.S. Energy Information Administration, out earlier today. That put production at the lowest level since early January. Stocks shifted fractionally lower last week.

Ahead of Thursday morning’s export report from USDA, analysts expect the agency to show corn sales ranging between 19.7 million and 68.9 million bushels for the week ending April 6. Sales will need to come in toward the higher end of these estimates to surpass the prior week’s tally of 50.1 million bushels.

Per the latest data from the European Commission, 2022/23 EU corn imports are still tracking substantially ahead of last year’s pace after reaching 855.9 million bushels through April 9.

Ukraine’s total grain exports during the 2022/23 marketing year are trending 13.5% below last year’s pace so far as the country continues to deal with the ongoing Russian invasion. That includes corn sales totaling 905.5 million bushels, plus an additional 496.0 million bushels of wheat sales. Ukraine is among the world’s top exporters of both commodities.

Taiwan purchased 2.6 million bushels of animal feed corn, likely sourced from Argentina, in an international tender that closed earlier today. The grain is for shipment between May 26 and June 14.

Preliminary volume estimates were for 310,962 contracts, falling moderately short of Tuesday’s final count of 385,656.

Soybeans

Soybean prices continued to push higher on Wednesday on a round of technical buying partly spurred by severely low production potential in Argentina. Traders will also continue to closely watch the upper Midwest and Northern Plains, which are still partially covered in snow. May futures added 8.25 cents to $15.0550, with July futures up 2 cents to $14.7325.

The rest of the soy complex was mixed. Soymeal futures firmed more than 0.5% today, while soyoil futures stumbled more than 1.5% lower.

Soybean basis bids were mostly steady across the central U.S. on Wednesday but did move a penny higher at an Ohio elevator today.

Ahead of tomorrow morning’s export report from USDA, analysts think the agency will show soybean sales ranging between 9.2 million and 29.4 million bushels for the week ending April 6, expressing confidence that last week’s total will best the prior week’s lackluster tally of 3.9 million bushels. Analysts also expect to see soymeal sales ranging between 100,000 and 375,000 metric tons last week, plus up to 35,000 MT of soyoil sales.

European Union soybean imports during the 2022/23 marketing year reached 348.0 million bushels through April 9. That’s a year-over-year decline of 12.8% so far. EU soymeal imports are also lower than year-ago totals after reaching 12.17 million metric tons.

Brazil needs infrastructure, and China needs commodities. Farm Futures executive editor Mike Wilson caught up with Rabobank global grains and oilseed strategist Stephen Nicholson to discuss China’s role in moving Brazilian infrastructure forward and much more – click here to learn more.

Due to increased demand from China and other Asian nations, Brazilian trade group Abiove has raised its 2022/23 soybean export forecast by another 51.4 million bushels for a new total of 3.443 billion bushels. Abiove also upped its estimates for Brazilian soymeal exports for the current marketing year, at 21 million metric tons.

Preliminary volume estimates were for 276,919 contracts, sliding slightly below Tuesday’s final count of 305,623.

Wheat

Wheat prices were mixed but mostly lower following some uneven technical maneuvering on Wednesday. May Chicago SRW futures firmed 4.5 cents to $6.7850, while May Kansas City HRW futures fell 6 cents to $8.6225 and May MGEX spring wheat futures dropped 3.25 cents to $8.59.

Prior to Thursday morning’s export report from USDA, analysts expect the agency to show wheat sales ranging between 2.8 million and 18.4 million bushels for the week ending April 6. Combined old and new crop sales only reached 7.5 million bushels in the prior week.

European Union soft wheat exports during the 2022/23 marketing year have reached 875.6 million bushels through April 9. That’s a 7.9% year-over-year increase so far. EU barley exports are running moderately below last year’s pace, meantime, with 216.8 million bushels over the same period.

Jordan issued an international tender to purchase 4.4 million bushels of milling wheat from optional origins that closes on April 18. The grain is for shipment in October and November.

South Korea purchased 2.2 million bushels of animal feed wheat from optional origins in an international tender that closed earlier today. The grain is for arrival in late September. Another South Korean buyer purchased 1.7 million bushels of milling wheat from the United States in an international tender that closed earlier today. That grain is for shipment in June.

Preliminary volume estimates were for 235,827 CBOT contracts, tracking moderately above Tuesday’s final count of 217,340.

About the Author(s)

You May Also Like