Analysis: China's import volume of DDGS to fall 50% in 2016

Increased domestic us in China to hurt U.S. DDGS import volumes.

November 18, 2016

Affected by the huge price decrease of corn and antidumping duties on imported dried distillers grains with solubles (DDGS) from the U.S., China's import volume of DDGS fell 71% in September from the year before. It is predicted that the import volume of DDGS in China will fall 50% in 2016 due to the increasing domestic DDGS supply in China, according to a new report from CCM.

The imported DDGS in China mainly comes from the U.S. According to China Customs, the import volume of DDGS was 272,200 metric tons in September 2016 in China, down 46% from last month and down 71% compared to September 2015.

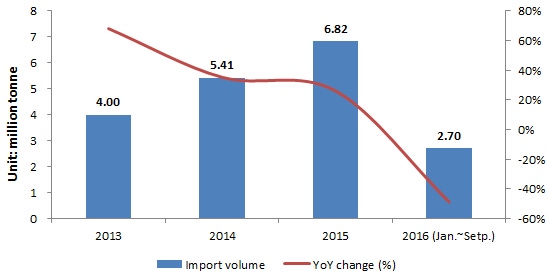

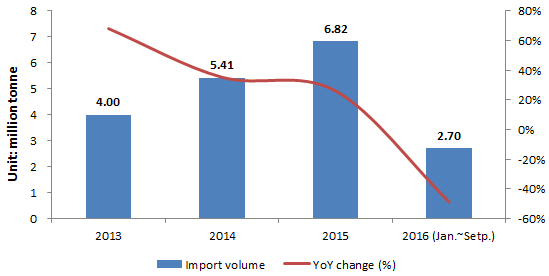

Source: China Customs

The accumulative import volume of DDGS was 2.7 million mt in China in January to September 2016 (Figure), down 48.74% on the year. Although the import volume of DDGS kept rising from 2012 to 2015 — growth rates have exceeded 25% in the past three years — the import volume declined sharply entering 2016.

“The decrease of DDGS import volume in China is mainly attributed to two reasons. One is the falling price of corn in China, and the other is antidumping (duties) on imported DDGS from the USA,” said Liang Jiawei, editor of Corn Product China News, CCM.

Lower corn prices lead to decreasing import volume

Because DDGS is one of substitutes for feed use corn, the changing price of corn affects the import volume of DDGS in China. As such, CCM said the increasing DDGS import volume in China in the past was greatly relevant to the expensive corn in China.

Entering the year 2016, the corn price slumped in China. According to CCM’s price monitoring, the average market price of corn fell 19.18% year over year.

After the rapid fall of corn price in China, CCM said the import volumes of its other substitutes fell, as well. Besides DDGS, wheat and sorghum both fell in their import volumes. According to China Customs, the accumulative import volume of wheat was 3,857,800 mt in January to September 2016, down 55.76%; as for sorghum, the accumulative import volume was 5,679,400 mt in January to September 2016, down 29.85% from the prior year.

Antidumping on imported DDGS from U.S.

Since the imported DDGS in China are mainly from the U.S., CCM noted that the historical low import volume of DDGS in September is also attributed to China's antidumping duties on DDGS from the U.S.

In fact, in January 2016, China’s Ministry of Commerce (MOC) began its antidumping investigation on DDGS imported from the U.S. After a nine-month investigation, MOC concluded that the U.S. was dumping DDGS in China.

Since Sept. 23, according to MOC, importers in China will pay a deposit at 10.0-10.7% to China Customs as a temporary antidumping measure.

Due to the cost increase for imported DDGS, many feed enterprises preferred DDGS produced in China after they adjusted on the formulations, which led to the decreased import volume of DDGS.

DDGS import volume to fall 50% in 2016

Although the import volume of DDGS keeps falling, the fourth quarter remains tough for DDGS import volume. CCM predicts that the import volume of DDGS in China will fall 50% in 2016.

As the peak season (winter) for alcohol consumption is approaching, the demand for alcohol encourages the production of alcohol factories and then increases the supply of DDGS in China.

In addition, the Chinese government began to provide subsidies for corn deep processing enterprises in Jilin province in November.

“More corn purchasing means more subsidies from the Chinese government. With more processing on corn, the supply of DDGS is expected to increase in China,” Liang said.

Moreover, with the falling temperature in winter, the aquaculture industry enters its slower season and has less demand for feed. DDGS, in some way, would be affected, CCM noted.

You May Also Like