Placements continue to fall likely due to a number of factors.

The U.S. Department of Agriculture's National Agricultural Statistics Service recently released the latest “Cattle on Feed” report, with results that were near pre-report analyst estimates.

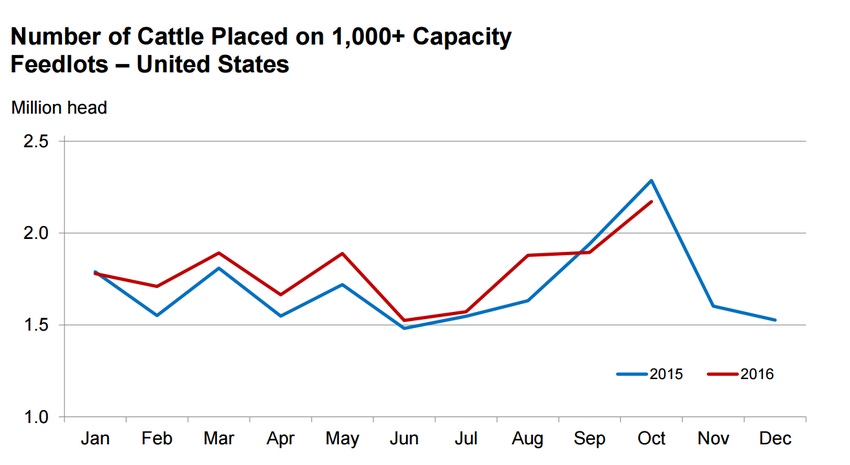

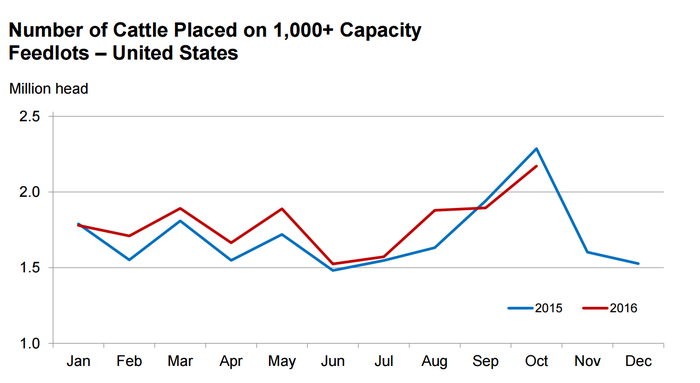

The report showed that feedlots continued a strong marketing pace in October with marketings up 4.6% year over year, despite one less business day in the month. October placements followed the September monthly decrease with another 5% reduction in placements year over year (Figure). The combination of large marketings and fewer placements left the Nov. 1, 2016 cattle on feed inventory down 1.3% from one year ago at 10.665 million head.

Source: USDA NASS

In the “Daily Livestock Report,” Steiner Consulting Group said a number of factors have limited placements so far this fall.

“Weather in key production areas has been quite mild and this has allowed producers to keep animals outside of feedlots, particularly given the extremely volatile markets and depressed fed cattle prices out front,” the report said.

Additionally, Steiner suggested that feedlots have also been struggling with poor margins, and this has limited demand for calves to be placed on feed in early fall.

Jim Robb of the Livestock Marketing Information Center also pointed out that part of the reason for the reduction in placements may be due to fewer dairy calves now going into feedlots as some packers have limited or stopped buying dairy bred animals.

Oklahoma State University Extension livestock marketing specialist Derrell Peel said despite the year-over-year decreases in placements in September and October, total feedlot placements are currently up 673,000 head from 2015, a 3.9% increase for the year to date. However, year-to-date feedlot marketings through October are up an impressive 5.2%, or some 855,000 head more than the same period last year. In fact, Peel said that in the last six months, the year-over-year increase in feedlot marketings has been more than double the increase in the number of cattle placed in feedlots compared to last year.

“The faster pace of cattle movement through feedlots has translated in more cattle slaughter and more beef production in 2016 than previously expected,” he said.

Year-to-date beef production is 5.3% higher than last year. Steer slaughter, in particular, has exceeded expectations this fall and is up nearly 7% year over year so far this year, though it is expected to moderate to smaller year-over-year increases for the remainder of the year, Peel noted.

“Additional steer slaughter, combined with year-over-year increases in heifer and cow slaughter have pushed total cattle slaughter up 5.6% so far this year. Increased slaughter is partially offset with lower carcass weights since May,” Peel said.

Weekly steer carcass weights have averaged 9 lb. less since May with heifer and cow carcass weights down about 2 lb. on a weekly average basis. Peel said carcass weights have been down from last year's record levels despite excellent feeding conditions this fall.

“Both steer and heifer carcass weights appear to have peaked seasonally the last week of October and should decline for the remainder of the year. The first winter storm, which covered the central and northern Plains last week, may help pull carcass weights down faster in November,” he said.

According to Peel, the decrease in feedlot placements in September and October likely means that some feeder cattle are being retained and will be pushed into next year.

“Certainly, there has been plenty of market incentive for cattle to be retained out in the country this fall. This may result is some additional increase in feeder supplies in 2017 on top of growing feeder supplies due to a bigger 2016 calf crop,” Peel said.

He said to remember, however, that growing domestic feeder supplies are being partially offset by a 29% year-over-year decrease in feeder cattle imports from Mexico and Canada so far this year, totaling 336,000 head fewer imports through September.

“These delayed fall feeder cattle are not expected to burden feeder markets excessively unless they get bunched up next spring," Peel said. "However, these retained feeders are being held in a wide variety of stocker and backgrounding programs across the country and will likely be spread out in weight and timing next spring.”

Peel noted that wheat pasture stocking has been slow this fall and additional stocker placements on wheat may continue after Jan. 1 as producers look to graze out more wheat acres unless wheat market prospects improve significantly.

Overall, Steiner Consulting suggested that smaller on feed supplies and relatively more current feedlot conditions should help support fed cattle values in the very short term.

“It is unclear that futures at this point have priced enough of a winter weather premium, especially for February," the firm said. "The main challenge for the beef market is post-holiday demand. Meat protein supplies are plentiful, and there will be fierce competition for the meat case in January and February. Summer futures are heavily discounted as the market expects placements to increase in (the first quarter of 2017).”

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)