Egg supply rebounding; more adverse economic conditions may weaken global beef demand.

Kansas State University agriculture economist Glynn Tonsor said given recent developments in multiple financial markets, it is useful to look at the broader situation underpinning the start of 2016 “outside” of the cattle markets in order to further assess possible upcoming changes within the cattle complex.

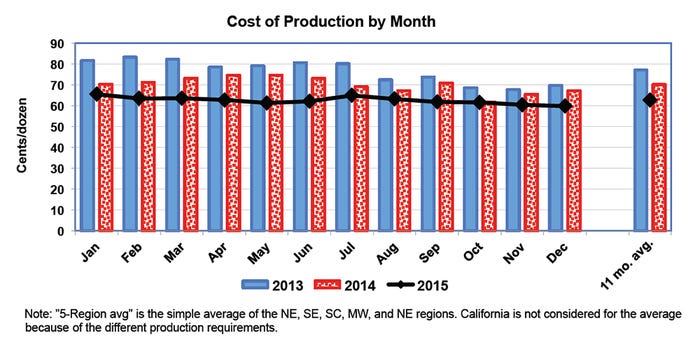

Source: Egg Industry Center

According to Tonsor, the Dow Jones Industrial average and broader Standard & Poor’s 500 index were both down 6% in the year’s first full week of trading, setting records for the worst start to a calendar year. Market pundits point to a host of candidate reasons for the stock market reductions, led principally by concerns about China’s economic growth and corresponding anxiety surrounding broader global growth in 2016, he said.

“What is critical for beef industry stakeholders to appreciate is how ongoing concerns around global economic growth impact prospects for beef demand,” he noted. “A simple yet critical concept to grasp is that more adverse economic conditions correspond to weaker global demand for beef.”

Taking a quick look at the sizeable drop in cattle futures prices last week, when little changed regarding supply fundamentals, clearly illustrates this point, Tonsor added.

Moreover, he said key reasons for reductions in cattle prices in 2015 were the strengthening U.S. dollar and adverse global economic growth developments that led to limited beef exports.

“While, of course, no individual producer can change the course of beef demand strength, everyone can do their due diligence in understanding key aspects of what demand is and what influences it,” Tonsor said.

An improved understanding, along with focused management of things one can control “in house” — such as critical production costs and product quality control — will position any decision-maker to make the most out of any situation, he noted.

“In fact, one can benefit by ‘making lemons out of lemonade’ only if you recognize the customer base for said lemonade. That is, being effective at producing something is only valuable if you have access to a properly identified customer who exists and is willingly and able to purchase your product. Likewise, in the beef cattle industry, if one does not fully appreciate demand, the prospects for prosperity are certainly restricted,” Tonsor said.

Egg supply rebounding

The American Egg Board (AEB) said the U.S. egg supply is rebounding well after the egg industry endured a tough six months brought on by an unprecedented outbreak of avian influenza.

“A number of factors are at play in the supply rebound, beyond affected farms repopulating: Egg imports, fewer exports and unaffected farms increasing production have all contributed to help with the supply gap,” AEB noted.

Furthermore, the Egg Industry Center in Ames, Iowa, reported that half of the layers lost in 2015 already have been replaced, and if the recovery continues at the current rate, flocks should be at or near 100% pre-outbreak levels by midyear 2016. With supply returning to more normal levels, prices are expected to come down in the first quarter, AEB said.

“As the supply of egg products continues to recover, there will be ample availability for use in the food industry, and barring any further incidents, we expect supply and pricing to regain their previous consistency,” AEB executive vice president John Howeth said.

Production costs decline

According to the Egg Industry Center’s January “Costs & Prices Report,” lower corn and soybean prices resulted in an 11.1% decrease in the cost of production for egg producers (Figure).

In December, corn prices were $8.06/bu., a 4.8% decrease from the previous year, and soybean meal prices were $149.81-per-ton lower than the prior December.

The changes equated to a $40.26-per-ton (16.5%) reduction in feed costs and 7.44 cents/doz. lower cost of production than the year prior.

Despite the lower feed costs, egg prices paid to producers also were 40.67 cents/doz. (27.7%) lower than in December 2014.

About the Author(s)

You May Also Like