Lower prices for livestock and crop receipts drive down 14.6% net cash farm income from the 2015 estimate.

Farm income was already projected lower in 2016, and the U.S. Department of Agriculture ratcheted their estimates even further lower in its latest forecast released Nov. 29.

Net cash farm income for 2016 is forecast at $90.1 billion, down 14.6% from the 2015 estimate.

Agriculture Secretary Tom Vilsack, said although the forecast is down, it shows the health of the overall farm economy is “strong in the face of challenging markets.” He added, “After reaching record highs in 2012-2014, net farm income declined in 2015 and is forecast to decline in 2016, but the bigger picture shows that farm income over the last five-year period reflects the highest average five-year period on record.”

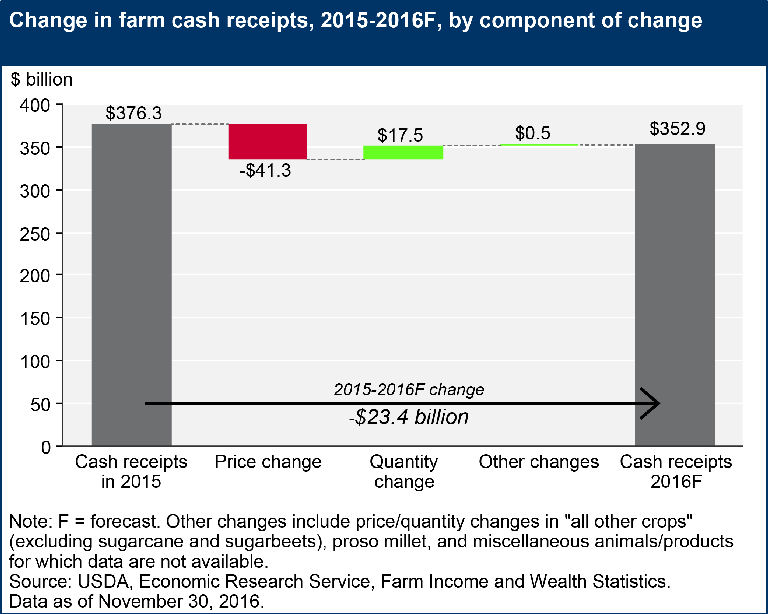

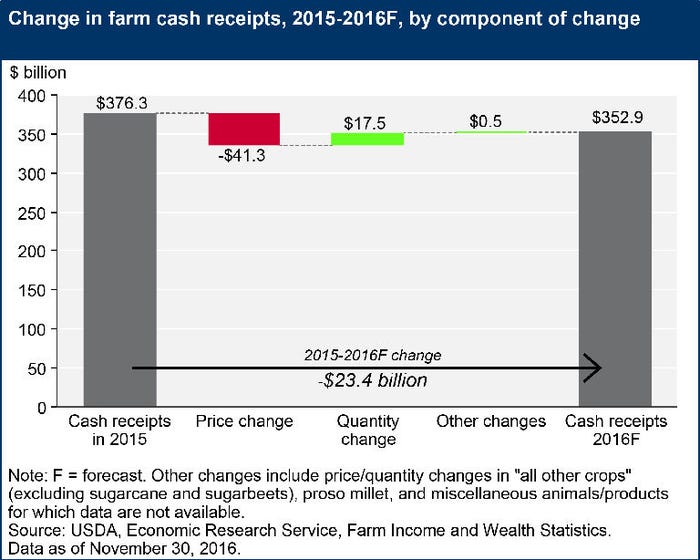

Cash receipts across all commodities are expected to fall $23.4 billion (6.2 percent) in 2016. This net impact can be decomposed into a separate 'price effect' that lowers receipts by $41.3 billion and a 'quantity effect' that raises receipts by $17.5 billion (plus a $0.5-billion increase in receipts for minor commodities whose prices could not be differentiated from overall receipts).

Net farm income, a more comprehensive measure of profitability, is forecast to be $66.9 billion in 2016, down 17.2% from the 2015 estimate, and $4.6 billion lower than what was previously forecast in August. Jim Williamson, who leads the farm income and wealth statistics team at USDA’s Economic Research Service (ERS) shared that the primary driver of those changes comes from the updated November WASDE (World Agricultural Supply and Demand Estimates) which called for increased supplies and lower prices. Although crop receipts were up $4.2 billion, it was not able to counter the decline in animal and animal product receipts.

Overall, cash receipts are forecast to fall $23.4 billion (6.2%) in 2016 due to a $23.4-billion (12.3%) drop in animal/animal product receipts; crop receipts are forecast essentially unchanged from 2015. Nearly all major animal specialties—including dairy, meat animals, and poultry/eggs—are forecast to have lower receipts, including a 14.8-percent drop ($11.6 billion) in cattle/calf receipts.

A marginal expected gain in crop cash receipts is driven largely by a $5.3-billion increase in oil crop receipts, primarily soybeans, while feed crops (mainly corn) and vegetables/melons are down $2.2 billion (3.8%) and $1.4 billion (6.9%), respectively. While overall cash receipts are expected to decline, receipts for several crop commodities are expected to increase by at least 10% above 2015 estimates, including cotton, up $0.9 billion (17.5%).

Likewise, while animal and animal product receipts are forecast overwhelmingly down in 2016, turkey (up $0.6 billion or 10.6%) and miscellaneous livestock (up $0.2 billion or 2.9%) receipts both grew. Direct government farm program payments are projected to rise $2.1 billion (19.1%) to $12.9 billion in 2016.

Williamson said the regional distribution of farming patterns has created a variable impact on net farm income depending on the regions. Because livestock net cash income is down across the board, those areas more heavily dependent on livestock and dairy production experienced greater pressure. The northern crescent region of the upper northeast saw 9.5% declines due to dairy prices, whereas the Heartland and Mississippi Portal saw benefits of higher soybean prices pull their net cash income up 4.1% and 11.8% respectively.

For the second year in a row, production expenses are down. Total production expenses are forecast down $9.2 billion (2.6%) compared to 2015, led by declines in farm-origin inputs (feed, livestock/poultry, and seed) as well as fuel/oils.

Williamson said although the debt-to-asset ratio, which helps determine the solvency of the sector and the ability to meet payments in the face of crisis, has picked up for the fourth straight year. ERS reported farm asset values are forecast to decline by 2.1% in 2016, and farm debt is forecast to increase by 5.2%.

“Farm sector equity, the net measure of assets and debt, is forecast down by $79.9 billion (3.1%) in 2016,” the report noted. “The decline in assets reflects a 0.5-percent drop in the value of farm real estate, as well as declines in animal/animal product inventories, financial assets, and machinery/vehicles. The rise in farm debt is driven by higher real estate debt (up 8.6%).”

Vilsack said as seen in the August forecast, “the estimates again show that debt to asset and debt to equity ratios -- two key indicators of the farm economy's health -- continue to be near all-time lows, and more than 90% of farm businesses are not highly leveraged.”

The median income of farm households increased steadily over 2010-14, reaching an estimated $81,637 in 2014. After dipping in 2015, median farm household income is forecast to remain essentially unchanged in 2016 at an expected $76,839.

In recent years, slightly more than half of farm households have lost money on their farming operations each year; most of these households earn positive off-farm income, ERS reported.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)