Afternoon report: Corn and soybean prices also firm in Thursday’s session.

An ammonia pipeline used to transport Russian ammonia was damaged in Ukraine, which prompted Kremlin officials to threaten “negative impact(s)” to a Black Sea deal that allows for safe passage of shipping vessels. The news spooked wheat prices higher on Thursday, with come contracts trending more than 2.5% higher. Corn and soybean prices also moved higher on the ensuing spillover strength, and as traders finished squaring positions ahead of Friday morning’s World Agricultural Supply and Demand Estimates (WASDE) report from USDA.

Wetter conditions are on their way to a large swath of the central U.S. between Friday and Monday, with many areas likely to see another 0.75” or more during this time, per the latest 72-hour cumulative precipitation map from NOAA. Further out, the agency’s new 8-to-14-day outlook predicts near-normal precipitation levels for most of the Corn Belt between June 15 and June 21, with above-normal temperatures likely for the Midwest and Plains during that span.

On Wall St., the Dow improved another 170 points in afternoon trading to reach 33,835 as investors await a new round of inflation data and the next Federal Reserve meeting, which both happen next week. Energy prices shifted lower, meantime, with crude oil down 1.75% this afternoon to $71 per barrel on a potential deal between the United States and Iran that would open up the possibility of oil imports. Diesel faded 0.5% lower, with gasoline down more than 1%. The U.S. Dollar softened moderately.

On Wednesday, commodity funds were net buyers of soybeans (+2,000) and soymeal (+4,000) contracts but were net sellers of corn (-7,500), soyoil (-2,500) and CBOT wheat (-6,000).

Corn

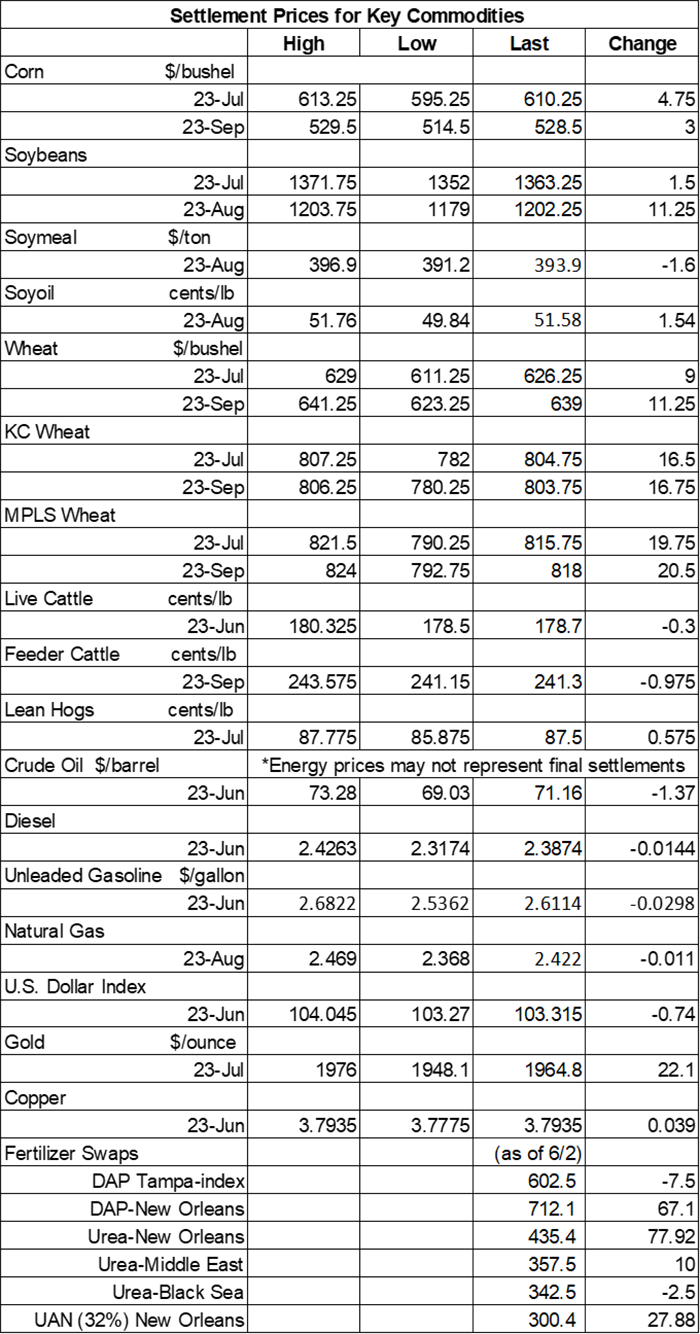

Corn prices benefited from a round of technical buying partly spurred by spillover strength from wheat. July futures added 4.75 cents to $6.09, with September futures up 3 cents to $5.28.

Corn basis bids were mixed after firming 8 cents at an Illinois river terminal while fading 3 to 8 cents lower at three other Midwestern locations on Thursday.

Corn found 6.8 million bushels in old crop sales in the week through June 1, which were partly erased by new crop reductions of 4.2 million bushels, leaving last week’s total tally at just 2.6 million bushels. That was on the very low end of trade estimates, which ranged between zero and 39.4 million bushels. Cumulative totals for the 2022/23 marketing year are still running more than 600 million bushels below last year’s pace so far, with 1.251 billion bushels.

Corn export shipments were much more robust, easing 4% below the prior four-week average to 49.0 million bushels. China, Mexico, Japan, South Korea and Honduras were the top five destinations.

NOAA’s Climate Prediction Center issued its latest monthly advisory today and reports that El Niño conditions are now present and should gradually strengthen heading into this winter. This phenomenon has some negative implications in the Southern Hemisphere – in particular, Australia’s winter crop production could erode 34% from recent record highs. ENSO cycles also occasionally impact grain marketing – click here for a deep dive we took on the subject a few years back.

From Ohio to Minnesota to Kansas – just to name a few states – growers have been sharing their tales of overly dry conditions. Farm Futures grain market analyst Jacqueline Holland gathers these anecdotes together in Feedback From The Field, which is regularly updated throughout the season. Want to know what your fellow farmers have been talking about lately? Click here to get started.

Multiple South Korean importers purchased a total of 7.8 million bushels of animal feed corn from optional origins in two private deals that closed earlier today. The grain is for arrival between September and November.

Preliminary volume estimates were for 399,686 contracts, which was moderately above Wednesday’s final count of 355,666.

Soybeans

Soybean prices followed other grains higher on a round of technical buying on Thursday as traders await the next round of USDA supply and demand data tomorrow morning. July futures picked up 1.5 cents to $13.6225, while August futures rose 10.75 cents to $12.78.

The rest of the soy complex was mixed today. Soymeal prices incurred moderate losses, while soyoil futures jumped more than 3% higher.

Soybean basis bids were steady to soft after tumbling 20 cents lower at an Iowa river terminal and dropping 4 cents at an Ohio elevator on Thursday.

Soybean exports found combined old and new crop sales of 17.3 million bushels last week. Old crop sales trended 68% higher week-over-week. Total sales were toward the higher end of trade estimates, which ranged between net reductions of 1.8 million bushels and net sales of 25.7 million bushels. Cumulative sales for the 2022/23 marketing year are slightly below last year’s pace, with 1.778 billion bushels.

Soybean export shipments were up 7% from a week ago but 7% below the prior four-week average, with 9.1 million bushels. Germany, Mexico, Japan, Egypt and South Korea were the top five destinations.

Preliminary volume estimates were for 317,884 contracts, shifting moderately above Wednesday’s final count of 274,240.

Wheat

Wheat prices found variable gains on Thursday, with most contracts rising between 1.5% and 2.5% as rising tensions in the Black Sea region kicked off an ample round of technical buying today. Nearly all contracts closed the session with double-digit gains. September Chicago SRW futures gained 11.25 cents to $6.39, September Kansas City HRW futures rose 16.75 cents to $8.0275, and September MGEX spring wheat futures climbed 20.5 cents to $8.17.

Wheat exports kicked off the 2023/24 marketing year with sales totaling 8.6 million bushels, plus another 32.2 million bushels that were carried over from the 2022/23 marketing year, which ended May 31. That leaves total 2022/23 exports at 652.5 million bushels, which was 5% below the prior year’s tally.

Wheat export shipments were at 7.0 million bushels. The Philippines, Mexico, Venezuela, Sri Lanka and Honduras were the top five destinations.

Egypt, one of the world’s top importers, may not reach its local wheat procurement goal of 147 million bushels this season, according to government officials. Procurements have reached 115.7 million bushels through June 7, which is down 12% year-over-year so far.

As expected, Japan purchased 3.2 million bushels of food-quality wheat from Canada and Australia in a regular tender that closed earlier today. Nearly two-thirds of the total was sourced from Canada, with the remainder coming from Australia. The grain is for shipment beginning in August.

Tunisia issued an international tender to purchase 3.7 million bushels of soft milling wheat from optional origins that closes on Friday. The grain is for shipment between July 1 and August 15.

Preliminary volume estimates were for 191,919 CBOT contracts, firming 20% above Wednesday’s final count of 159,309.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)