Ag Economy Barometer reveals farmers not optimistic China trade war will be resolved by July 1.

May 7, 2019

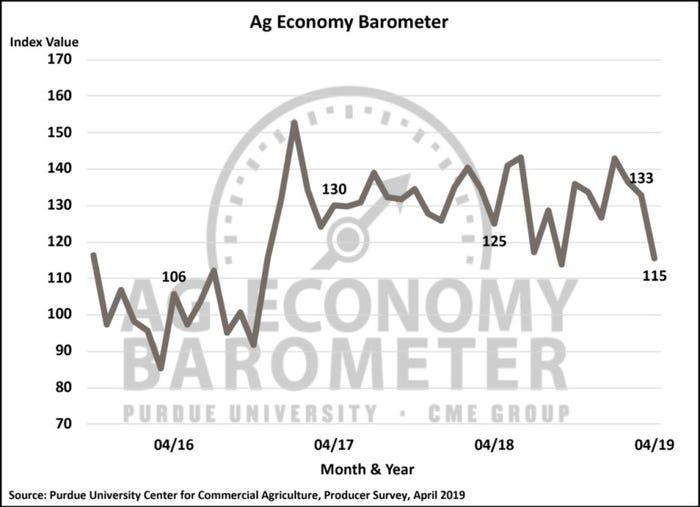

Worsening perceptions of both current economic conditions and weaker expectations for the future caused agricultural producer sentiment to plummet, according to the latest Purdue University/CME Group Ag Economy Barometer released May 7. The barometer plunged 18 points to 115, down from 133 in March.

The barometer, a sentiment index, is based on a monthly survey of 400 agricultural producers across the U.S. This marks the fourth-largest one-month drop since data collection began in October 2015.

“Farmers are becoming increasingly anxious over their future financial performance,” said James Mintert, the barometer’s principal investigator and director of the Purdue University Center for Commercial Agriculture. “Producers have taken stock of their financial position and prospects for 2019 as they head into planting season and are concerned about the uncertainty arising from the ongoing trade disputes with key ag trading partners. Right now, it seems that producers are being cautious.”

That caution is seen in producers’ attitudes toward making large investments in their farming operation. In the April survey, when asked whether they feel that now is a “good time” or “bad time” to make large farm investments, only 22% of farmers stated that it was a good time to invest, while 74% said it was a bad time. That combination pushed the Large Farm Investment Index down nine points compared to March.

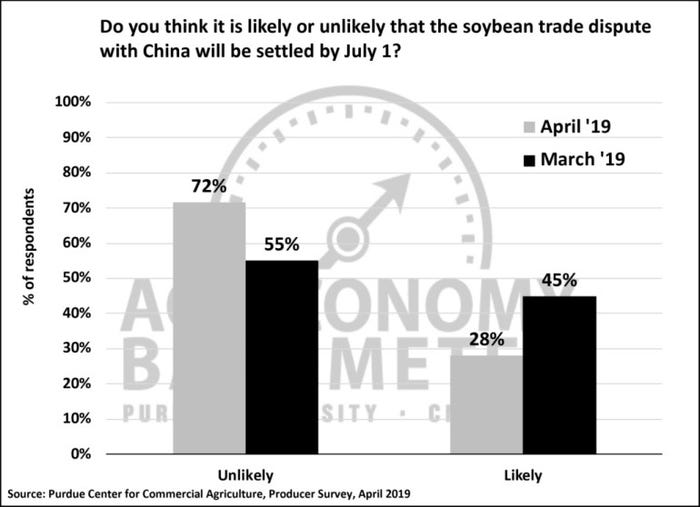

Producers also expressed less optimism regarding prospects for resolution of the ongoing soybean trade dispute with China. On the April survey, only 28% of respondents feel that the dispute will be resolved before July 1, down from 45% in March. However, 71% still feel the dispute will ultimately be resolved in a way that benefits U.S. agriculture. In a separate question, when asked whether they believe that the U.S. should rejoin the Trans-Pacific Partnership, 47% answered favorably, 28% were not in favor of such a move and 25% were uncertain.

Farmers’ expectations for farmland prices in the upcoming 12 months also weakened in April as the percentage expecting higher values fell to 13% from 14% in March, while the percentage expecting lower values increased to 28% from 25%. Although the one-month change in the perspective on farmland values was more modest than the decline in the investment index, it still stands in sharp contrast to the perception producers had of farmland values a year earlier. In April 2018, 18% of producers expected higher farmland values, while 64% expected values to remain about the same and 18% expected values to decline -- a notably more optimistic outlook than recorded in April 2019.

To gauge producers’ expectations for 2019, the survey asked whether respondents expect their farms’ 2019 financial performance to be better than, worse than or about the same as in 2018. More than half (56%) of farmers in the April survey said they expect their farms’ financial performance to be about the same as last year. However, 27% said they expect this year’s financial performance to be worse than last year. In comparison, when the same question was included in the April 2018 survey, just 19% of respondents expected worse financial performance for their farm than in the prior year.

Since January, more survey respondents have been indicating that they have concerns about commodity prices. As a result, Purdue researchers asked additional questions related to commodity prices in order to understand producer perspectives on the future direction of corn and soybean futures prices. For the past four months, those results have been compared with futures and options market-based probability estimates to determine whether there is a significant difference in sentiment between producers and futures and options market participants. Early findings indicate that producers have consistently had a more negative outlook compared to those who participate directly in the futures and options markets.

For example, in January, 32% of respondents expected December corn futures prices to fall below the 25% probability level, but by April, 42% of respondents expected prices to fall below the 25% probability level. Producer expectations for soybean prices at the start of this year were already substantially more pessimistic than market-derived expectations. In January, 43% of producers said they expected soybean prices to fall below the 25% probability level, and this increased to 48% in April -- substantially more negative than the perspective of futures and options market participants.

Moreover, producers became relatively less optimistic over the course of the winter and early spring. This increasingly pessimistic view of corn and soybean prices may be playing a role in the reduced sentiment shown in the barometer as well as the recent drop in both the Index of Current Conditions and the Index of Future Expectations.

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)