Afternoon report: Plus – Wall Street had a major rally today. Here’s what it means.

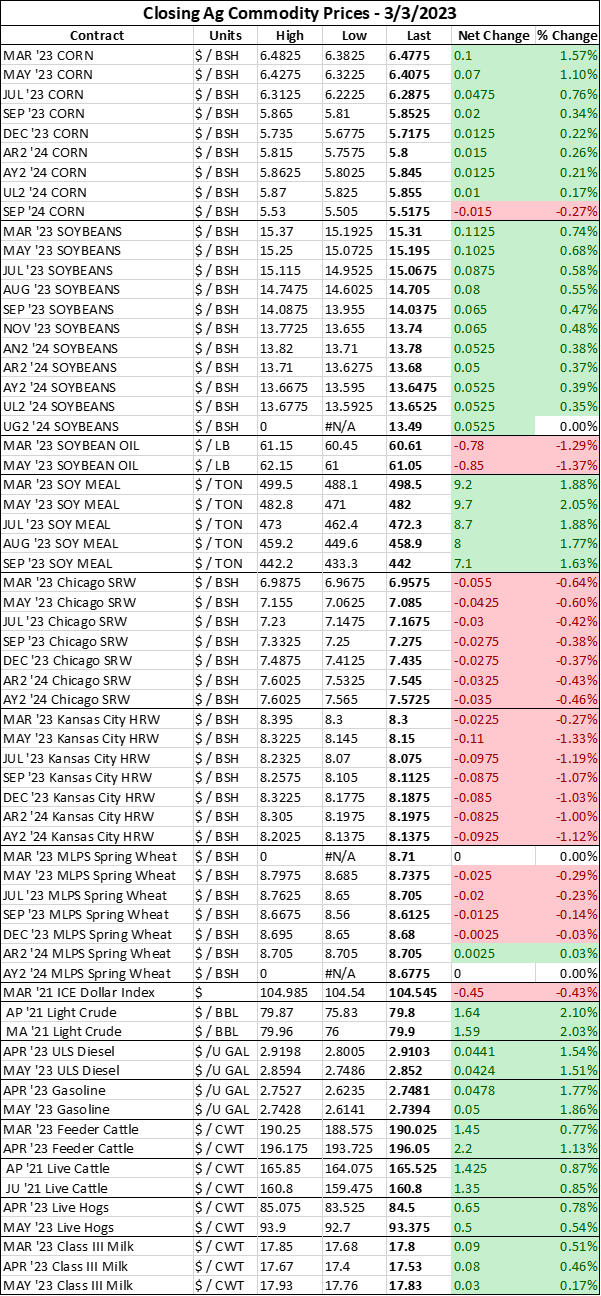

Corn: Corn prices edged $0.01-$0.07/bushel higher today on a fresh round of technical buying. After posting losses in six of the last seven trading days, many traders believed the corn market to be oversold.

The technical bounce also fueled optimism that international buyers may return to U.S. shores, especially as concerns mount about timing issues for Brazil’s second corn crop and drought stress for Argentina’s corn crop.

That’s a good sign, because this is the time of year we typically expect to see U.S. corn exports start to ramp up. Early season order volumes were lackluster, so any fresh news of export purchases will be met favorably by corn bulls.

Soybeans: The soymeal market staged another rally today, with nearby March23 futures prices up $9.20/ton to settle at $498.50/ton. A surge in domestic demand, as evidenced by rising cash prices, also contributed to the bullish soymeal party today.

Slow soy crushing speeds amid more crop shortfall worries in top global soymeal and soyoil exporter Argentina are driving these higher prices, which pushed soybean futures higher for the third day in a row. "Behind the support in the market is the simple fact that this is horrible finishing weather for the soybeans in Argentina," Charlie Sernatinger of Marex Capital said in a note to clients, as reported by Reuters.

Markets are bracing for USDA to make more cuts to Argentine soybean production in next week’s WASDE reports. "Most people believe that the WASDE report is going to show a huge cut in the Argentinian soybean crop," Mark Gold, managing partner at Top Third Ag Marketing, echoed in a Reuters report.

I keep waiting for the soyoil market to respond to palm oil production issues in Malaysia and export restrictions expected in Indonesia. Both countries are the largest producers and exporters of palm oil, which is the largest-produced edible oil product in the world.

However, based on today’s losses in the soyoil market, I suspect that lackluster renewable diesel production targets laid out by the EPA are driving this bearish market activity. The EPA uses estimates based on USDA’s Baseline Projections, which are not the most reliable estimates to be using for RVO targets.

I’ve harped on this at length before, so I won’t stay on my soapbox for long. The Baseline Projections are used for federal budgetary purposes and don’t always reflect certain market dynamics – like unexpected shocks, atypical weather events, or expanding plant capacity. They aren’t a reliable estimate to forecast renewable diesel production coming online in the next couple years, which is likely higher than what USDA currently has outlined for soy crush production.

But the market is running with the Baseline Projections, which are lower than the expansion announcements have suggested. That’s why soyoil markets have been so bearish lately while soymeal futures are surging.

Wheat: Despite this morning’s gains, U.S. wheat prices closed today’s trading session down $0.02-$0.11/bushel. Demand concerns plagued the wheat complex today as rapid Russian shipping paces cotniue to keep a lid on international wheat prices.

Kansas City wheat took the biggest price hit today as the short-term and extended forecasts are all calling for higher chances of precipitation in some of the most drought-stressed regions of the Plains over the next couple weeks, which could be highly beneficial for hard red winter wheat crop development in the region.

Losses were limited by a heat wave currently tearing through India. India could face another year of wheat production shortfalls that will keep it from participating in the global wheat trade as a heatwave blisters ripening crops in key production regions in Northern and Central India.

India banked on several consecutive years of bumper wheat crops to become an exporting lifeline following Russia’s invasion into Ukraine last year. Last year’s crop experienced similarly hot and dry conditions, forcing India to reinforce its ban on wheat exports.

Amid tight global supplies due in large part to the ongoing Russian-Ukrainian war, markets had hoped that India would return to the export market this spring and help reduce some of the strain on global wheat supplies. But the chances of that happening are drying up with India’s soil conditions.

February was unusually hot and dry for Indian wheat crop development and temperatures for early March continue to trend in a scorching fashion with no sign of rain on the horizon. Crops have already been showing signs of stress as key reproductive stages begin – in some cases too far ahead of schedule due to the heat stress already endured.

"Higher temperatures in March can trim output by 4 to 5 million tonnes. We are estimating production of around 106 to 107 million tonnes," Pramod Kumar S., president of the Roller Flour Millers' Federation of India (RFMFI), told Reuters. However, many traders are anticipating even bigger losses as the March forecast continues to fuel the flames of this latest drought.

Crop shortfalls in India this year mean that domestic supplies will drop to the lowest level in six years. India has also struggled with domestic food price inflation, so this news also raises the chances of political unrest in the world’s second largest country by population.

"The government will do everything to ensure food security and to keep prices under control. It can even allow imports if needed," Kumar told Reuters.

Weather: More moisture is expected to fall on the Central Plains today as a winter storm system from the Central Rockies pushes east. Accumulation will likely be light.

Meanwhile, heavy showers and thunderstorms will blanket a large portion of the Heartland today, stretching from the Southern Plains to New England. Areas of Illinois, Indiana, and Ohio could see a staggering volume of rain over the next 24 hours – up to four inches of accumulation along the Ohio River Valley.

The system will dissipate overnight, paving the way for mostly clear skies across the Heartland tomorrow. Sunday will bring a chance of snow showers in the Northern Plains that could creep into the Upper Midwest by early Monday morning.

NOAA’s 6 to 10-day outlook is trending cooler than usual for the entire country through late next week, with the highest chances of cold temperatures settling over the Central Plains. Chances for precipitation late next week are trending lower, but still above normal volumes with the highest probability of showers forecast in the Central Plains.

In terms of temperature, the 8 to 14-day outlook is showing below average coldness will continue to cover the entire country through next weekend, though the front will shift in the Southeast. Chances for precipitation during the second full week of March are trending below average for the Upper Midwest and Eastern Corn Belt and above average for the West, with the highest chances spanning across the western edge of the Southern Plains.

Financials: The S&P 500 broke past the $4,000 benchmark during today’s trading session, rising a robust 1.53% to $4,043.52 following a U.S. services sector report that saw the domestic consumer spending on service economy products rise to the highest level since last summer.

“We’re trying to draw a signal from each data release about whether that means that we’re close to the peak in inflation and interest rates,” Sebastian Mackay, a multi-asset fund manager at Invesco, told the Wall Street Journal.

In fact, the U.S. service sector has grown in 32 of the last 33 months (last December was the lone exception over the past few years). Today’s report suggests the economy is more resilient than central bankers had forecasted, indicating that top finance ministers may have a more challenging task of fighting inflation via interest rate increases in the months to come.

Manufacturing data also improved in February, suggesting that the strong global growth could be fanning more inflationary pressures. Stocks surged on the report’s sentiment about strong gains in the service sector, but today’s Wall Street gains are likely capped by continued interest rate hikes from the Fed.

“If we see another strong services print today, that will certainly dictate the case for higher-for-longer policy rates in the U.S.” Laura Cooper, a macro strategist at BlackRock, echoed Mackay ahead of the data release. “We have seen bond markets start to price that in more meaningfully. There is still this upside risk that we could see even more pressure on yields.”

Here’s what else I’m reading this morning on FarmFutures.com:

Bryce Knorr explains the impacts a recession would have on farming over the next couple years.

Naomi Blohm reminds growers that U.S. grain stocks are still tight and only Mother Nature can fix it.

Advance Trading’s Josh Green weighs the chances of the market heading towards sub-$4/bushel corn prices.

Senior editor Ben Potter has five helpful tips on how to make the most out of your on-farm meetings.

Here’s a look at the numbers – USDA’s 2023 acreage, production, and usage estimates as released at last week’s USDA Agricultural Outlook Forum.

USDA’s chief economist told farmers and market players alike last week that 2023 will likely bring bigger crops and lower prices to the Heartland amid global pressures, but that net farm incomes will still be strong throughout the year.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)