Afternoon report: Corn prices fail to follow suit after facing small cuts.

Grain prices were mixed but mostly higher as traders continued to square positions ahead of Friday’s hotly anticipated Prospective Plantings report. Tight domestic and global stocks kept soybean prices on the rise, closing with gains of more than 1.5%. Wheat also found variable gains on Tuesday that ranged between 0.2% and 1.3%. Corn failed to follow suit despite another flash sale to China announced this morning, closing with losses of around 0.25%.

More wet weather is on its way to the central U.S. between Wednesday and Saturday, per the latest 72-hour cumulative precipitation map from NOAA. An area stretching from southern Minnesota through central Michigan is likely to gather the largest levels during this time. Seasonally wet weather will be probable across nearly all of the Corn Belt between April 4 and April 10, per NOAA’s new 8-to-14-day outlook, which also shows warmer-than-normal conditions for the Mid-South, Southeast and Ohio River Valley.

On Wall St., the Dow faded 123 points lower to 32,309 as rising bond yields applied downward pressure. Energy futures were mixed. Crude oil firmed 0.5% this afternoon to $73 per barrel

On Monday, commodity funds were net buyers of all major grain contracts, including corn (+4,000), soybeans (+7,500), soymeal (+500), soyoil (+4,500) and CBOT wheat (+5,500) contracts.

Corn

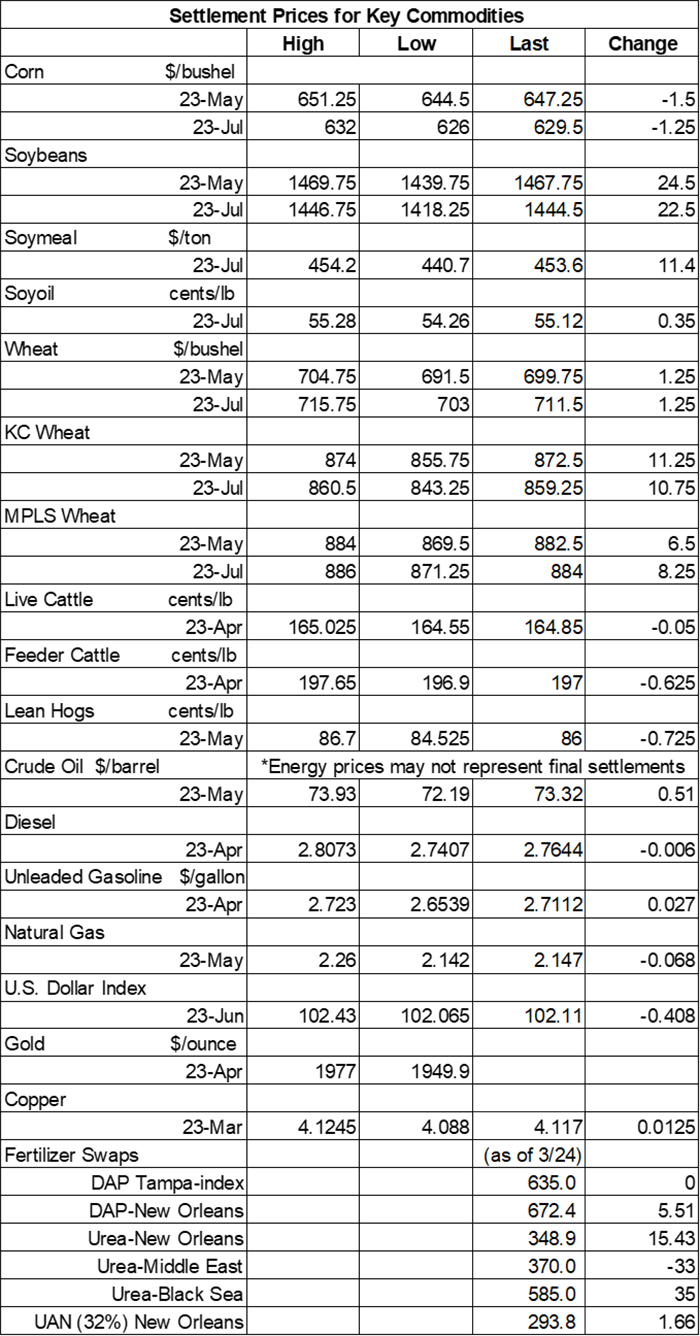

Corn prices edged slightly lower as traders shrugged off a flash sale to China announced this morning, engaging instead in some net technical selling following a choppy session. May futures eased 1.5 cents to $6.4675, with July futures down 1.25 cents to $6.2850.

Corn basis bids held steady across the central U.S. on Tuesday.

Private exporters announced to USDA the sale of 5.4 million bushels of corn for delivery to China during the 2022/23 marketing year, which began September 1.

Prior to Friday’s Prospective Plantings report from USDA, a group of more than 20 analysts (including Farm Futures) indicated that U.S. farmers could plant around 90.880 million acres of corn in 2023. Individual estimates ranged between 87.677 million and 92.050 million acres.

Brazil’s Anec now expects the country’s corn exports will reach 32.9 million bushels in March, which is modestly below its prior projection from a week ago. Anec additionally expects Brazil to export around 21.7 million bushels of wheat this month. Meantime, the Rural Clima consultancy reported that Brazil’s second corn crop should see “regular rainfall” in April, which would be a positive for the country’s production potential. Brazil’s second crop accounts for roughly three-fourths of its total corn production.

Per the latest data from the European Commission, out earlier today, EU corn imports during the 2022/23 marketing year have jumped 69% above last year’s pace so far, with 802.3 million bushels through March 26. Ukraine, the United Kingdom, Canada, Russia and Moldova were the top five suppliers.

South Africa’s Crop Estimates Committee is expecting the country’s 2023 corn production to gather a year-over-year increase of around 2.6%, with a new projection of 625.1 million bushels. South Africa is the continent’s top corn producer.

Preliminary volume estimates were for 270,663 contracts, shifting slightly below Monday’s final count of 295,711.

Soybeans

Soybean prices trended steady higher through Tuesday’s session on the way to gains of more than 1.5%. Stocks remain historically low, although Brazil’s harvest is making large replenishments to global supplies. Traders eagerly await USDA’s new acreage estimates when they arrive Friday morning. May futures rose 24.5 cents to $14.6675, with July futures up 22.5 cents to $14.4325.

The rest of the soy complex continued to push higher as well. Soymeal futures climbed more than 2.5%, while soyoil futures tracked nearly 0.75% higher today.

Soybean basis bids were mostly steady across the central U.S. on Tuesday but did tilt 9 cents lower at an Ohio elevator and 5 cents higher at an Illinois river terminal today.

Ahead of USDA’s Prospective Plantings report, out Friday morning, analysts are expecting to see soybean planting estimates at 88.242 million acres. Individual estimates ranged between 87.350 and 89.620 million acres. It would also be moderately above 2022 totals of 87.450 million acres, if realized.

European Union soybean imports during the 2022/23 marketing year have reached 319.3 million bushels through March 26, which is moderately below last year’s pace so far. EU soymeal imports are also down year-over-year, with 11.54 million metric tons over the same period.

Brazil’s Anec estimates that the country’s soybean exports will reach 558.4 million bushels in March, which is slightly below the group’s prior projection from a week ago. Anec also expects Brazilian soymeal exports to reach 1.757 million metric tons this month.

Preliminary volume estimates were for 220,027 contracts, moving moderately above Monday’s final count of 177,917.

Wheat

Wheat prices followed other grains higher on Tuesday, capturing variable gains by the close. May Chicago SRW futures picked up 1.25 cents to $6.9925, May Kansas City HRW futures rose 11.25 cents to $8.7150, and May Kansas City HRW futures added 6.5 cents to $8.80.

Prior to Friday’s Prospective Plantings report from USDA, analysts expect to see winter wheat acreage estimates come in at 36.256 million acres. That would be roughly 3 million acres more than 2022 totals, if realized. Individual trade guesses ranged between 34.300 million and 37.000 million acres. Also considering spring wheat and durum acres, analysts estimate all-wheat plantings will reach 48.852 million acres this season.

European Union soft wheat exports during the 2022/23 marketing year are up 8% from a year ago, with 832.6 million bushels through March 26. Morocco, Algeria, Nigeria, Egypt and Saudi Arabia were the top five destinations.

China plans to auction off another 33.1 million bushels of its state reserves of imported wheat on April 4. The country has held a series of wheat auctions over the past several months in its ongoing attempt to boost local supplies and suppress high prices.

Turkey purchased 25.5 million bushels of milling wheat from optional origins in an international tender that closed earlier today. Shipment is sought in multiple consignments between May 18 and July 10.

Jordan purchased 2.2 million bushels of hard milling wheat from optional origins in an international tender that closed earlier today. The grain is for shipment during the first half of September.

There are more farmers than ever who are now buying products and services on the internet. Farm broadcaster Max Armstrong reviews insights from a recent study by McKinsey & Co. in today’s edition of Farm Progress America – click here to listen.

Preliminary volume estimates were for 84,703 CBOT contracts, trending 13% below Monday’s final count of 97,241.

About the Author(s)

You May Also Like