Afternoon report: Prices climb nearly 1.5% higher on Tuesday; corn also firm.

Grain prices were mixed but mostly firm, anchored by big gains in soybeans following more dry forecasts for the already embattled crop in Argentina. Corn, soymeal and soyoil contracts also improved on Tuesday. Wheat suffered a technical setback, incurring losses that ranged between 0.2% and 1.9%.

Plenty more rain and/or snow is on its way to the central U.S. later this week. A band stretching from South Dakota through Michigan is likely to gather the greatest amounts between Wednesday and Saturday, per the latest 72-hour cumulative precipitation map from NOAA. In fact, Winter Storm Olive will delivery heavy snow, blizzard conditions, ice and other hazards to significant portions of the Plains, upper Midwest and Great Lakes region, according to analysis from the Weather Channel.

On Wall St., the Dow tumbled 674 points lower in afternoon trading to 33,152 on continued high inflation rates along with an inverted yield curve (historically the No. 1 signal that a recession is on its way). Energy futures were mixed but mostly higher. Crude oil eased 0.25% lower to $76 per barrel, while diesel jumped more than 3% higher and gasoline firmed 0.75%. The U.S. Dollar firmed moderately.

Last Friday, commodity funds were net buyers of corn (+1,000), soybeans (+500) and CBOT wheat (+500) contracts but were net sellers of soymeal (-500) and soyoil (-1,500).

Corn

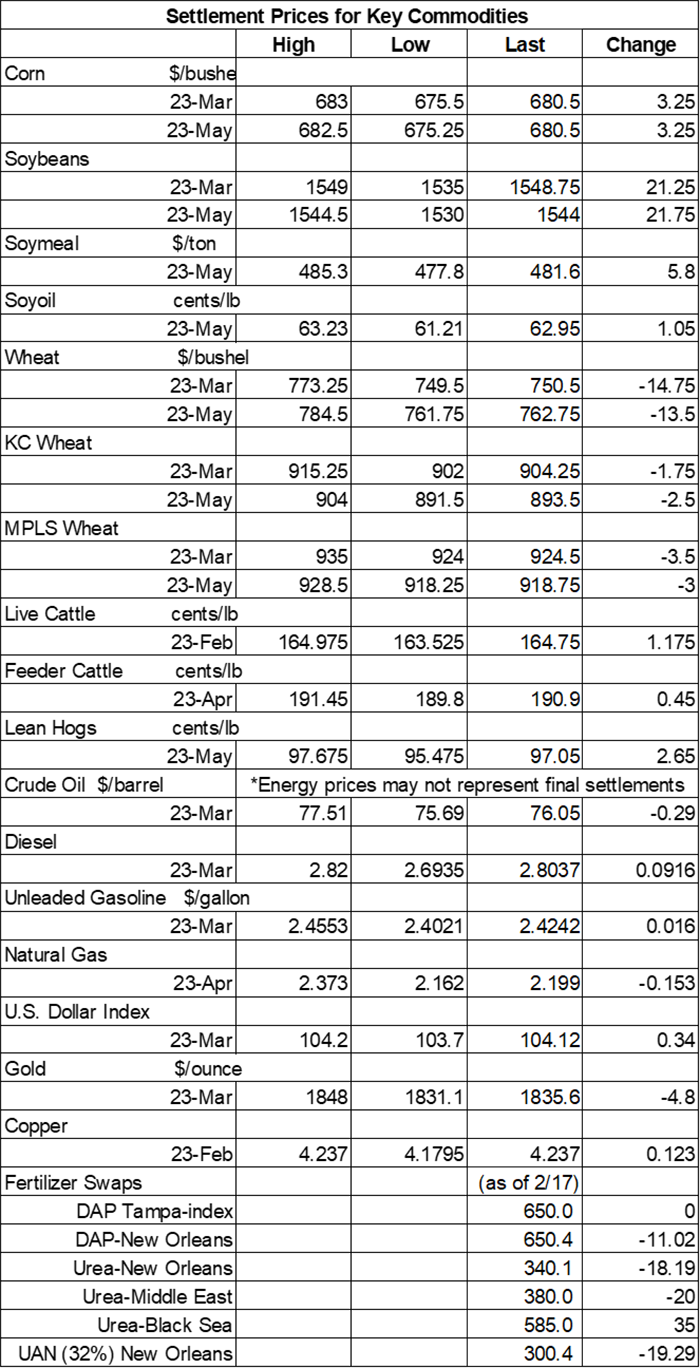

Corn prices made moderate inroads after spillover support from soybeans triggered some technical buying on Tuesday. March futures added 3.25 cents to $6.81, with May futures up 2.75 cents to $6.8025.

Corn basis bids were mostly steady to weak after trending 5 cents lower across three Midwestern locations on Tuesday. An Iowa processor bucked the overall trend after tracking 3 cents higher today.

Corn export inspections improved 10.5% week-over-week to reach 24.5 million bushels. That was near the middle of analyst estimates, which ranged between 19.7 million and 29.5 million bushels. Cumulative totals for the 2022/23 marketing year are tracking around two-thirds of last year’s pace so far, with 540.7 million bushels since the beginning of September.

Mexico was the No. 1 destination for U.S. corn export inspections last week, with 9.4 million bushels. Japan, Taiwan, Guatemala and Costa Rica rounded out the top five.

China has plans to conduct a large-scale trial of GMO corn and will likely plant around 660,000 acres this season as the country hopes to become less reliant on foreign grain imports. Currently, China’s corn yields are only at around 60% of U.S. yields. The country recently released a rural policy blueprint that stresses the importance of national food security and its intention to “anchor the goal of building a powerful agricultural country.”

Algeria issued an international tender to purchase up to 1.6 million bushels of corn, likely sourced from Argentina, that closes on Wednesday. The grain is for shipment in early April.

Two South Korean feedmill groups purchased a total of 5.3 million bushels of animal feed corn from optional origins in private deals that recently. At least some of the total is expected to be sourced from the United States or South America. The grain is for arrival in early June.

What is confirmation bias, and why is it important to learn about it as part of your grain marketing strategy? Ryan Fogel, ag risk advisor with Advance Trading, explores the situation in detail in today’s Ag Marketing IQ blog – click here to learn more.

Preliminary volume estimates were for 360,185 contracts, trending moderately higher than Friday’s final count of 306,645.

Soybeans

Soybean prices jumped almost 1.5% higher after more dry weather in Argentina, which is already suffering under overly dry conditions. The ensuing round of technical buying pushed March futures 21.25 cents higher to $15.4850. May futures rose 21.75 cents to $15.44.

The rest of the soy complex was also firm. Soymeal futures rose 1.2% higher on Tuesday, while soyoil futures climbed more than 1.75% higher.

Soybean basis bids held steady across the central U.S. on Tuesday.

Soybean export inspections took saw moderate week-over-week declines but remain relatively strong, with 58.0 million bushels. That was also near the middle of trade estimates, which ranged between 36.7 million and 72.2 million bushels. Cumulative totals for the 2022/23 marketing year are tracking slightly ahead of last year’s pace, with 1.521 billion bushels.

China again dominated all U.S. soybean export inspection destinations, with 18.5 million bushels. Germany, Egypt, Indonesia and South Korea filled out the top five.

The 2022/23 Brazilian soybean harvest is now 25% complete as of last Thursday, according to the AgRural consultancy. That’s an eight-point improvement from a week ago but still moderately behind last season’s pace of 33% so far. AgRural is forecasting Brazil’s soybean production potential at 5.545 billion bushels.

“Most years, the calendar is edging toward February before we get a good start in the shop,” according to Indiana farmer Kyle Stackhouse. “This year was no different. There is still some office work to finish up, but most days are spent in the shop.” Find out what all Stackhouse has been up to in his latest column – click here to learn more.

Preliminary volume estimates were for 268,035 contracts, tracking moderately higher than Friday’s final count of 192,601.

Wheat

Wheat prices suffered variable losses on the heels of a strengthening U.S. Dollar and ample overseas competition, which spurred some technical selling on Tuesday. March Chicago SRW futures eroded 14.75 cents lower to $7.5075, March Kansas City HRW futures eased 1.75 cents to $9.0475, and March MGEX spring wheat futures dropped 3.5 cents to $9.2675.

Wheat export inspections were down moderately from the prior week’s tally with 13.7 million bushels. That was also toward the lower end of trade guesses, which ranged between 11.0 million and 19.3 million bushels. Cumulative totals for the 2022/23 marketing year are running slightly behind last year’s pace, with 538.6 million bushels.

China was the No. 1 destination for U.S. wheat export inspections last week, with 2.5 million bushels. Japan, Mexico, Thailand and Taiwan rounded out the top five.

Turkey issued an international tender to purchase up to 29.0 million bushels of milling wheat from optional origins that closes on February 28. Traders believe this unusually large tender to be connected with the country’s increased needs following a devastating earthquake earlier this month. The grain is for shipment starting in early March.

India’s government will make available another 73.5 million bushels of wheat for bulk consumers (i.e. flour mills) in an effort to quell high prices, which reached record levels in January. India also has an export ban for wheat currently in place.

Jordan purchased an estimated 2.2 million bushels of hard milling wheat from optional origins in an international tender that closed earlier today. The grain is for shipment during the first half of July.

Japan issued a regular tender to purchase 3.5 million bushels of food-quality wheat from the United States, Canada and Australia that closes on Wednesday. Of the total, 38% is expected to be sourced from the U.S. The grain is for shipment starting in late March.

Preliminary volume estimates were for 141,552 CBOT contracts, which was well above Friday’s final count of 82,822.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)