Afternoon report: Corn and wheat prices also move noticeably lower on Tuesday.

Grain prices took a sharp turn lower to start the holiday-shortened week on Tuesday as traders turned their attention to ample overseas competition, historically large crops in Brazil and yield-friendly weather (for the most part) in the United States. Soybeans tumbled more than 3% lower, and some wheat contracts lost more than 4%. Corn losses were more moderate but still reached double digits by the close.

Most of the central U.S. will receive at least some measurable moisture between Wednesday and Saturday, aside from some parts of the eastern Corn Belt, per the latest 72-hour cumulative precipitation map from NOAA. Portions of the Southern Plains will see the most rainfall during this time. Further out, NOAA’s new 8-to-14-day outlook predicts some seasonally dry weather for the upper Midwest between June 6 and June 12, with cooler-than-normal conditions likely for most of the central U.S.

On Wall St., the Dow shifted 82 points lower in afternoon trading to 33,011 as investors await fresh news on debt ceiling negotiations. An agreement was reportedly reached over the weekend but will not be voted on until Wednesday at the earliest. Energy futures stumbled significantly lower on large global supplies coupled with some creeping demand concerns. Crude oil spilled more than 4% lower to $69 per barrel. Gasoline and diesel each faced cuts of around 3.75%. The U.S. Dollar softened slightly.

On Friday, commodity funds were net buyers of all major grain contracts, including corn (+8,500), soybeans (+5,000), soymeal (+2,500), soyoil (+2,000) and CBOT wheat (+4,500).

Corn

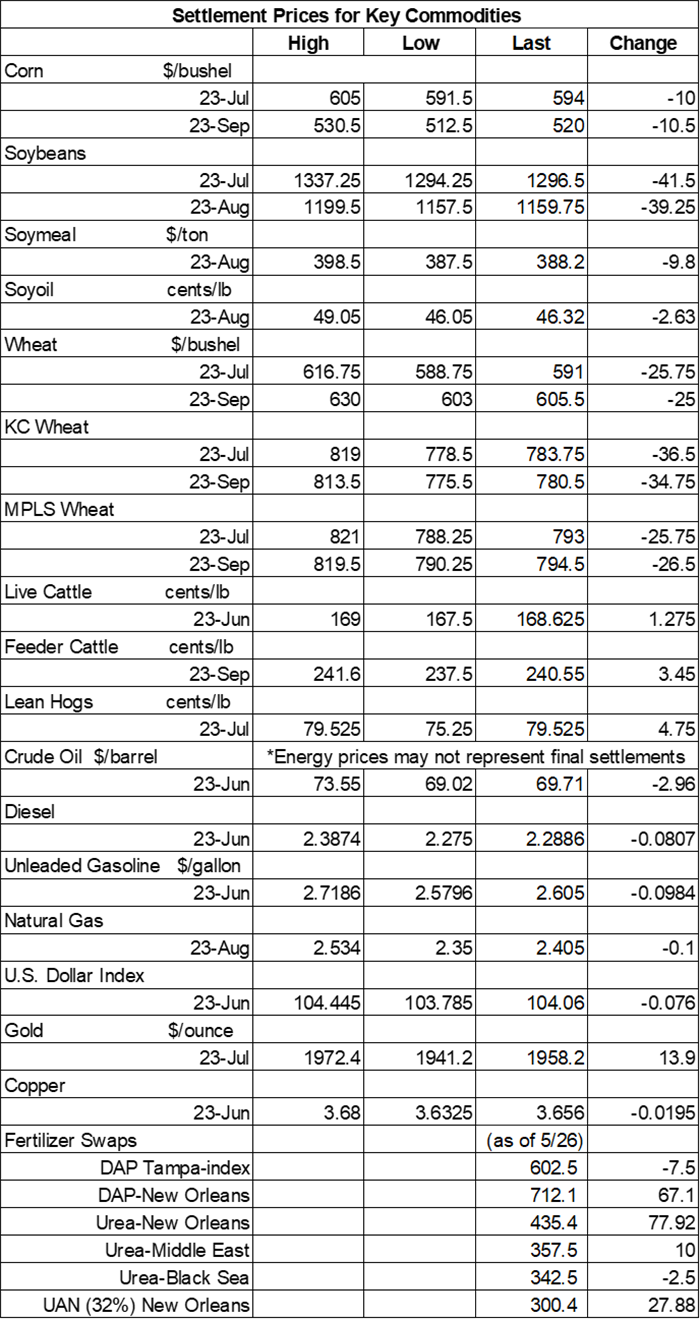

Corn prices succumbed to a round of technical selling prompted by mostly favorable spring weather and spillover weakness from other commodities. July futures dropped 10 cents to $5.94, with September futures down 10.5 cents to $5.1850.

Corn basis bids were mostly steady across the central U.S. on Tuesday but did tilt 10 cents higher at an Ohio elevator and 10 cents lower at an Iowa processor today.

Corn export inspections slid slightly lower to 51.7 million bushels last week. That was still toward the high end of trade estimates, which ranged between 23.6 million and 55.1 million bushels. China was the No. 1 destination, with 18.4 million bushels. Cumulative totals for the 2022/23 marketing year are still well below last year’s pace after reaching 1.130 billion bushels.

Ahead of the next crop progress report from USDA, out Monday afternoon and covering the week through May 28, analysts expect the agency to show corn plantings move from 81% completion a week ago up to 92% through Sunday. Individual trade guesses ranged between 90% and 95%.

Per the latest data from the European Commission, EU corn imports during the 2022/23 marketing year have climbed 61% above last year’s pace, with 958.2 million bushels through May 27. Ukraine, Brazil, Canada, Serbia and Russia were the top five suppliers.

Brazilian consultancy AgRural raised its estimates for the country’s total 2022/23 corn production, which is now at a record-breaking 5.016 billion bushels. Brazil’s safrinha (second) corn harvest is barely underway, with 0.8% complete through last Thursday, versus the prior year’s pace of 1.2%.

Preliminary volume estimates were for 361,976 contracts, sliding slightly below Friday’s final count of 381,076.

Soybeans

Soybean prices eroded steadily throughout Tuesday’s session on a variety of supply and demand concerns, incurring losses of more than 3% by the close. July futures tumbled 41.5 cents to $12.9575, with August futures down 43.75 cents to $12.1725.

The rest of the soy complex also faced severe cuts today. Soymeal prices eroded nearly 2.5% lower, while soyoil prices were slashed 5.5%.

Soybean basis bids were steady to firm across the central U.S. on Tuesday after improving 3 cents at an Ohio river terminal and 10 cents at an Ohio elevator today.

Soybean export inspections improved moderately to reach 8.8 million bushels last week. That was also near the middle of analyst estimates, which ranged between 3.7 million and 14.7 million bushels. Indonesia was the No. 1 destination, with 2.5 million bushels. Cumulative totals for the 2022/23 marketing year are tracking slightly below last year’s pace, with 1.780 billion bushels.

Prior to this afternoon’s crop progress report from USDA, analysts think the agency will show soybean plantings move from 66% complete as of May 21 up to 82% through May 28. Individual trade guesses ranged between 77% and 85%.

European Union soybean imports during the 2022/23 marketing year are down 12% from last year’s pace so far after reaching 427.3 million bushels through May 27. EU soymeal imports are also down year-over-year, with 14.32 million metric tons over the same period.

Brazil’s Anec modestly lowered its estimates for the country’s soybean exports in May after offering a new projection of 554.8 million bushels. Anec also expects to see Brazilian soymeal exports reach 2.218 million metric tons this month.

Preliminary volume estimates were for 236,855 contracts, which was modestly higher than Friday’s final count of 208,279.

Wheat

Wheat prices tumbled amid ongoing challenges with fierce global competition and relatively poor U.S. exports. Analysts are also expecting so see quality ratings improve when UDSA releases its next crop progress report later this afternoon. September Chicago SRW futures fell 25 cents to $6.0450, September Kansas City HRW futures tumbled 34.75 cents to $7.7950, and September MGEX spring wheat futures lost 26.5 cents to $7.9275.

Wheat export inspections faded moderately below the prior week’s total to 14.0 million bushels. That was very near the middle of trade estimates, which ranged between 7.3 million and 22.0 million bushels. Thailand was the No. 1 destination, with 4.4 million bushels. Cumulative totals for the 2022/23 marketing year are slightly below last year’s pace so far, with 718.6 million bushels.

Ahead of the next crop progress report from USDA, out Monday afternoon, analysts think the agency will show winter wheat quality ratings to increase slightly, moving from 31% in good-to-excellent condition a week ago up to 32% as of Sunday. For spring wheat, analysts expect to see planting progress move from 64% last week to 82% through Sunday.

European Union soft wheat exports during the 2022/23 marketing year are trending 11% above last year’s pace so far after reaching 1.044 billion bushels through May 27. Morocco, Algeria, Nigeria, Egypt and Saudi Arabia were the top five destinations. EU barley exports are down 13% year-over-year, meantime, with 272.3 million bushels.

U.S. importers purchased around 2.2 million bushels of wheat, likely sourced from Germany and Poland, in a tender that closed last week. The grain is for shipment in July.

Preliminary volume estimates were for 132,709 CBOT contracts, tracking moderately higher than Friday’s final count of 83,126.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)