Trajectory of industry from this point forward will be determined by market conditions in 2020.

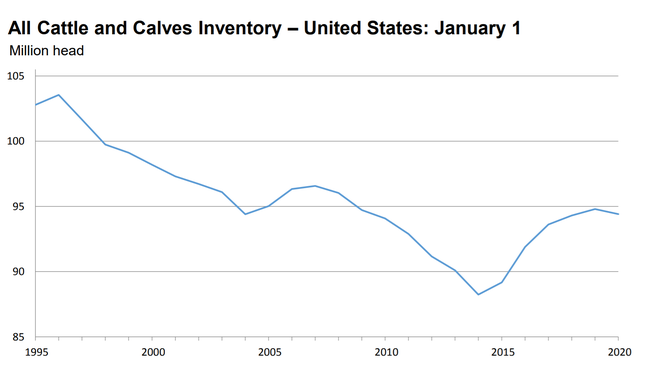

The U.S. Department of Agriculture released the latest “Cattle” report Friday, which confirmed that the U.S. cattle herd has, in fact, stopped expanding. The report showed that all cattle and calves in the U.S. as of Jan. 1, 2020, totaled 94.4 million head, 0.4% below the 94.8 million head reported on Jan. 1, 2019.

“This is the first time since 2014 that we’re seeing a contraction in the herd,” USDA livestock analyst Shayle Shagam said.

According to Oklahoma State University Extension livestock marketing specialist Derrell Peel, the peak beef cow inventory for 2019 was 31.7 million, which USDA revised downward by 75,000 head from the previous report. Peel said this means the total herd expansion in this cycle was an increase of 2.73 million head from the 2014 low of 29.0 million cows.

The decline wasn’t really a surprise to the markets, Shagam suggested, noting, “For the past couple of years, cow/calf operators have been facing some relatively weak returns, and compounding that situation has been relatively poor forage conditions in the past year.”

As such, some of them have decided to cut back on their production, he added.

All cows and heifers that have calved were 1% below the same period in 2019, at 40.7 million head. Beef cows, at 31.3 million head, were down 1% from a year ago. Beef replacement heifers, at 5.77 million head, were down 2% from a year ago.

“That is a total cyclical expansion of 9.4%, or an average of 1.9% per year for the five years of expansion,” he noted.

Milk cows, at 9.33 million head, were also down slightly from the previous year, USDA relayed. Milk replacement heifers, at 4.64 million head, were down 1% from the previous year.

As to whether some beef producers may change their current course come breeding season, Shagam said, “It’s going to depend very much on the state of forage conditions and on the state of producer returns as they go through the year.”

The inventory of other heifers on Jan. 1 was 9.71 million head, 1% above a year earlier, the report revealed. Steers weighing 500 lb. and over as of Jan. 1, 2020, totaled 16.7 million head, down 1% from Jan. 1, 2019. Bulls weighing 500 lb. and over as of Jan. 1, 2020, totaled 2.24 million head, also down 1% from 2019. Calves weighing under 500 lb. as of Jan. 1, 2020, totaled 14.7 million head, up 1% from the year before.

The U.S. feedlot inventory on Jan. 1 totaled 14.7 million head, a 2% rise from the previous year. USDA said cattle on feed in feedlots with capacity of 1,000 head or more accounted for 81.5% of total cattle on feed as of Jan. 1, 2020, up slightly from the previous year. The combined total of calves weighing under 500 lb. and other heifers and steers over 500 lb. (outside of feedlots) was 26.4 million head, slightly below Jan. 1, 2019.

USDA estimated the 2019 calf crop in the U.S. at 36.1 million head, a 1% decline from the prior year. Calves born during the first half of 2019 were estimated at 26.4 million head, down slightly from the first half of 2018. Calves born during the second half of 2019 were estimated at 9.71 million head, or 27% of the total 2019 calf crop, the report relayed.

Peel said the numbers show that the last pulse of larger cattle is currently in feedlots, and cattle slaughter will be up in the first quarter before declining through the second half of the year. However, he said higher carcass weights are expected to offset a slight decline in cattle slaughter and push total 2020 beef production higher to new record levels.

“Beef production is likely, however, to be lower year over year by the fourth quarter of the year,” Peel added.

Regarding what the future may hold, Peel said the trajectory of the cattle industry from this point forward will be determined by market conditions in 2020.

“Modestly higher prices projected in 2020, combined with improved international market potential, could restart herd expansion. Alternatively, continued political and economic turbulence or shocks, such as coronavirus, could drag markets down and hold cattle inventories flat or fall into more liquidation,” he said.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)