COVID-19, African swine fever continue to be the main challenges in 2022.

January 31, 2022

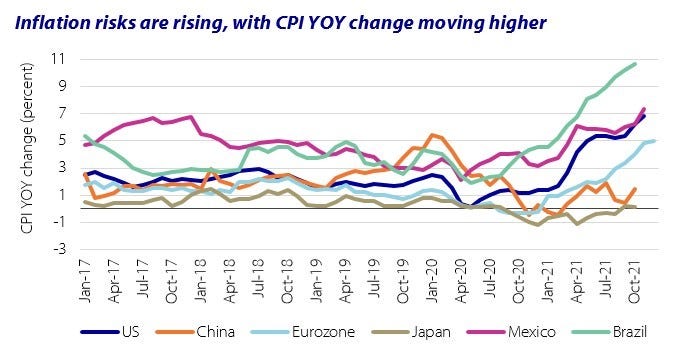

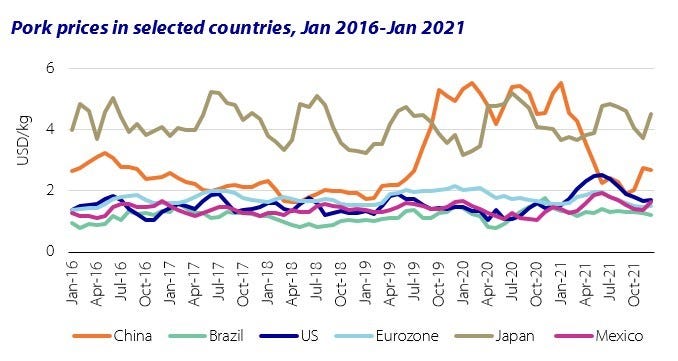

According to the latest pork report from Rabobank, COVID-19 will continue to challenge pork supply chains and consumers in various ways, affecting both production and demand. The slowing global economy will have more visible consequences in 2022, and price inflation of consumer goods will put extra pressure on consumers' wallets. However, pork prices increased marginally in the late part of 2021 but remain below 2021 peak levels.

Diseases, particularly African swine fever, are another major uncertainty for pork production, with the impact varying by region. "In Europe, ASF has spread to new countries in recent months, challenging 2022 European production. In Asia, ASF continues to spread in China, but the impact is much lower than in 2020," says Chenjun Pan, senior analyst – animal protein at Rabobank.

Rising costs are threatening margins and labor issues keep challenging operations

Input costs continue to rise. Shipping rates, energy prices and feed grain prices, together with labor costs, are challenging pork supply chains. "In a slowing economy, producers and processors are finding it difficult to pass on all additional costs to consumers, so margins will be under pressure," says Pan.

Input costs, particularly feed and transportation costs, will stay inflated in 2022. Dry weather in Brazil, 2021 flooding in China, low inventory around the globe and the uncertain impact of the Tonga volcanic eruption all imply that input costs could rise further. This would impose extra downward pressure on margins and profitability.

Also, labor issues remain a challenge in North America and some European countries. Around the globe, products requiring less labor will grow faster compared with labor-intensive products.

Global trade will decline, but prices will stay resilient

Global pork imports and exports will likely decline from 2021 levels, mainly driven by reductions in China's import demand as local production recovers. Although traditional importing countries – mainly Japan and South Korea, plus some new importing countries – will likely increase imports, major exporters will need to find a new balance between supply and demand.

"Despite ASF's spread, we expect production in some Asian countries to continue recovering. In China, Vietnam and the Philippines, the declining demand for imports is a result of better domestic production," says Pan. "While global import demand will likely decline in 2022, we expect pork prices to stay resilient given high production costs."

Source: Rabobank, which is solely responsible for the information provided, and wholly owns the information. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset. The opinions of this writer are not necessarily those of Farm Progress/Informa.

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)