Many producers shift to neutral on whether they think good or bad times are ahead.

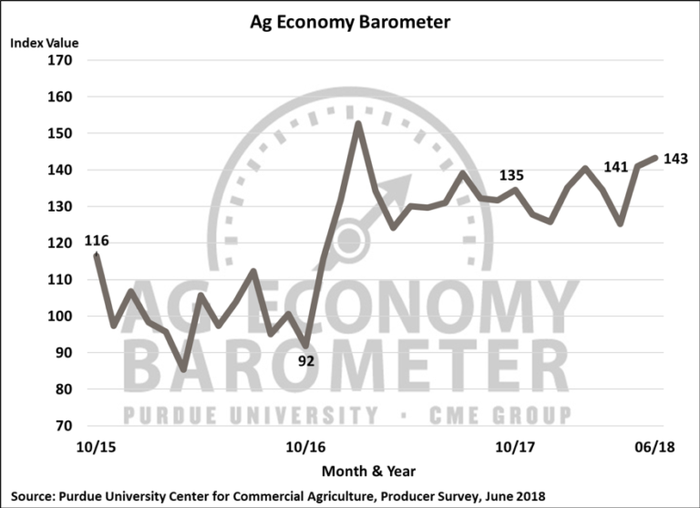

Despite unresolved trade war concerns and sharp price declines for key commodities, agricultural producer sentiment unexpectedly rose slightly in June, the latest Purdue University/CME Group Ag Economy Barometer results revealed. At 143, the June barometer reading, which is based on a monthly survey of 400 agricultural producers from across the country, still was only two points higher than May.

"In June, we saw a sizeable drop in commodity prices that caught many observers by surprise, but despite the price decline, producers' appraisal of current economic conditions improved compared to May," said James Mintert, the barometer's principal investigator and director of Purdue University's Center for Commercial Agriculture. "However, it was clear from survey responses that uncertainty regarding the agricultural outlook increased considerably."

The barometer's uptick was underpinned by an increase in the Index of Current Conditions, which climbed to 138 from a reading of 132 a month earlier. The Index of Future Expectations remained nearly unchanged, with a reading of 146 in June -- one point higher than in May.

Each month, the survey asks producers whether they expect "good times" or "bad times" in U.S. agriculture one year out and five years ahead. For June, responses were mixed, with many producers shifting away from a "good" or "bad" response and instead toward "neutral," which suggests a rise in uncertainty for the future.

The percentage of respondents expecting good times in U.S. agriculture during the year ahead declined from 32% in May to 26% in June, suggesting an erosion in producers’ optimism. At the same time, however, the percentage of producers expecting bad times declined from 54% in May to 46% in June. When asked to look ahead five years, producers expecting good times in U.S. agriculture declined from 51% in May to 45% in June, whereas those expecting bad times fell from 38% in May to 31% in June.

Several times a year, the barometer also asks producers if they expect prices for key commodities to move higher, lower or remain unchanged over the next 12 months. Compared to the beginning of 2018, producers have been slowly signaling that they expect commodity prices to recede, and this trend continued in June with an increase in the percentage of producers expecting lower prices.

Crop acreage changes

The June barometer survey also asked producers how much their crop acreage changed in 2018 and whether or not they use flexible cash rental leases to rent farmland.

As expected, most farmers' crop acreage did not change in 2018 compared to a year earlier, but the survey revealed that some farms were expanding crop acreage rapidly. For example, 8% of farms increased their crop acreage by more than 10%, and 6% of farms increased their crop acreage by up to 10% in 2018 versus 2017.

Usage of flexible cash rental leases has been increasing recently, and among the farmers in the survey who rent cropland, 36% reported that they plan to use a flexible cash rent lease on some of their acreage.

"Flexible cash rent leases provide a way for farm operators to share some risk with land owners while also providing landowners some of the stability that comes with a cash rental agreement. The increase in volatility in crop agriculture could be stimulating interest in flexible cash rent leases," Mintert said.

Large farm investments

The Purdue/CME survey asked whether now is a good time or a bad time to make large farm investments. The percentage of producers indicating that it’s a bad time for large farm investments has been trending lower since October 2016, falling to 60% in June compared to 67% a month earlier. However, the report authors noted that the percentage of producers indicating that it is a good time to make large farm investments also dropped to 26%, down slightly from the prior month and 8% below the most recent peak of 34% in February 2018.

In response to an additional question on the June survey, 13% indicated that they actually plan to make a large investment on their farm this year. More than half of respondents said it was because a building or piece of equipment needed to be replaced, but 18% said it was for farm expansion, and 10% said it was to reduce their tax liabilities.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)